Home

Resume

Designing a savings solution for underserved users

BachatBox · 2023 · 3 min read

Background

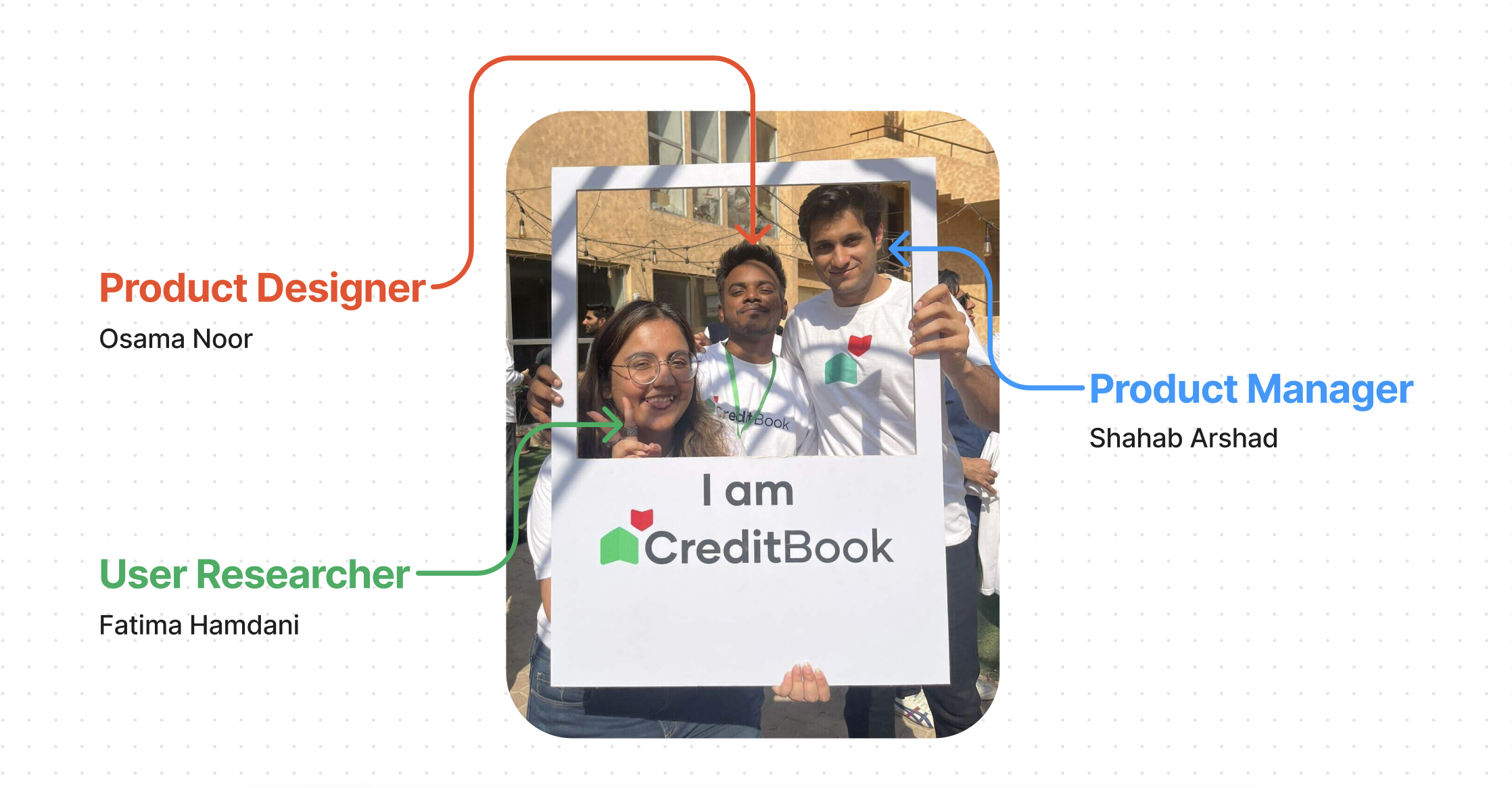

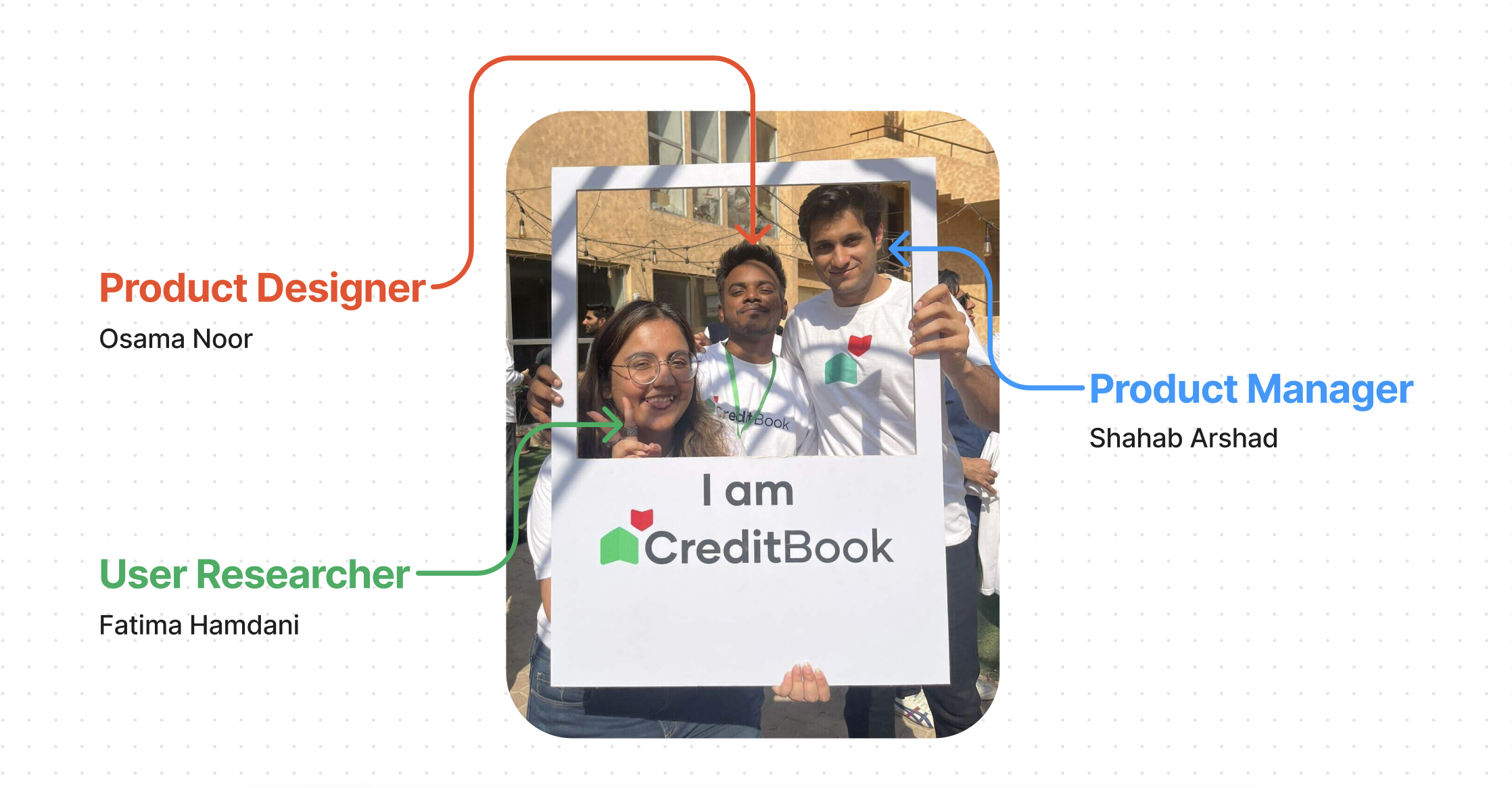

In early 2023, CreditBook discovered that many users were using the main ledger app to track personal savings goals such as buying gold, getting married, or traveling.

This pattern hinted at a need for a more intentional savings solution.

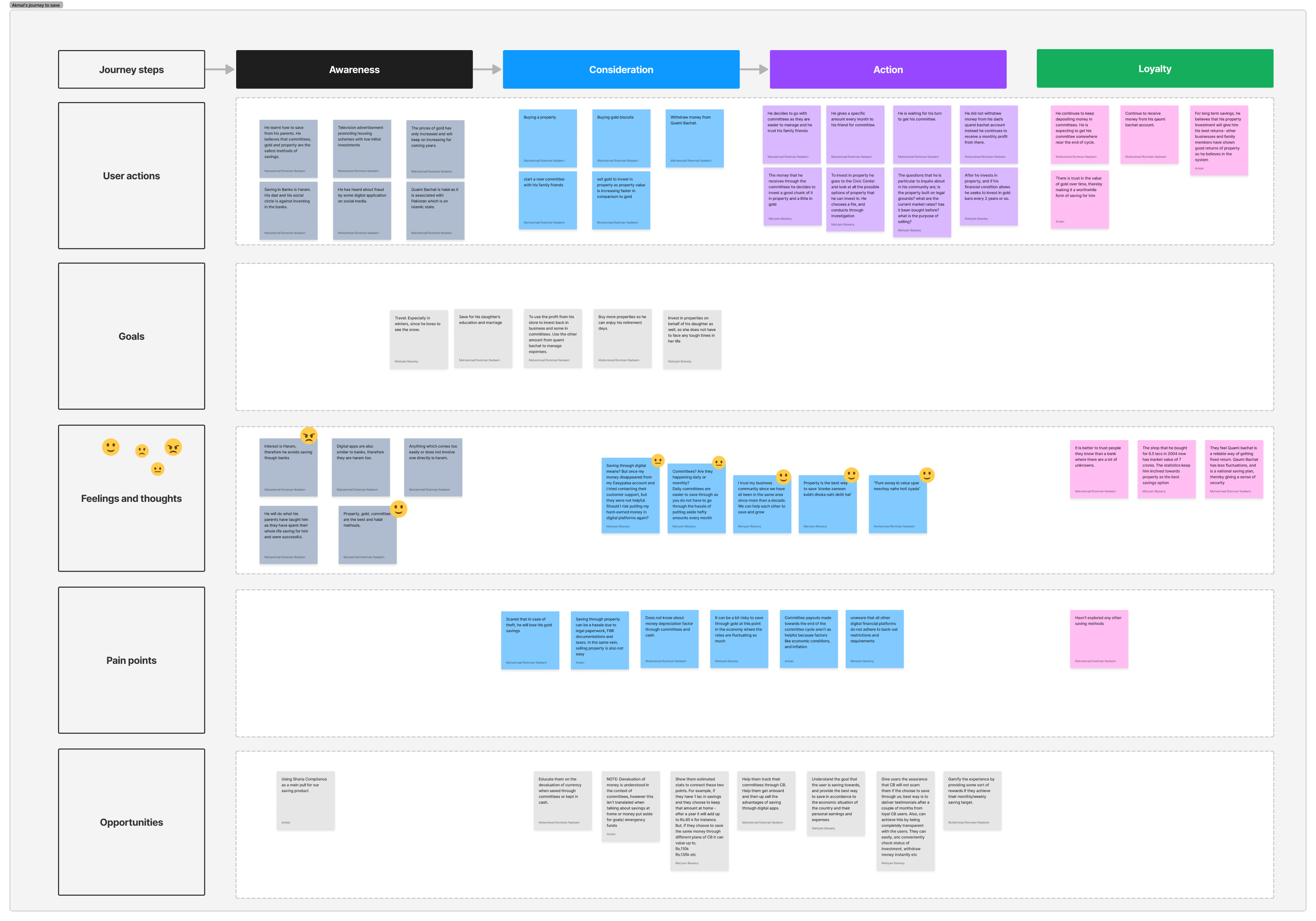

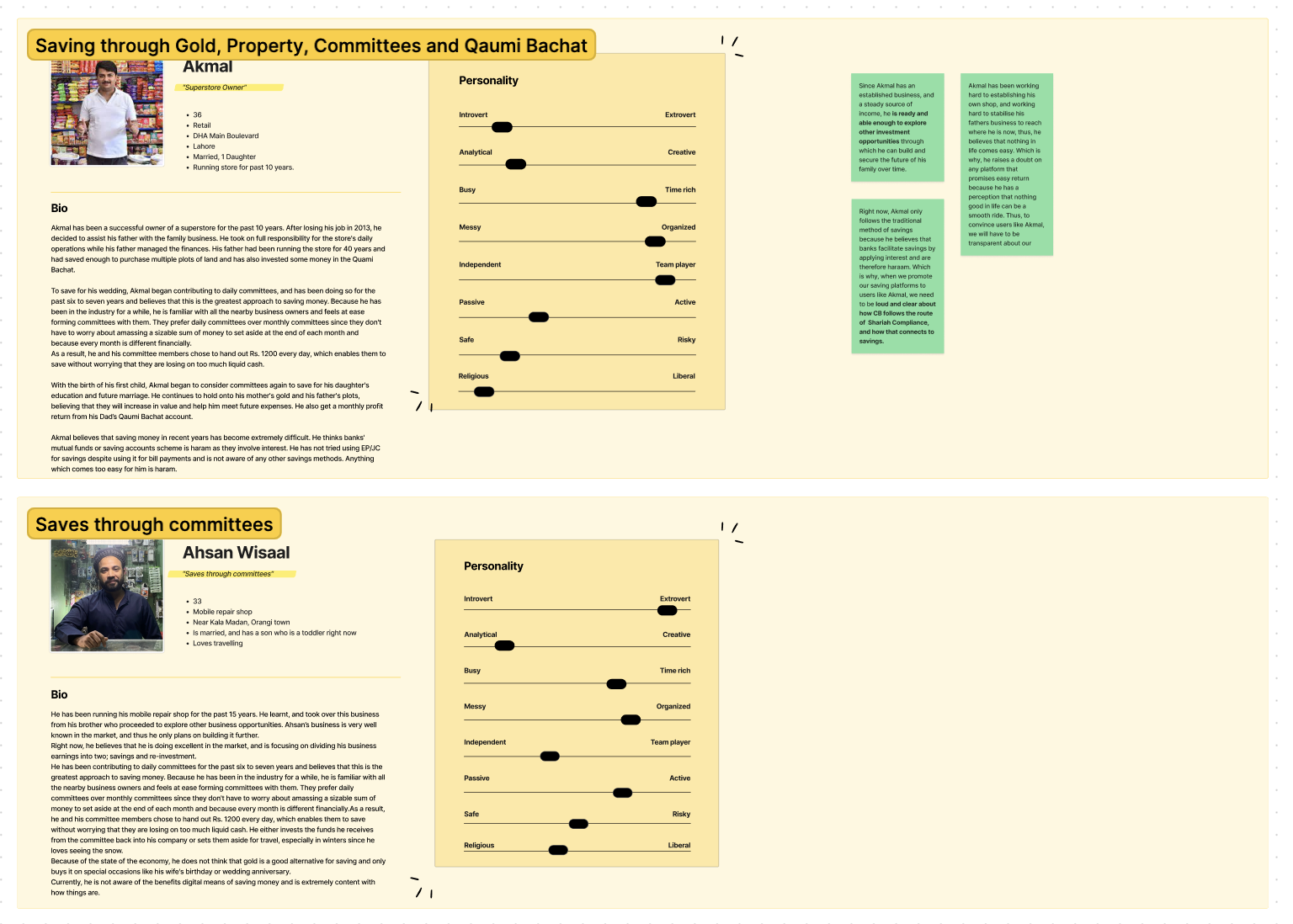

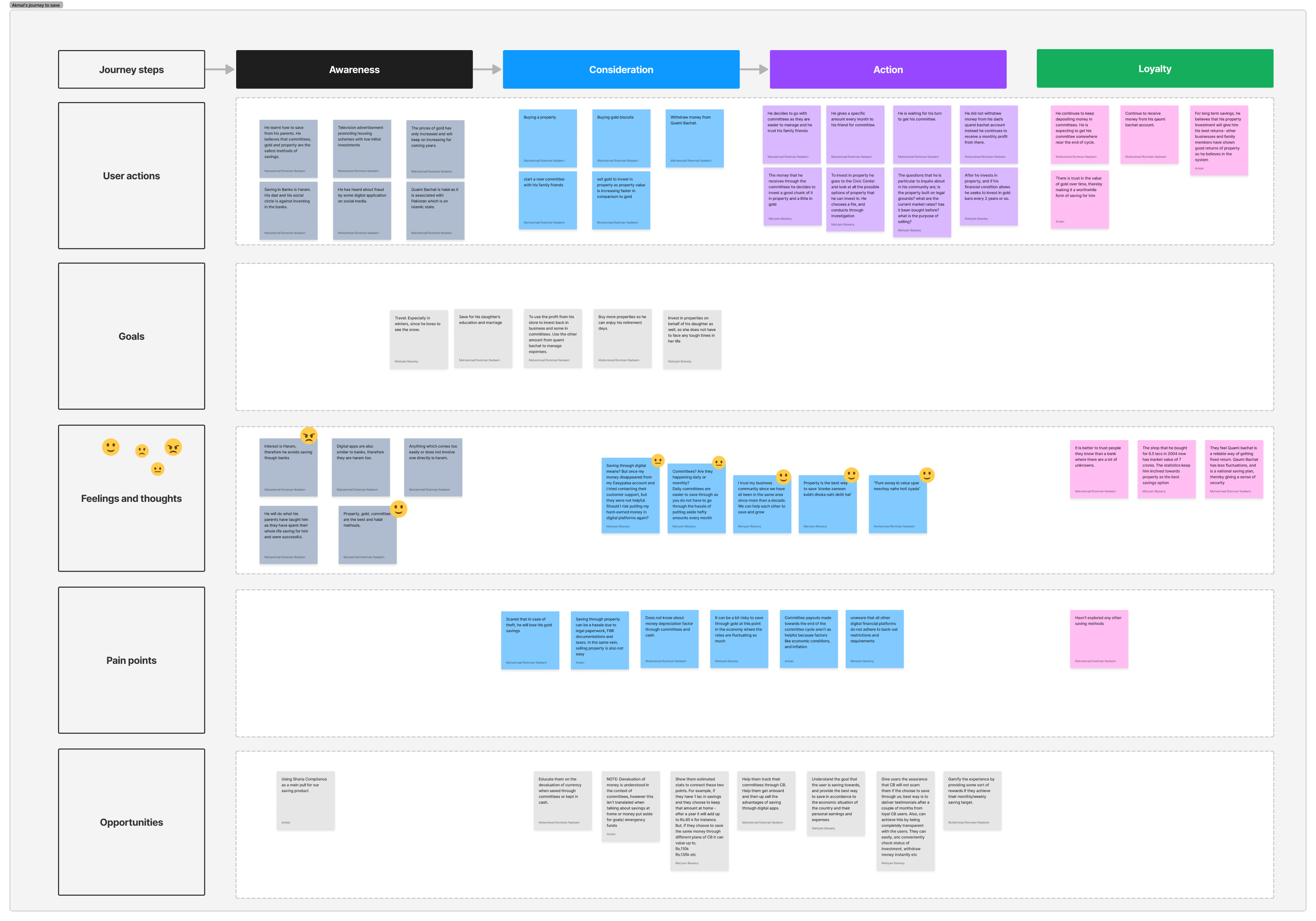

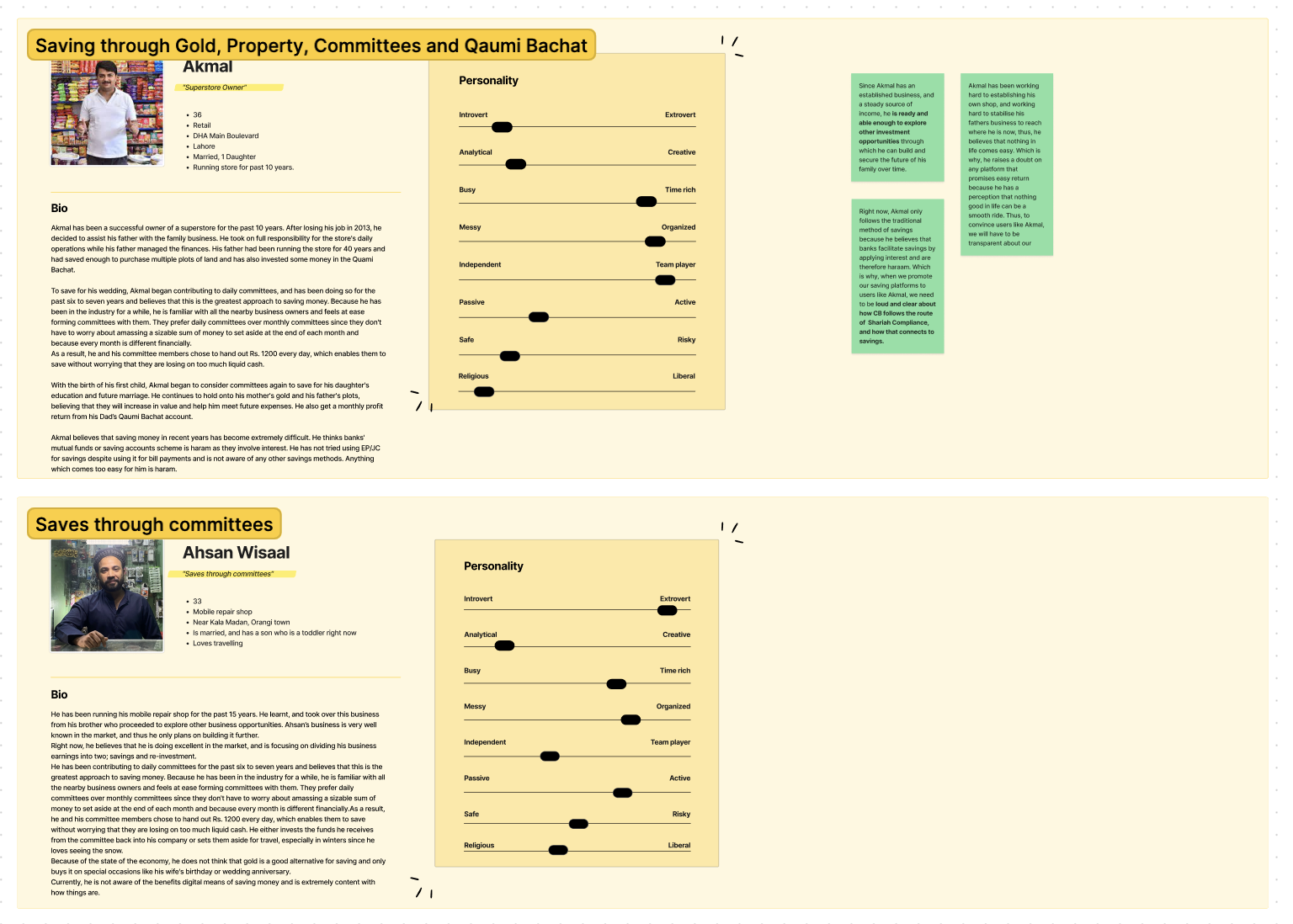

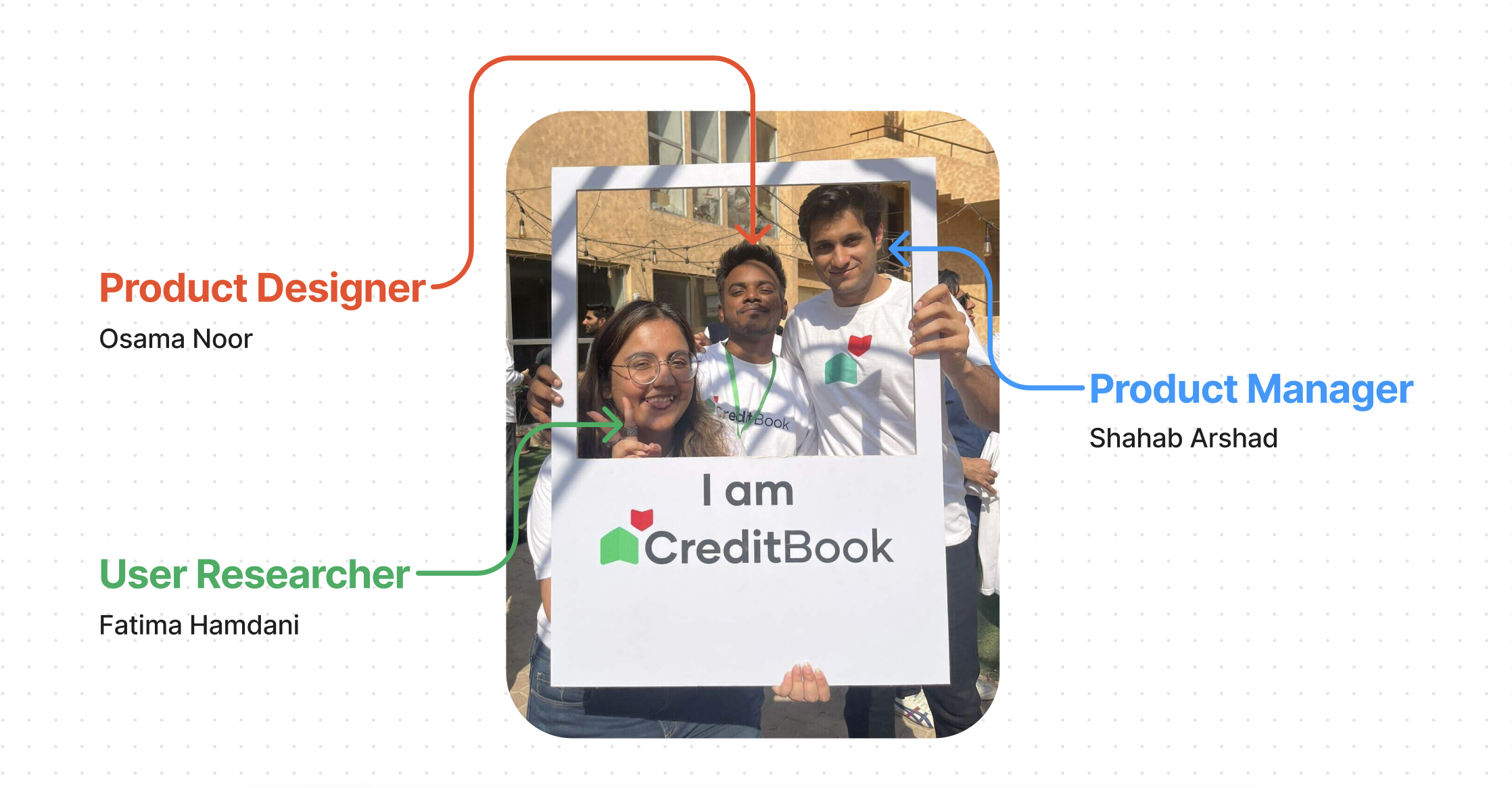

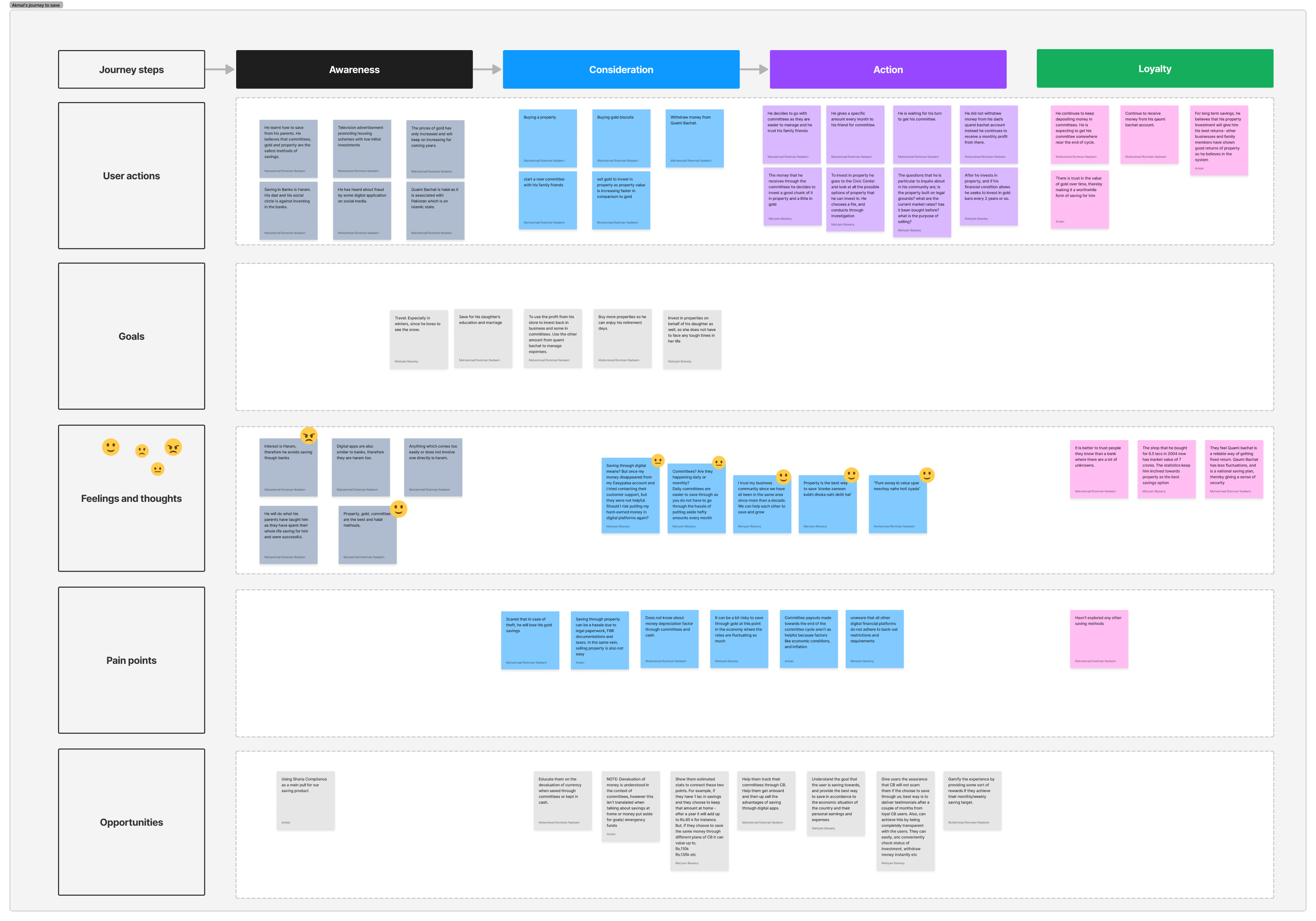

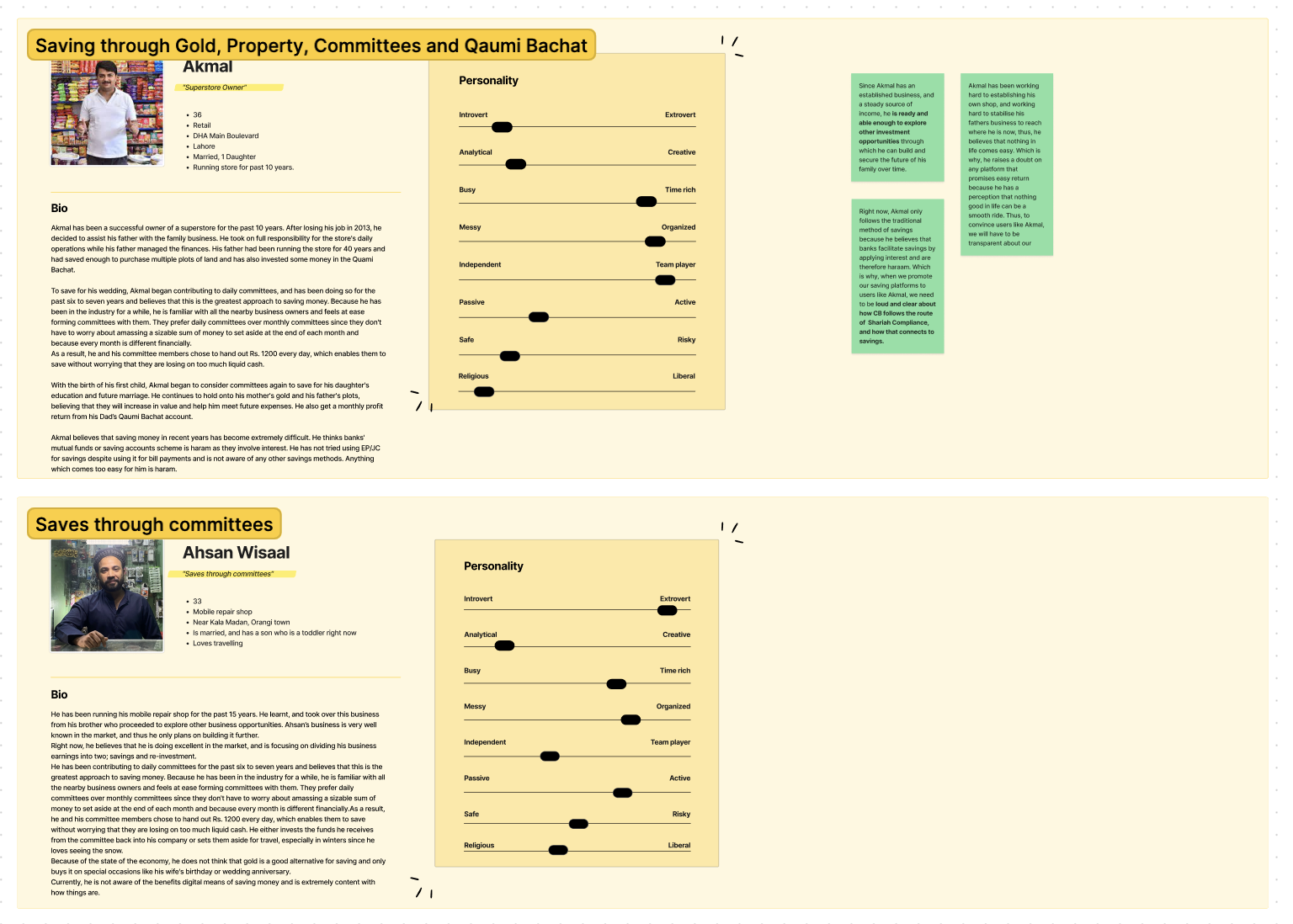

Research

Our goal was to understand the motivations, pain points, and behaviors around saving, especially for users with low financial literacy or limited trust in formal systems.

To achieve this, we conducted secondary research, user interviews, and field studies.

Motivations

• Secure family future

• Shariah-compliant saving

Behaviours

• Informal saving methods

• Goal-based saving

Pain points

• Low trust in formal systems

• No simple digital alternatives

What we learned

Most savings platforms are too complex for everyday Pakistanis. Traditional banks add to the problem with accessibility issues and paperwork, making formal saving feel out of reach for many.

So we asked ourselves

How might we help users with low digital or financial literacy confidently grow their savings and meet their financial goals?

Experimentation

To validate our assumptions about user behavior and move closer to a solution, we ran four quick no-code experiments over a month.

Each experiment tested a specific hypothesis based on our early research.

Baseline savings intent

Goal-driven saving

Savings goal tracker

Trust in deposits

Design principles

Based on two months of research and experimentation, I defined the following principles to anchor our solution.

Simplicity and Accessibility

Design simple and accessible experiences for users with limited digital literacy.

Effortless Money Movement

Make it easy and intuitive for users to deposit, manage, and withdraw their savings.

Low Barrier to Entry

Allow users to start saving with minimal upfront investment and documentation.

Trust and Transparency

Build credibility through transparent, consistent, and trustworthy interactions.

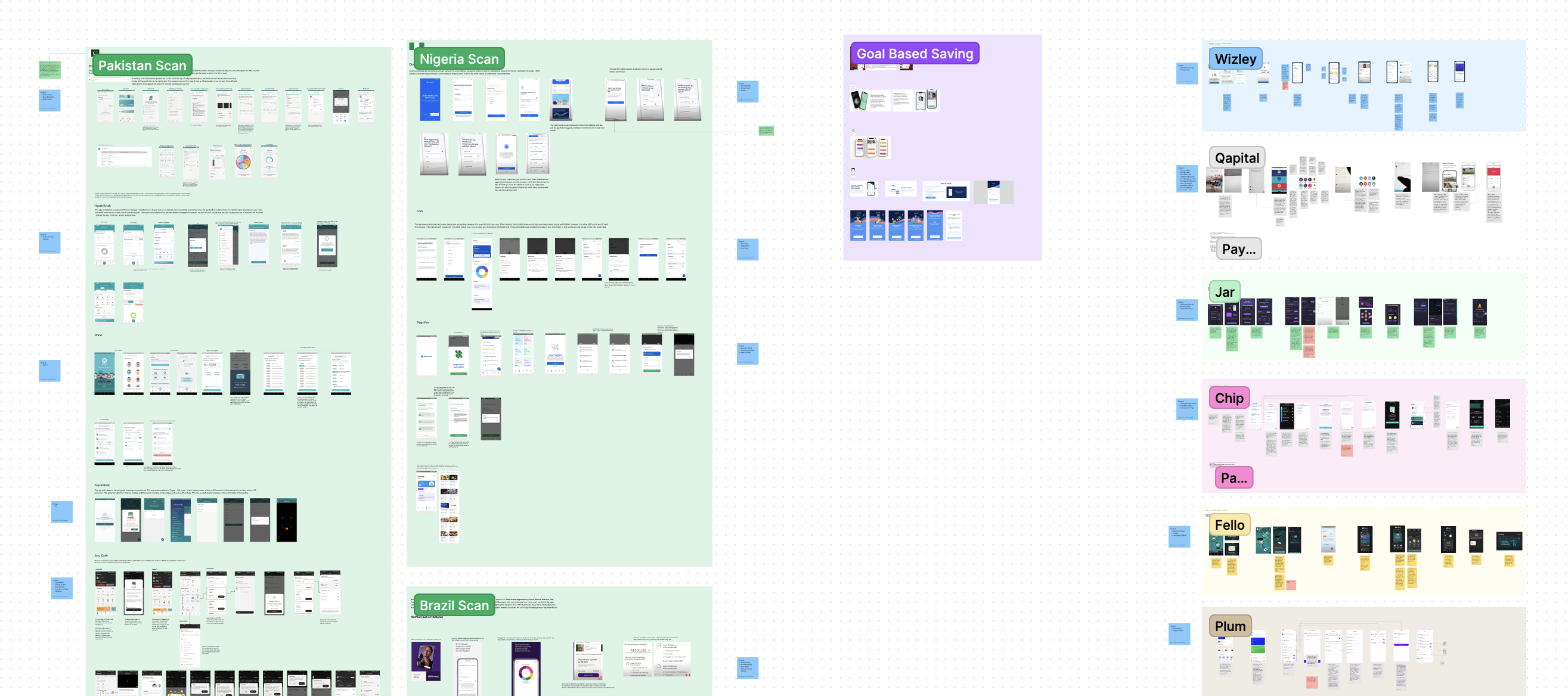

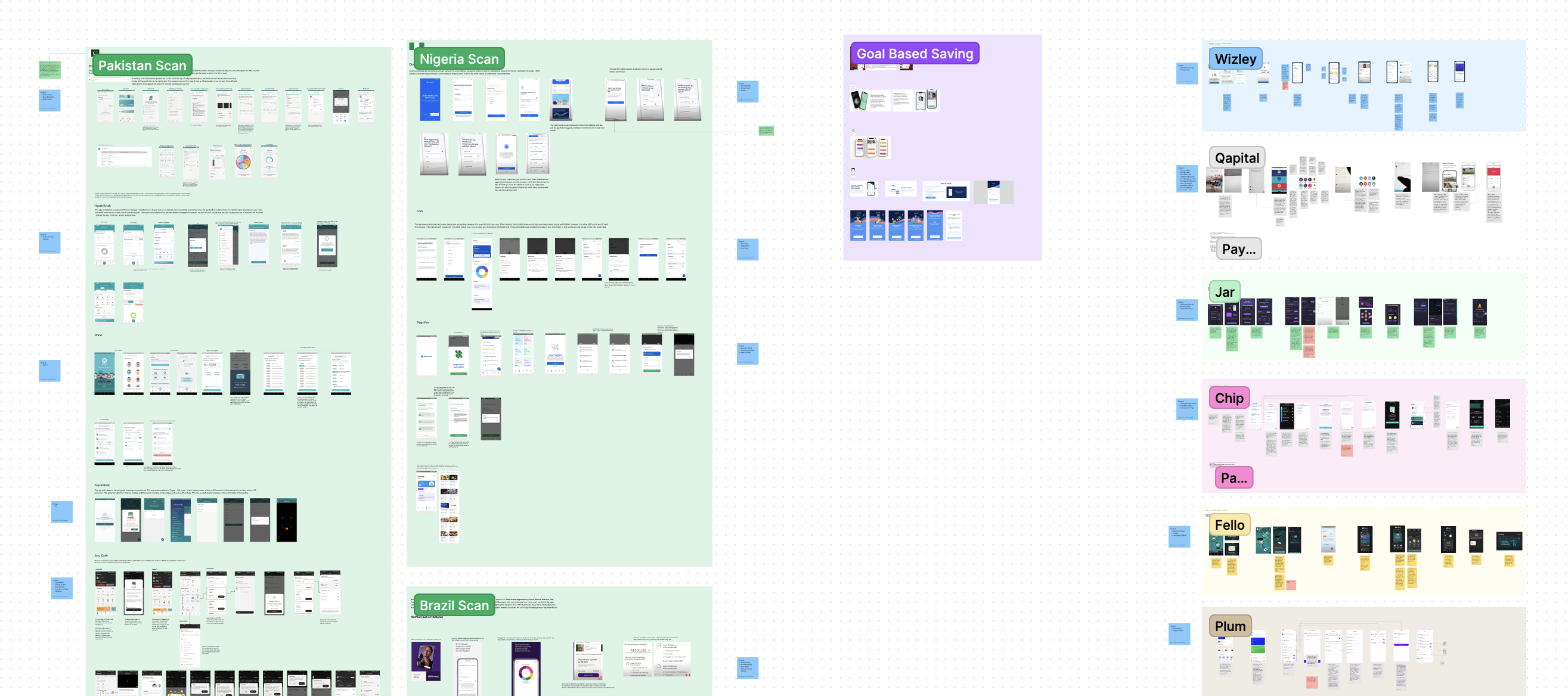

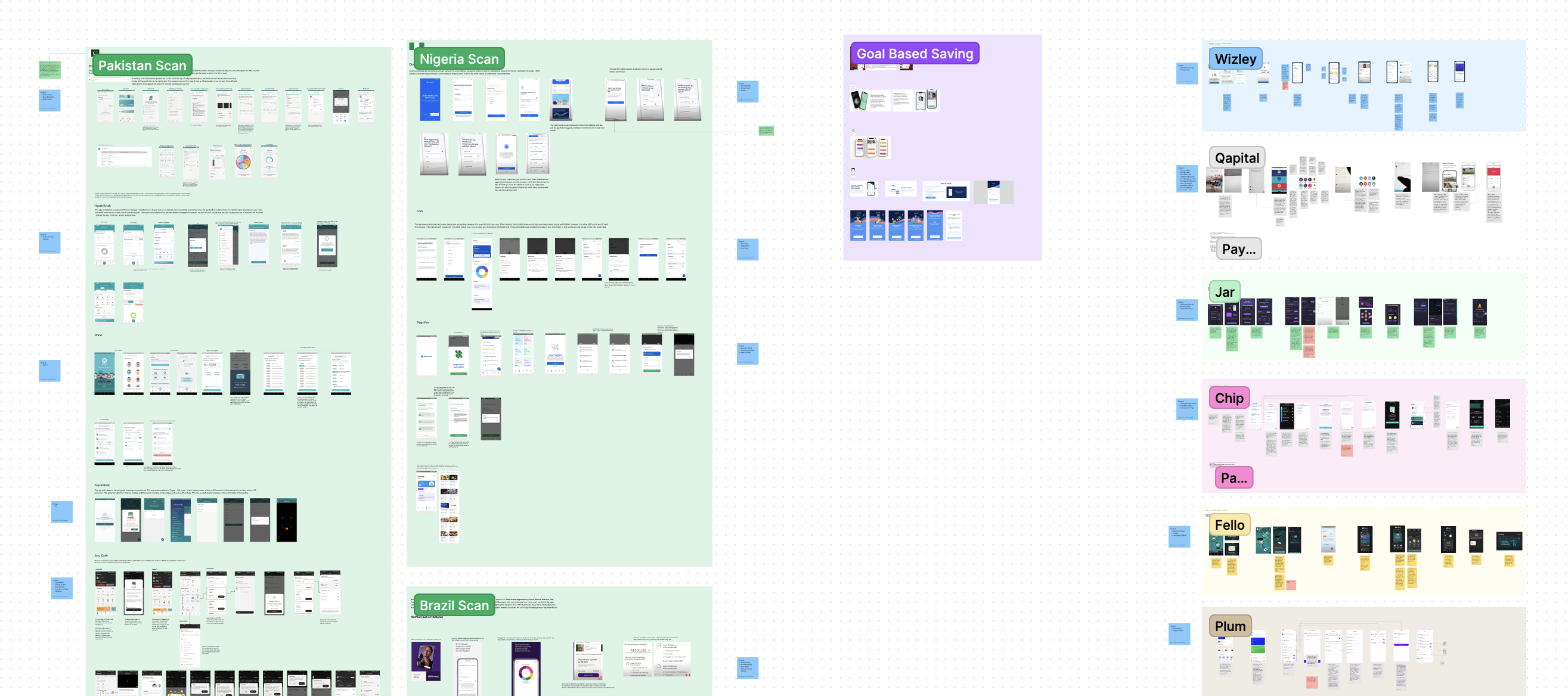

Benchmarking

To inform our solution and understand how markets with similar challenges design for inclusion, I studied apps from Nigeria, Brazil, and India to identify patterns we could learn from.

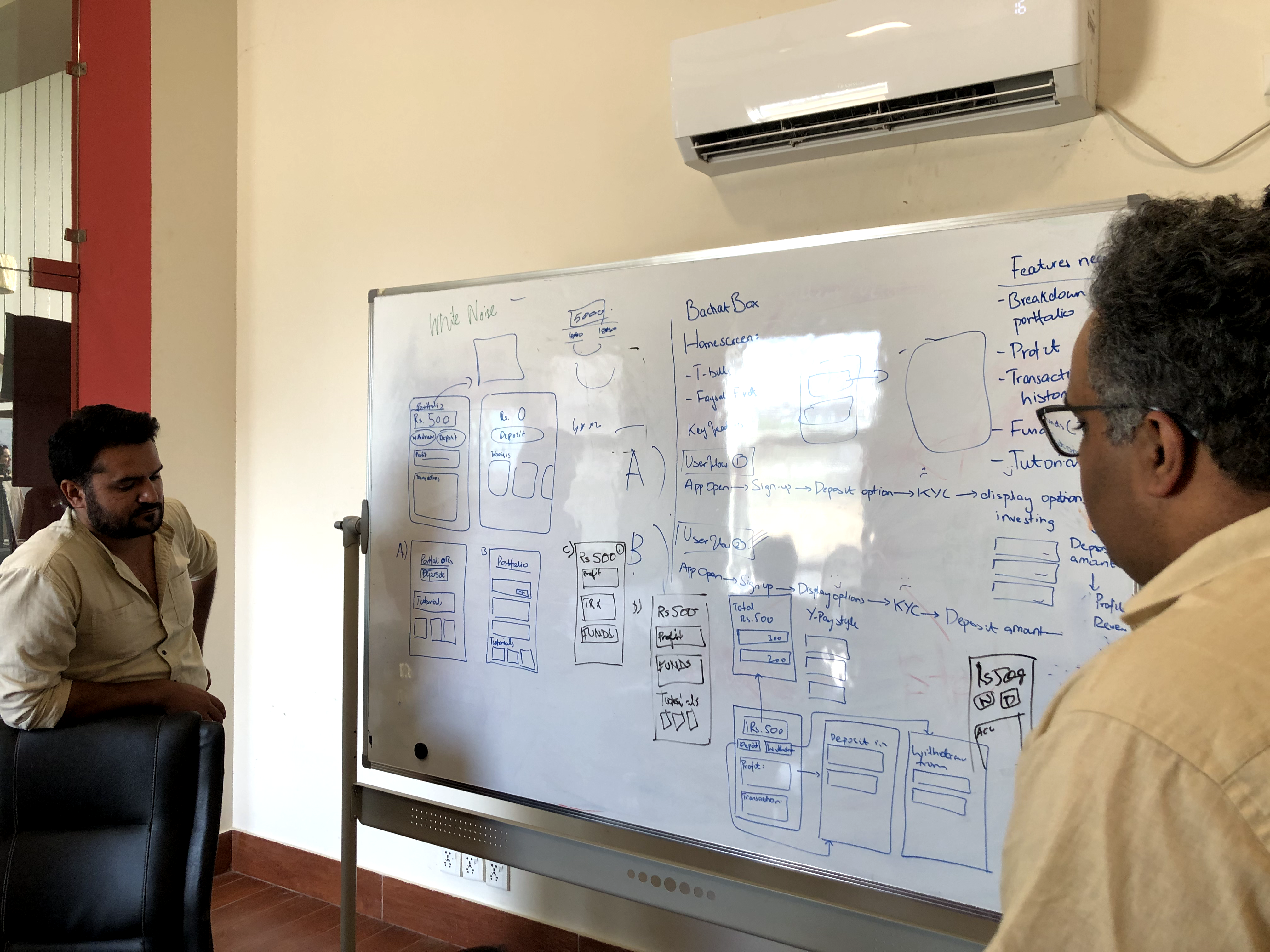

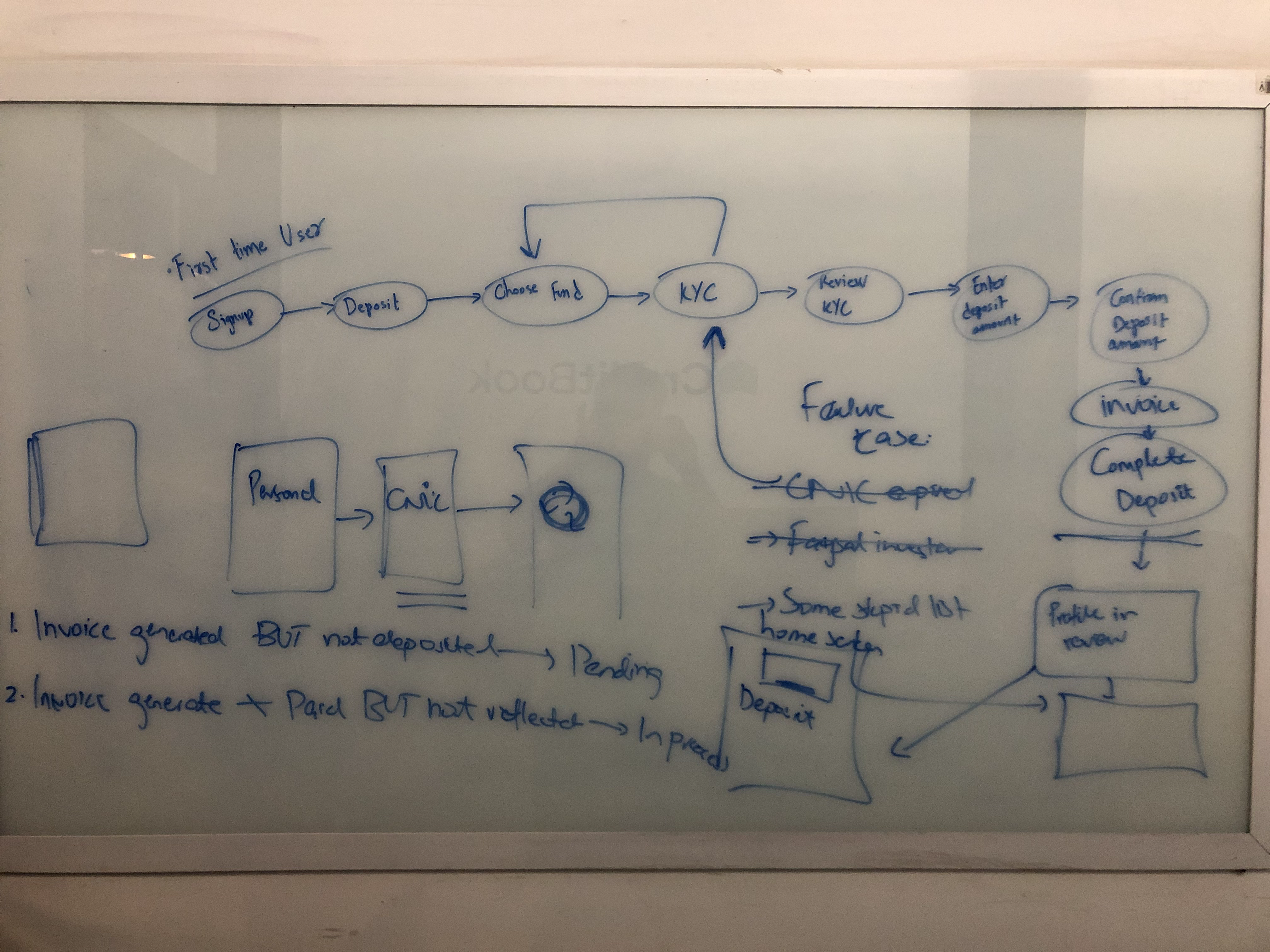

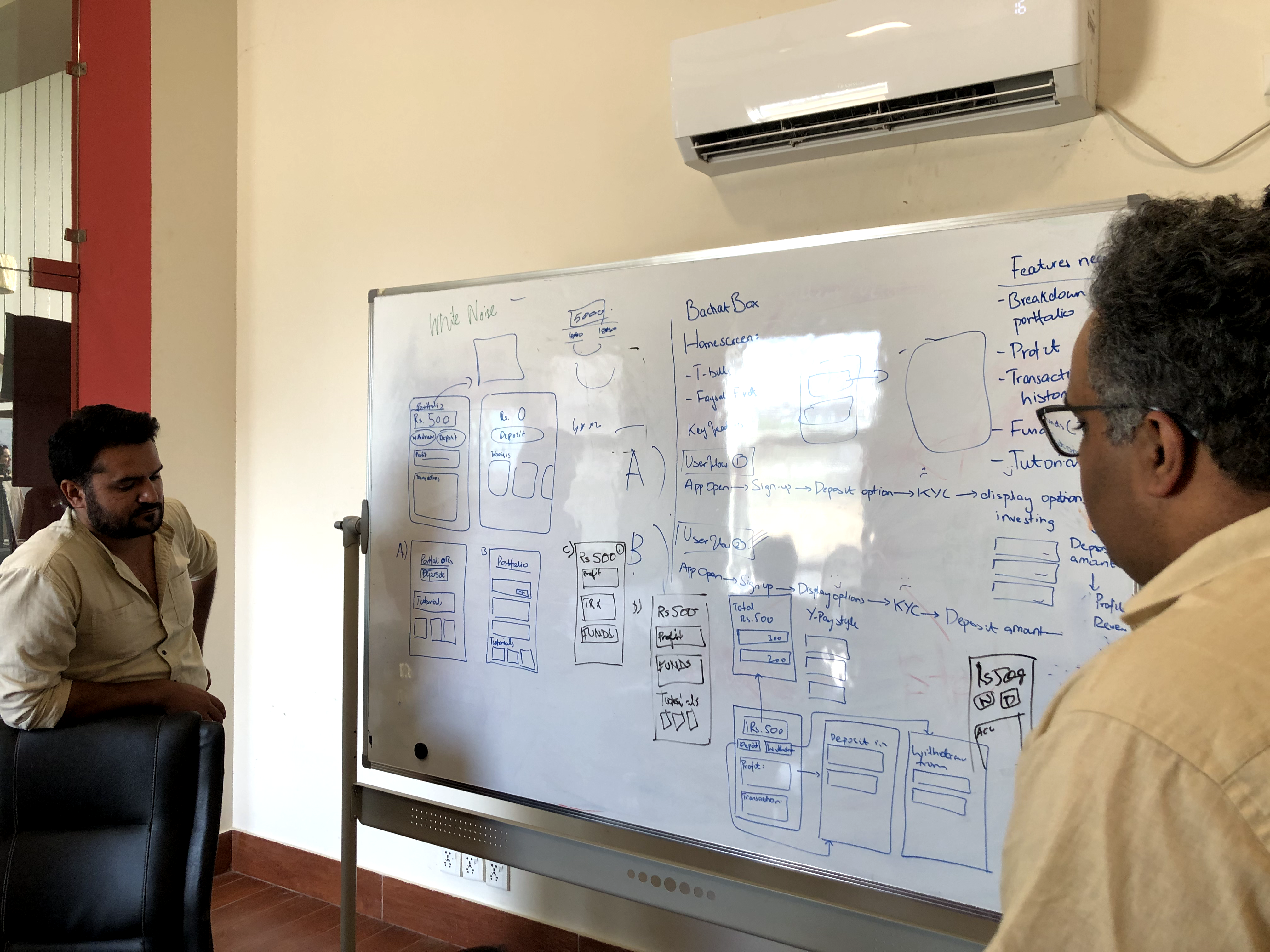

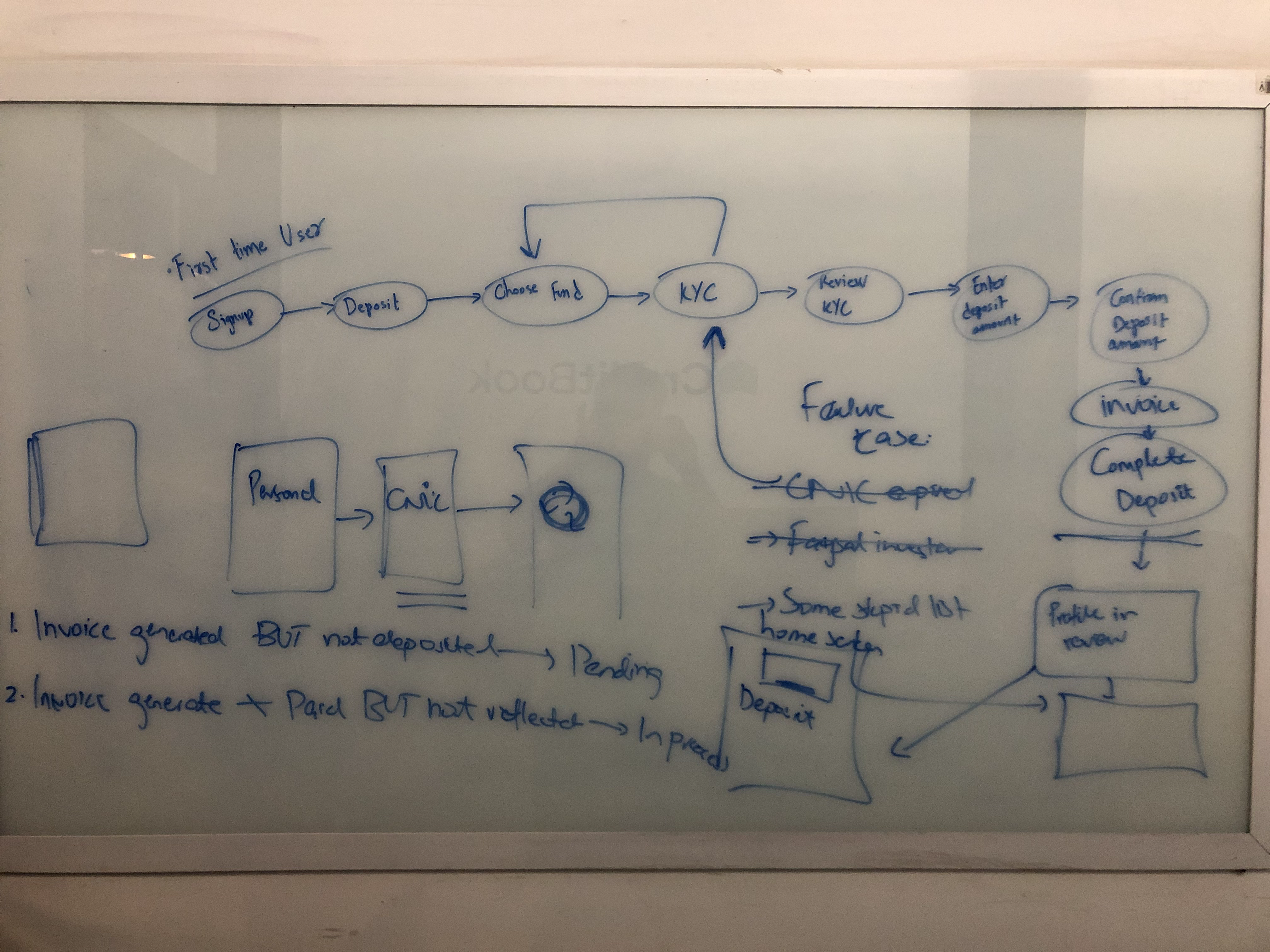

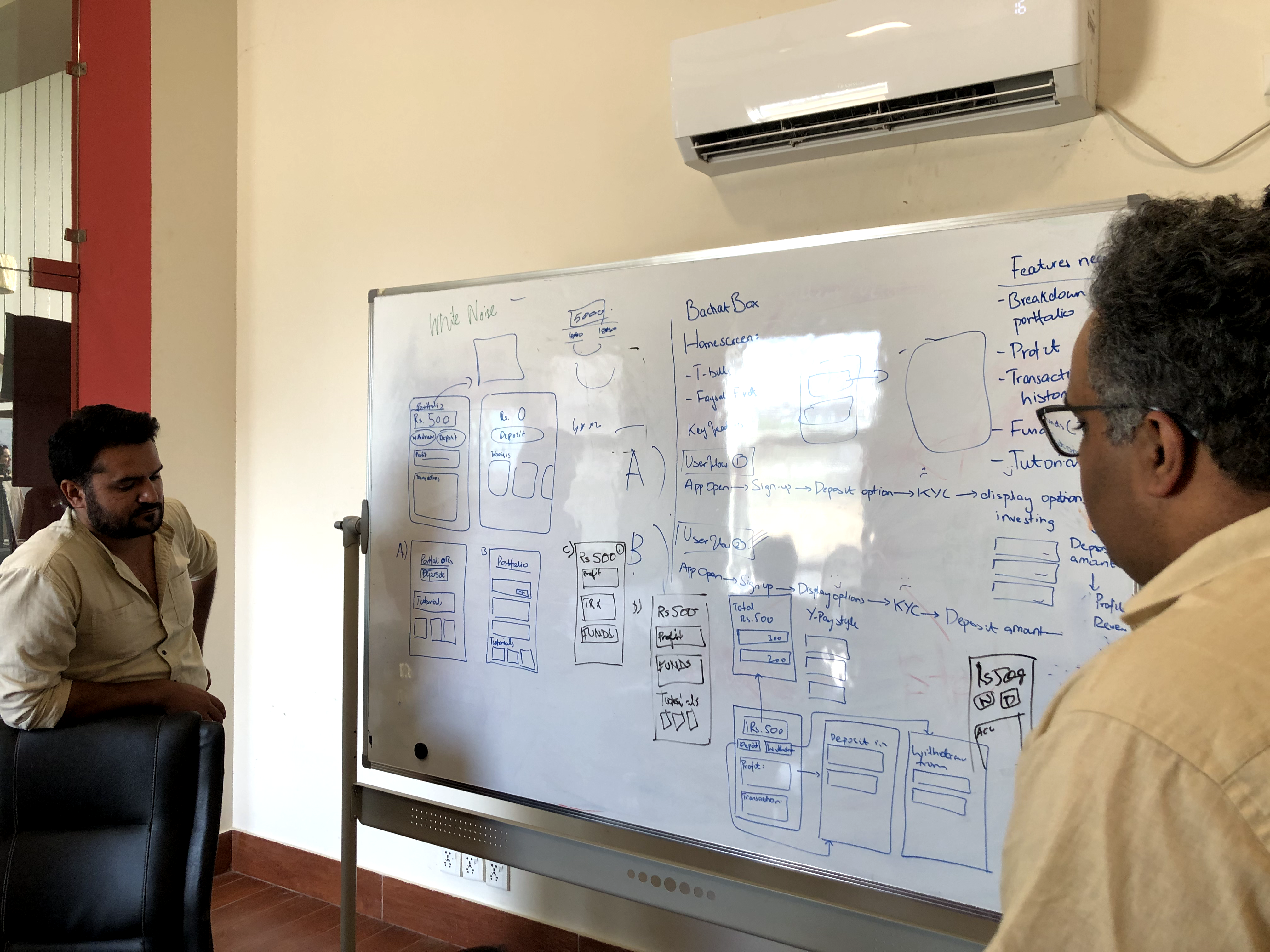

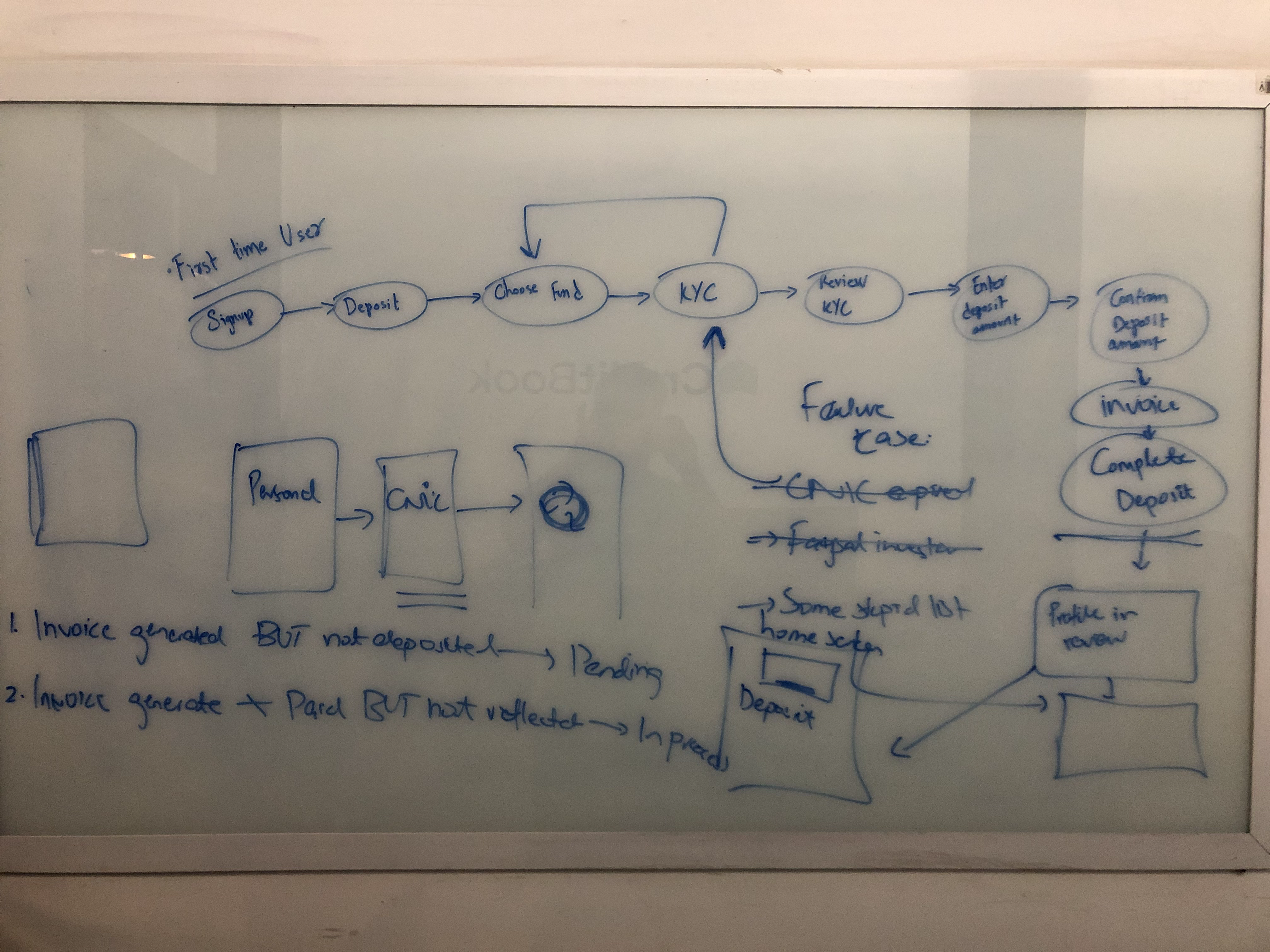

Brainstorming and Ideation

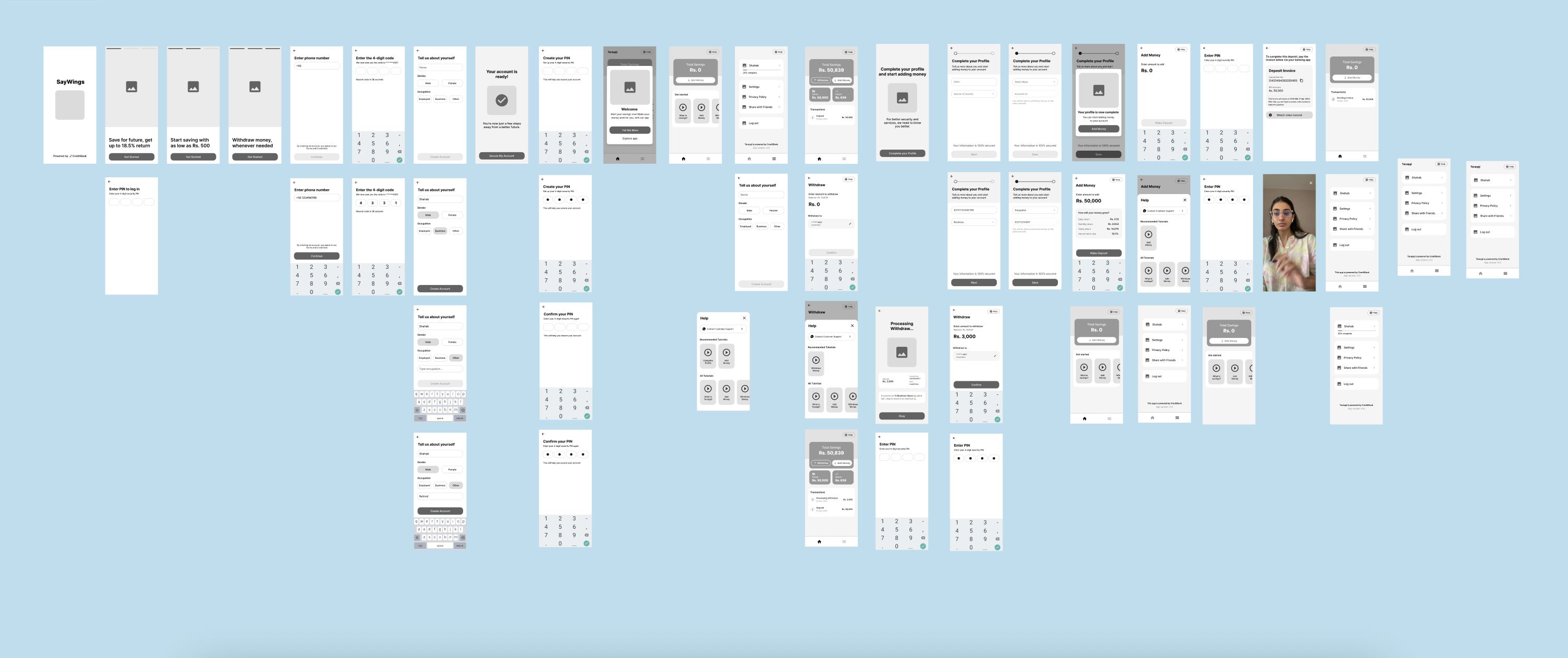

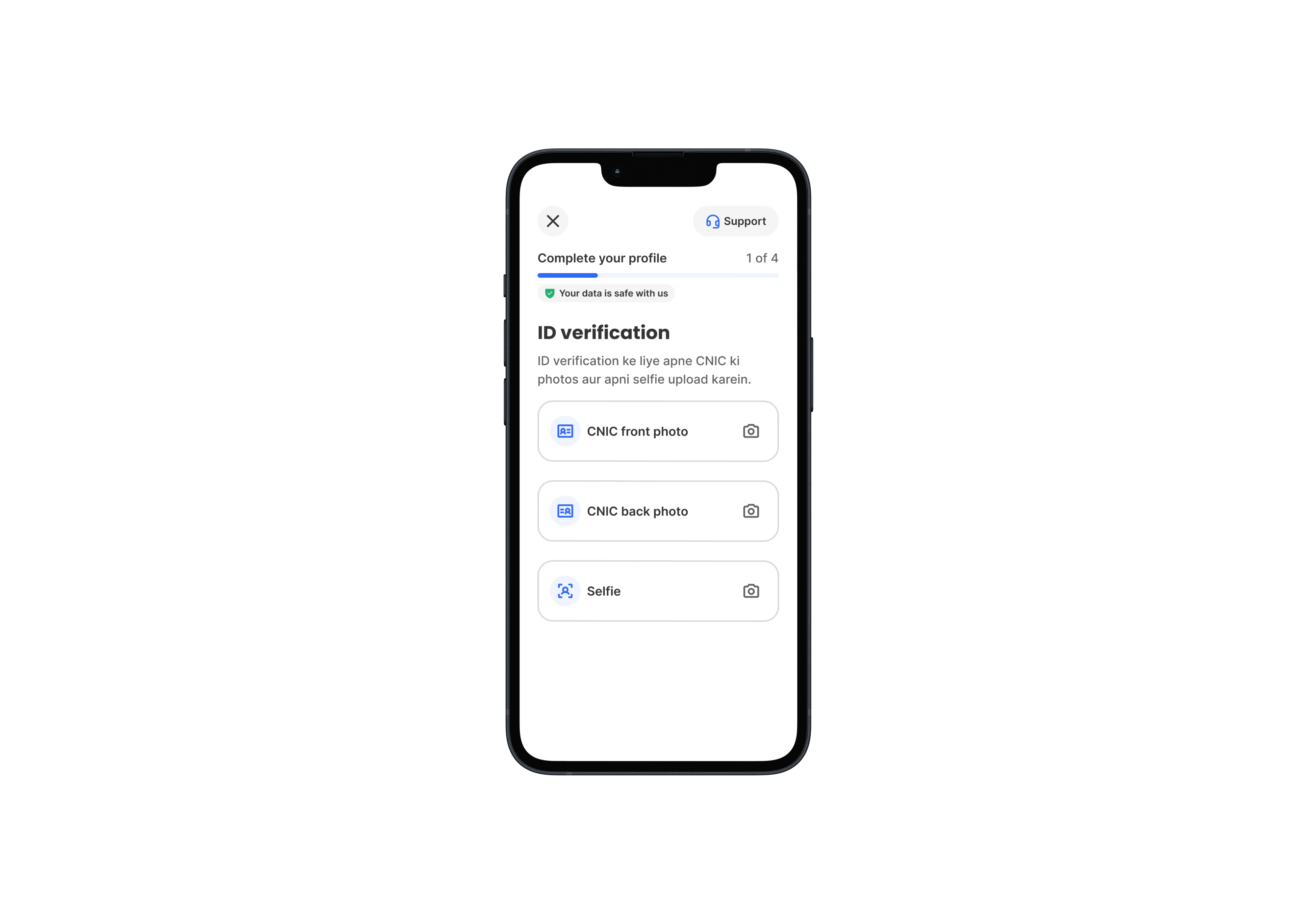

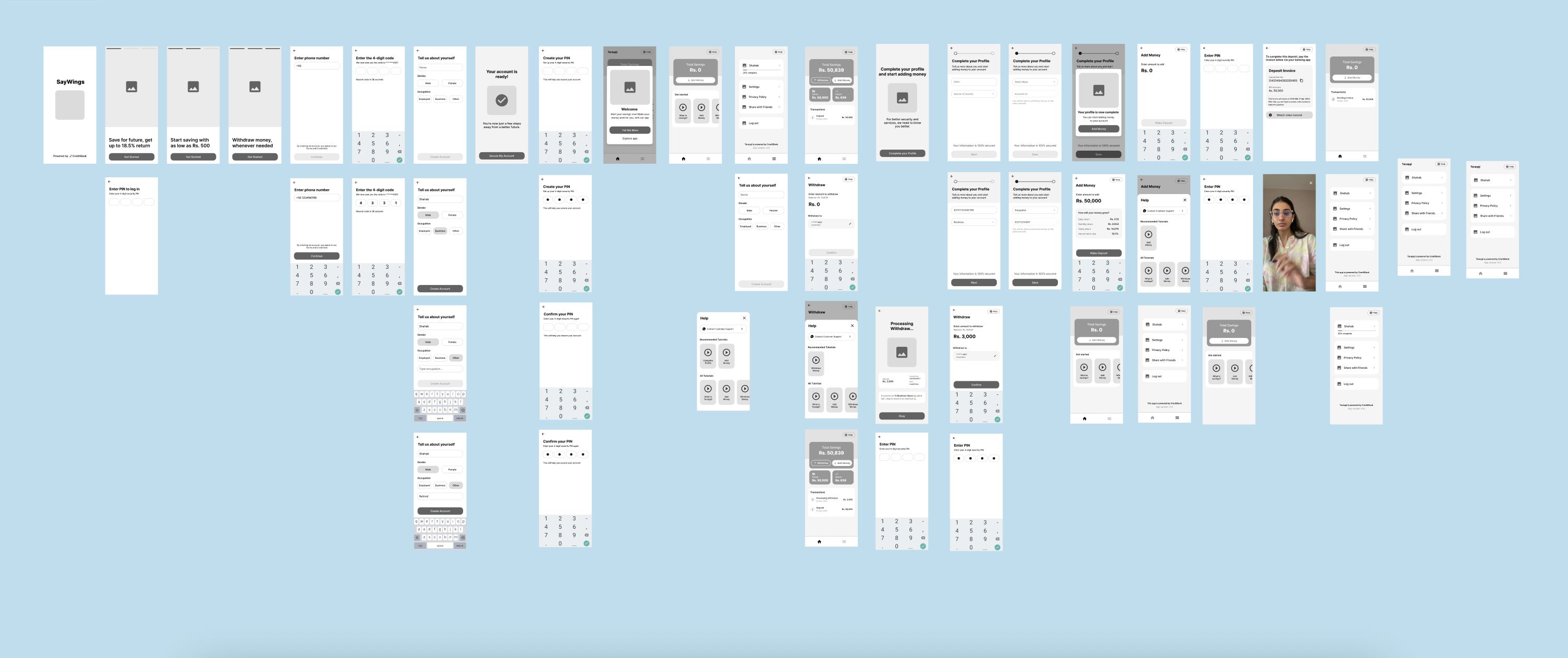

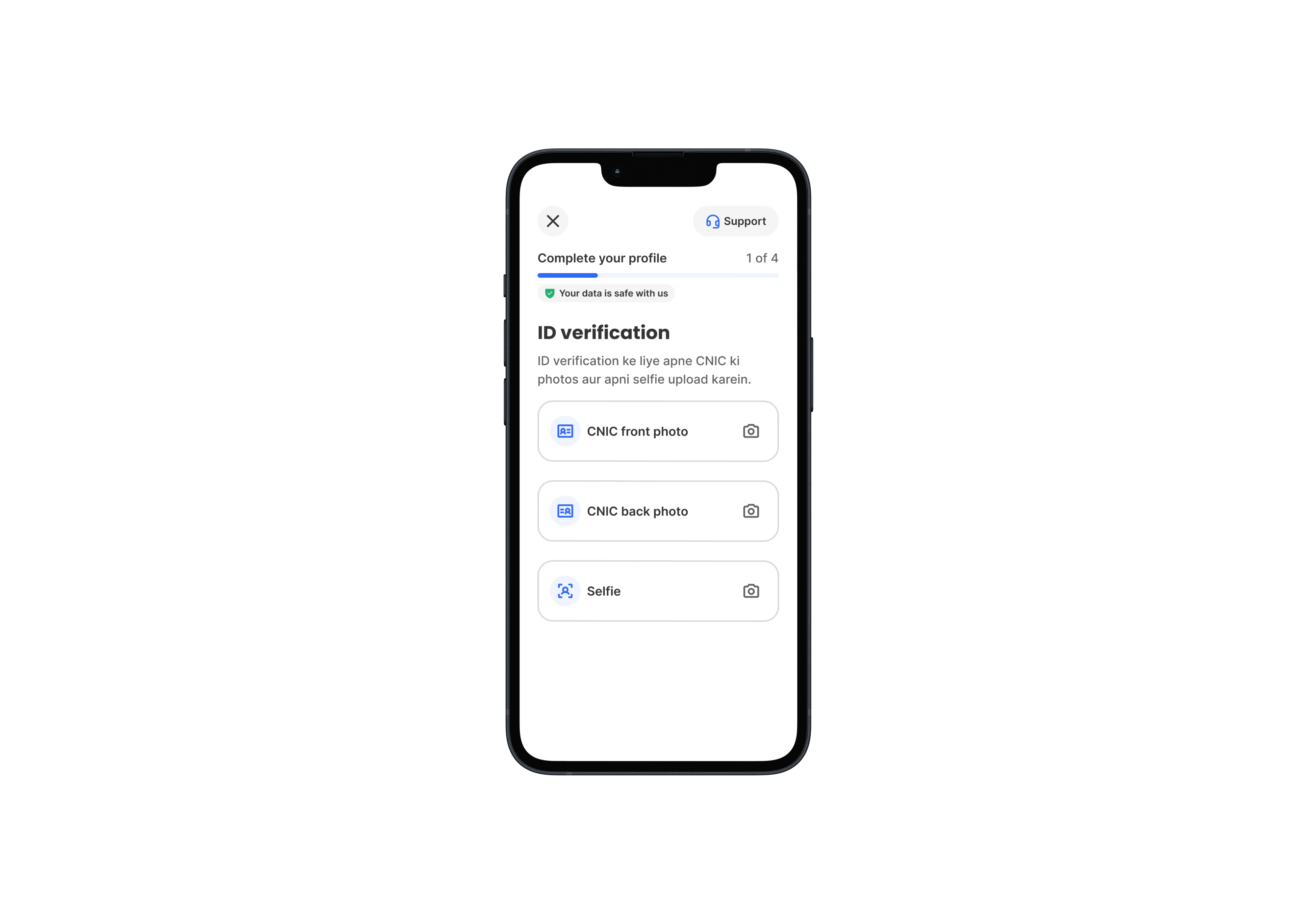

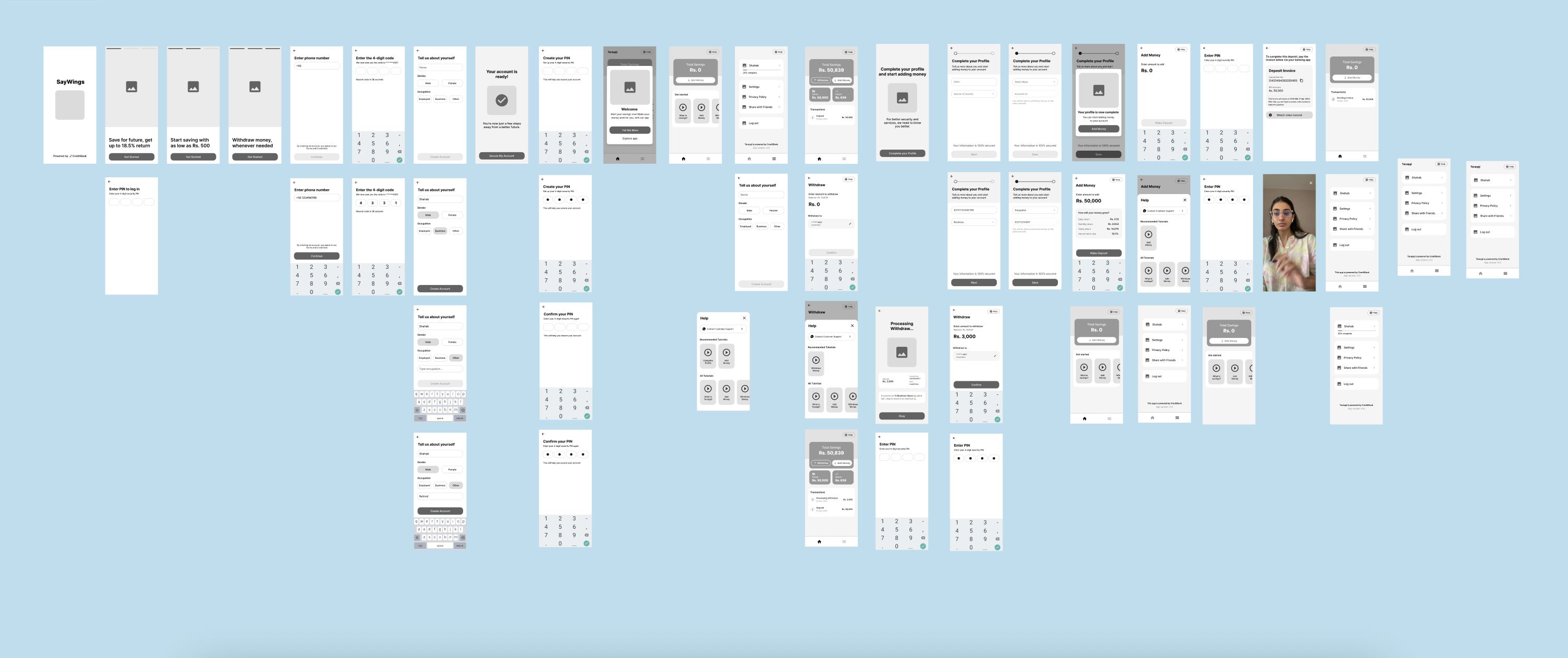

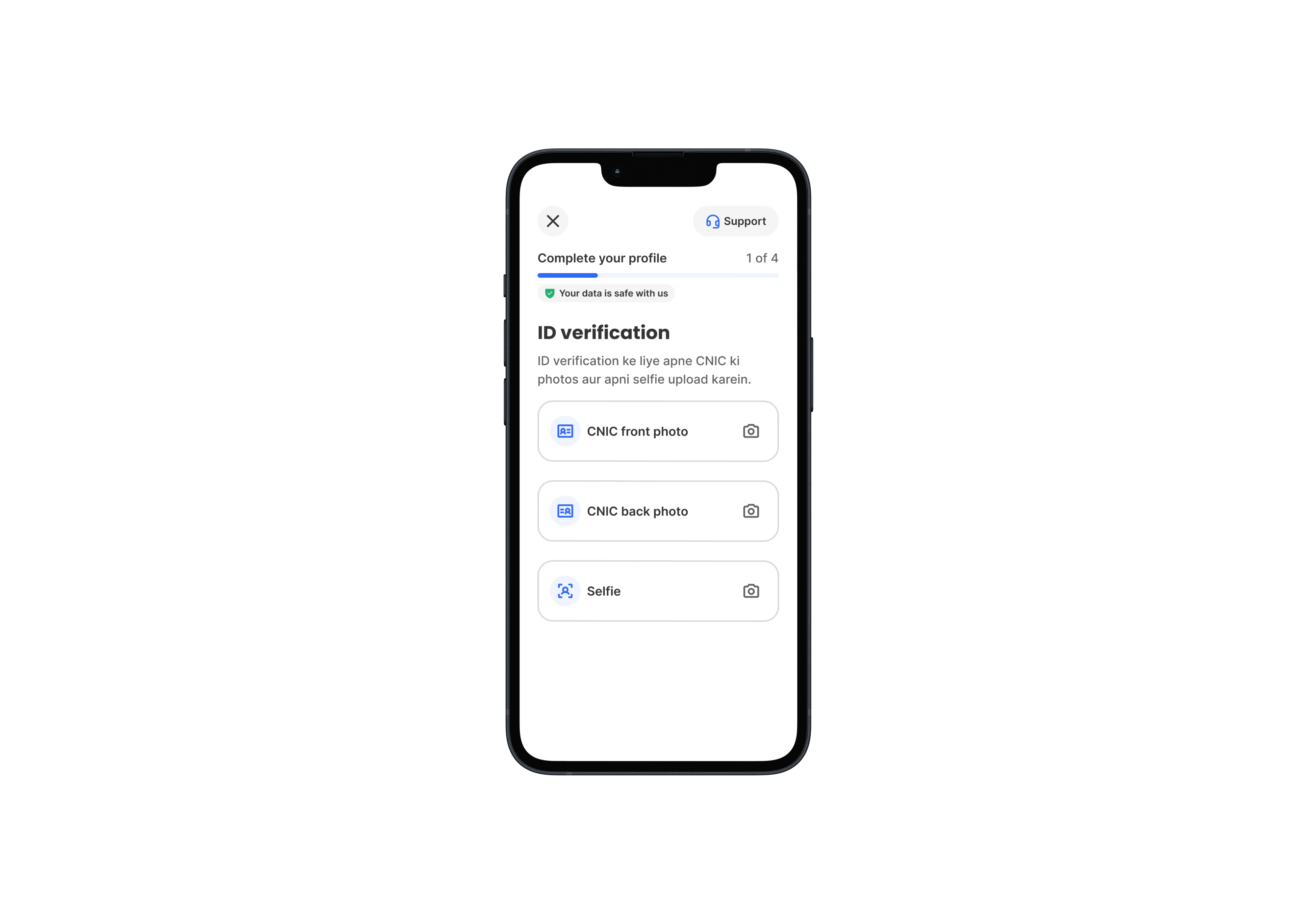

I led whiteboarding sessions with the Fintech and Ops teams to map KYC and regulatory flows and shape the end-to-end journey.

We worked closely with the Research team on ideation, which informed the wireframes I created to review with key stakeholders.

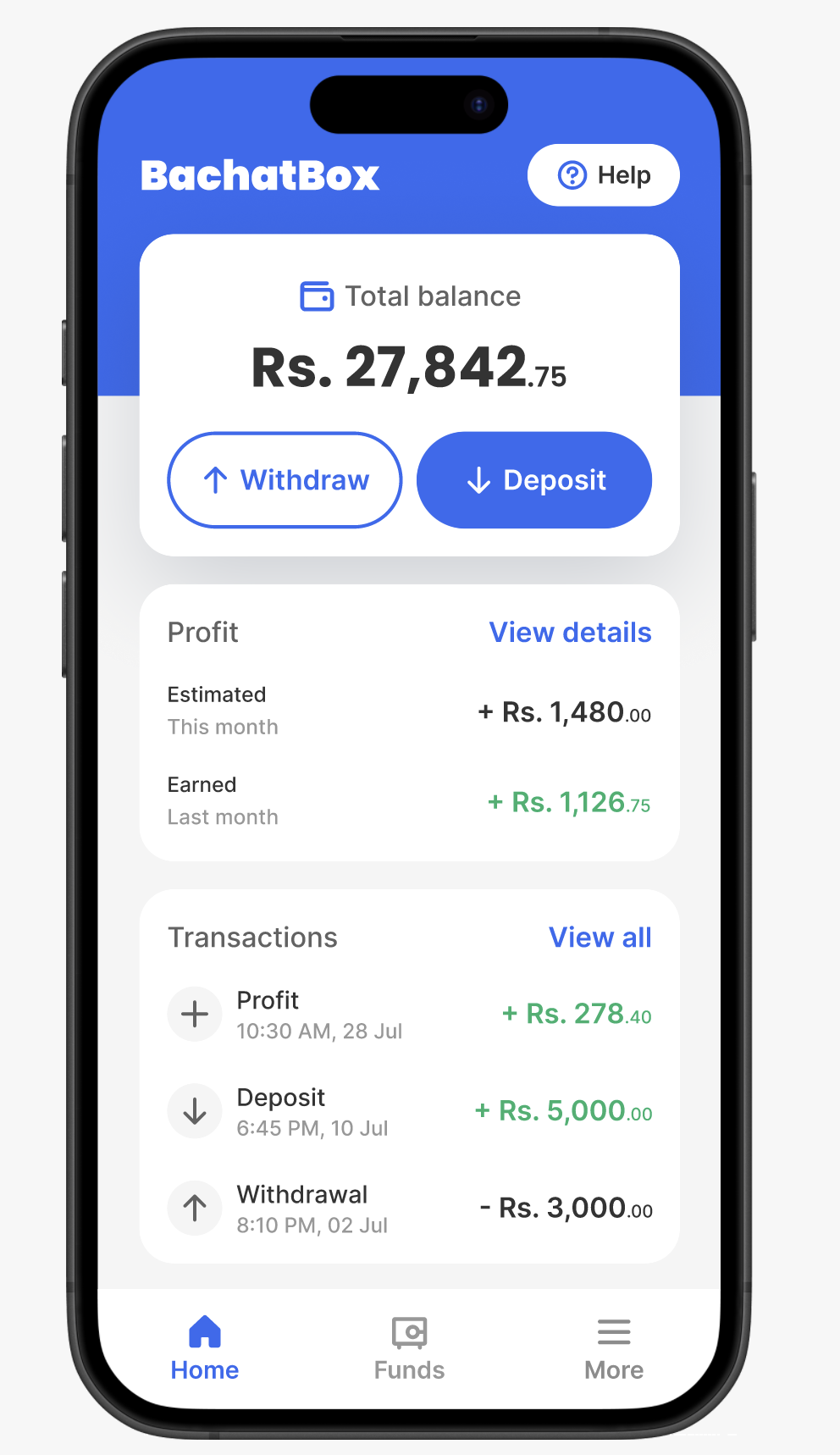

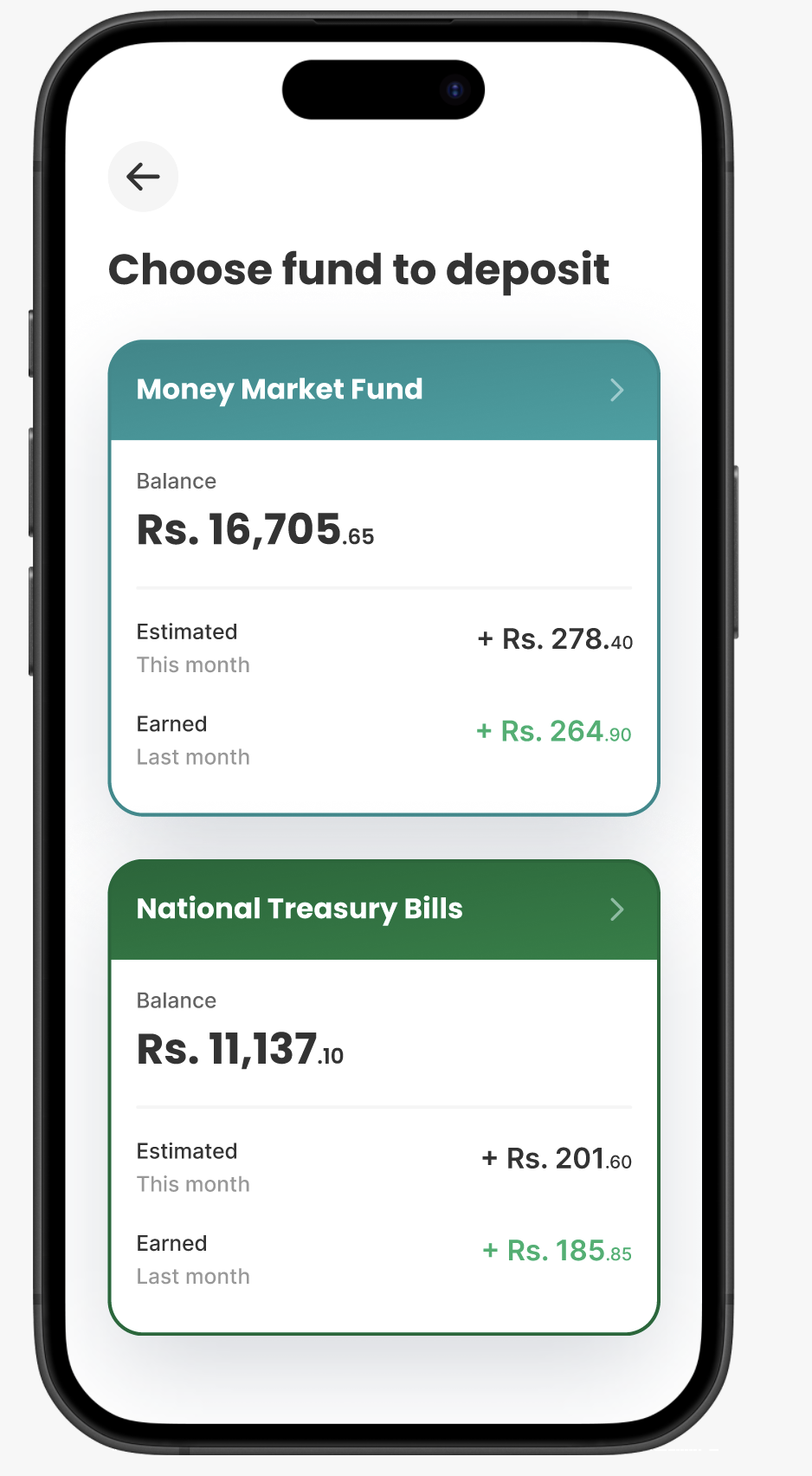

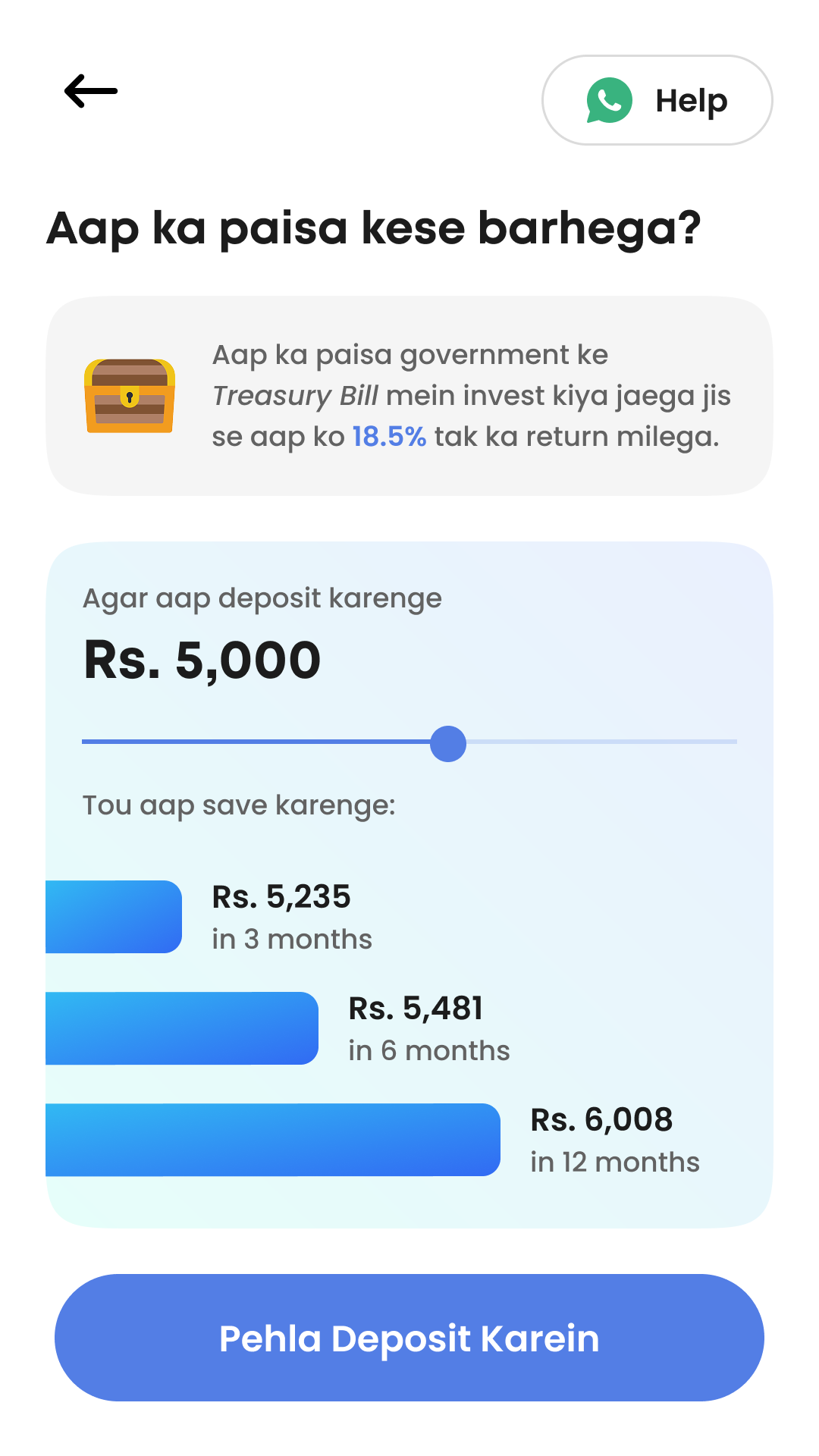

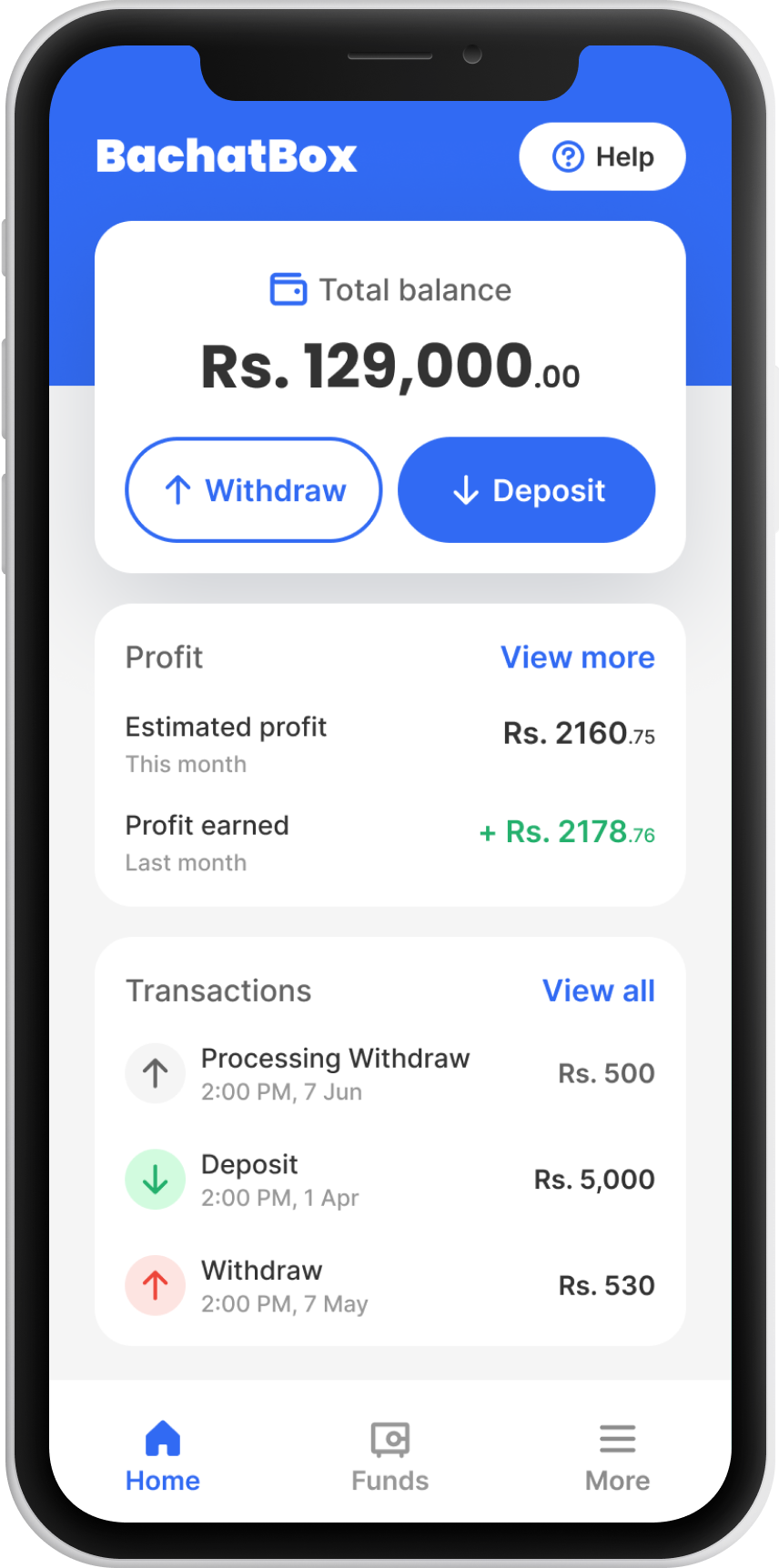

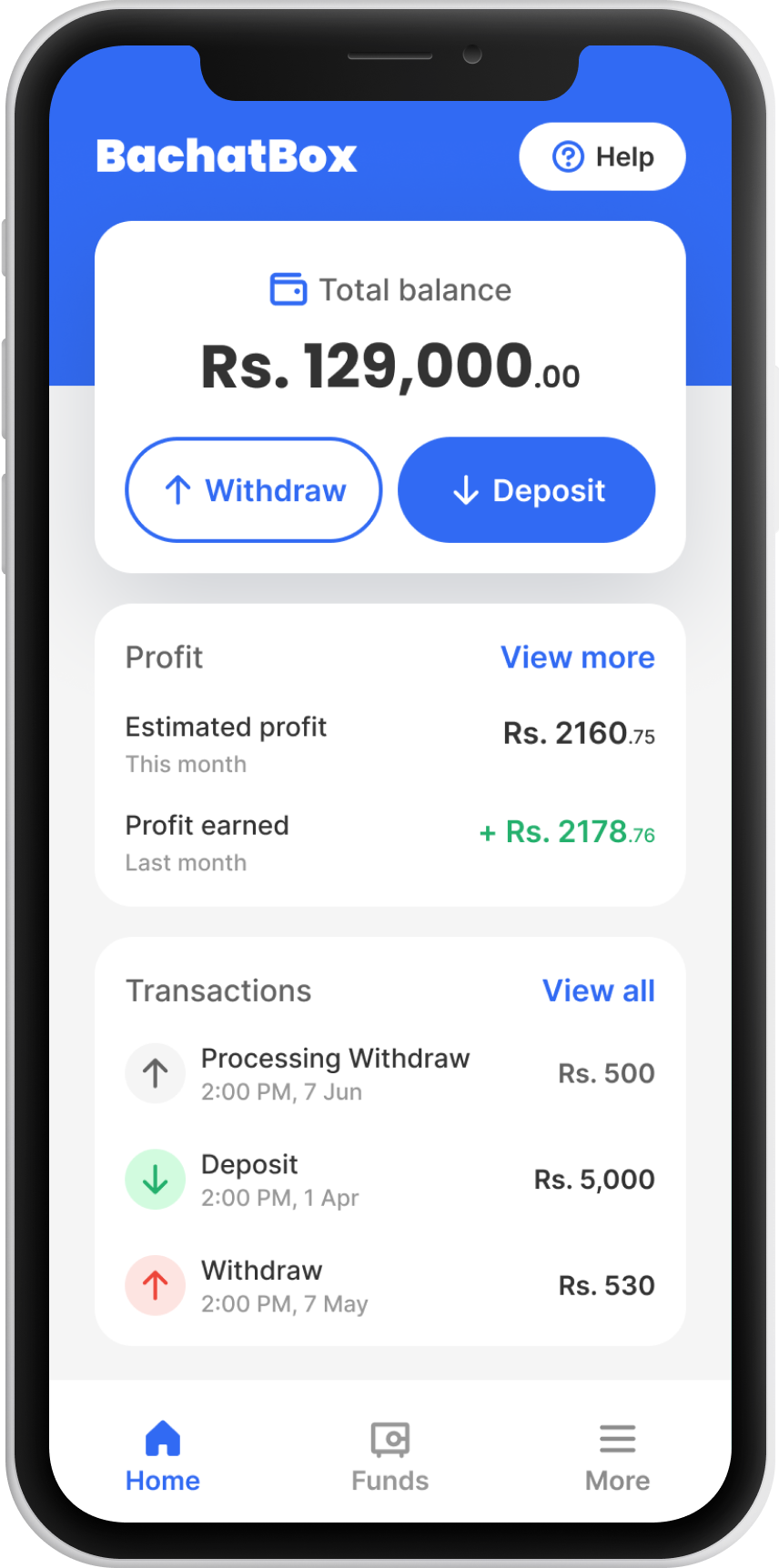

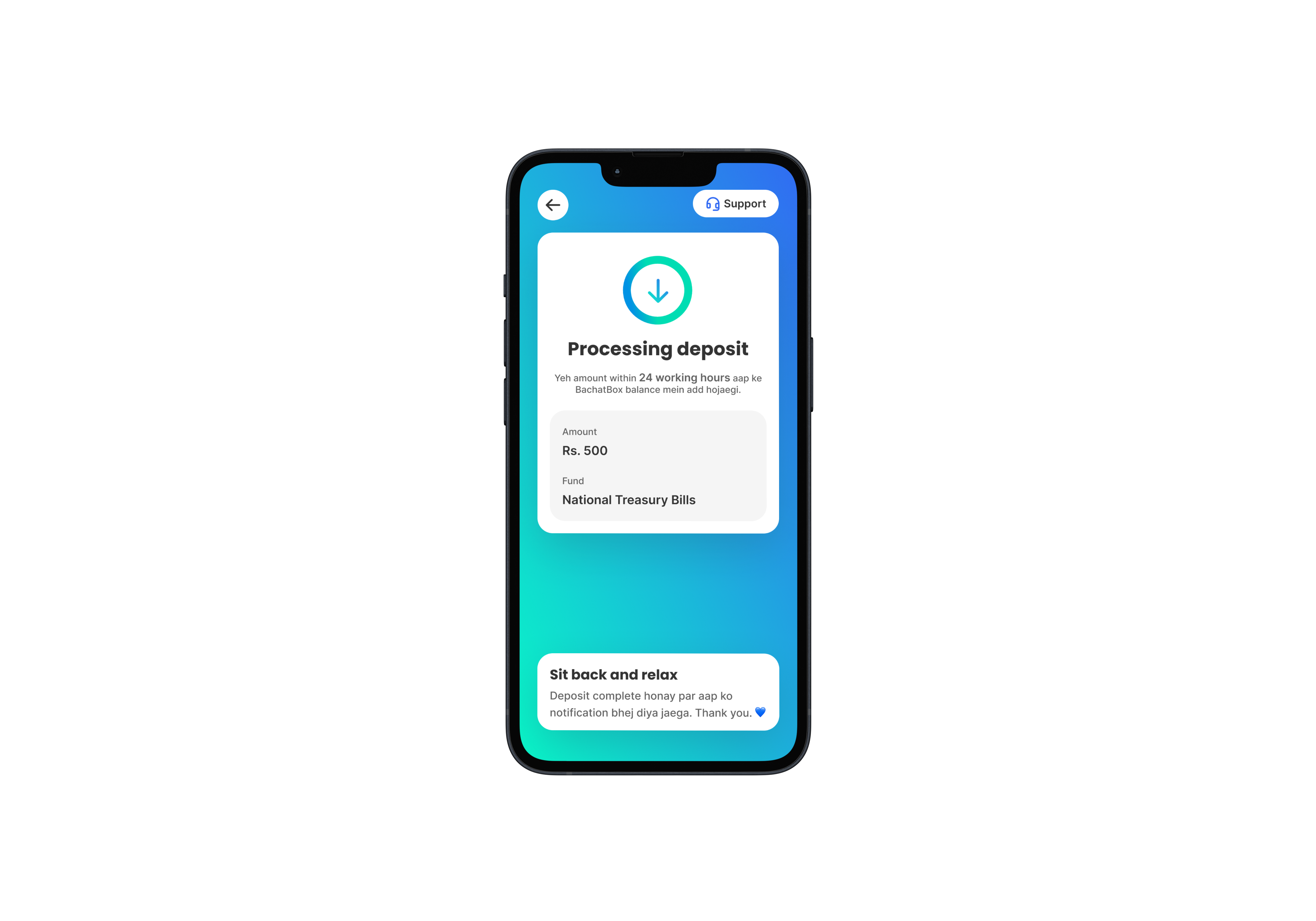

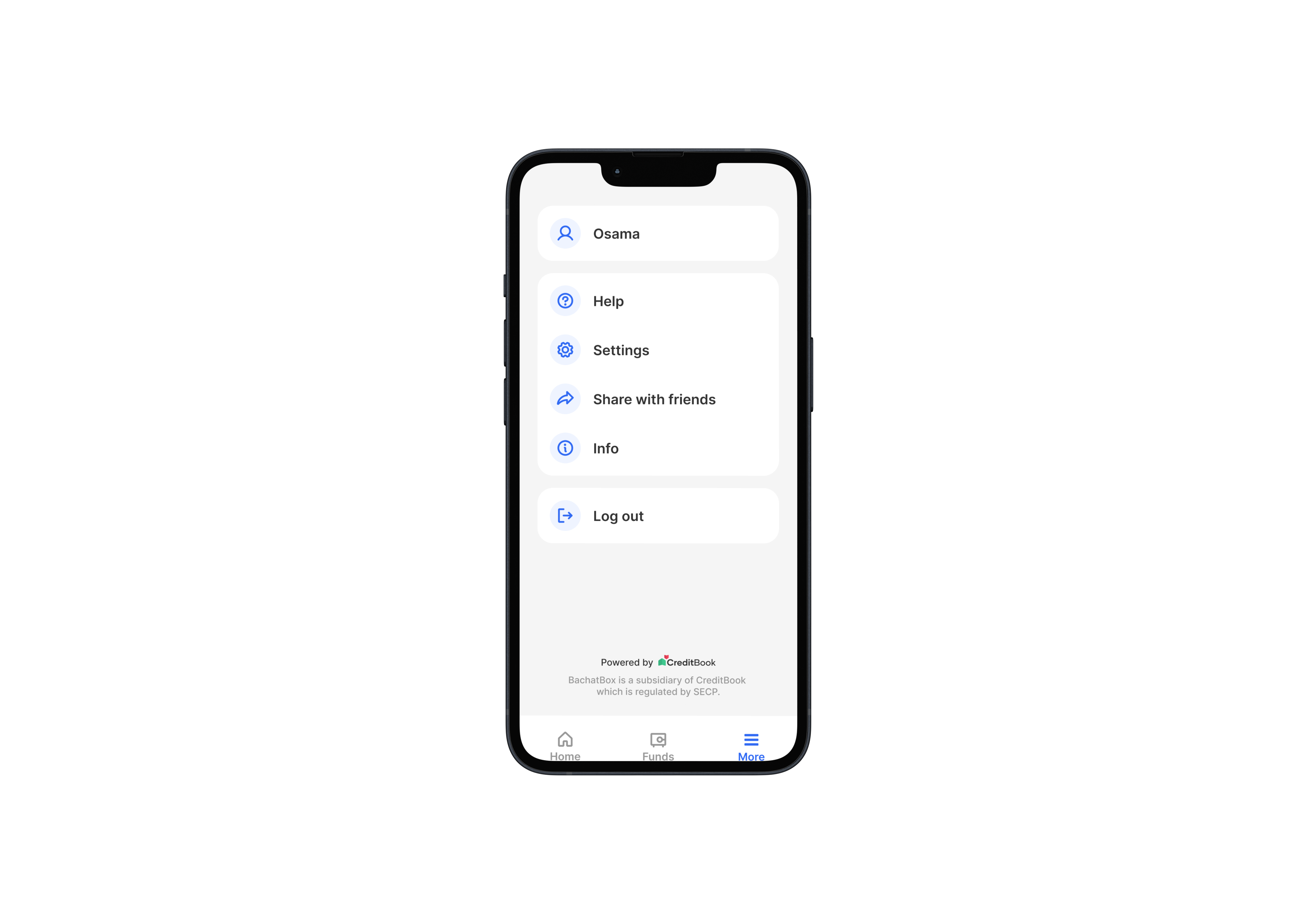

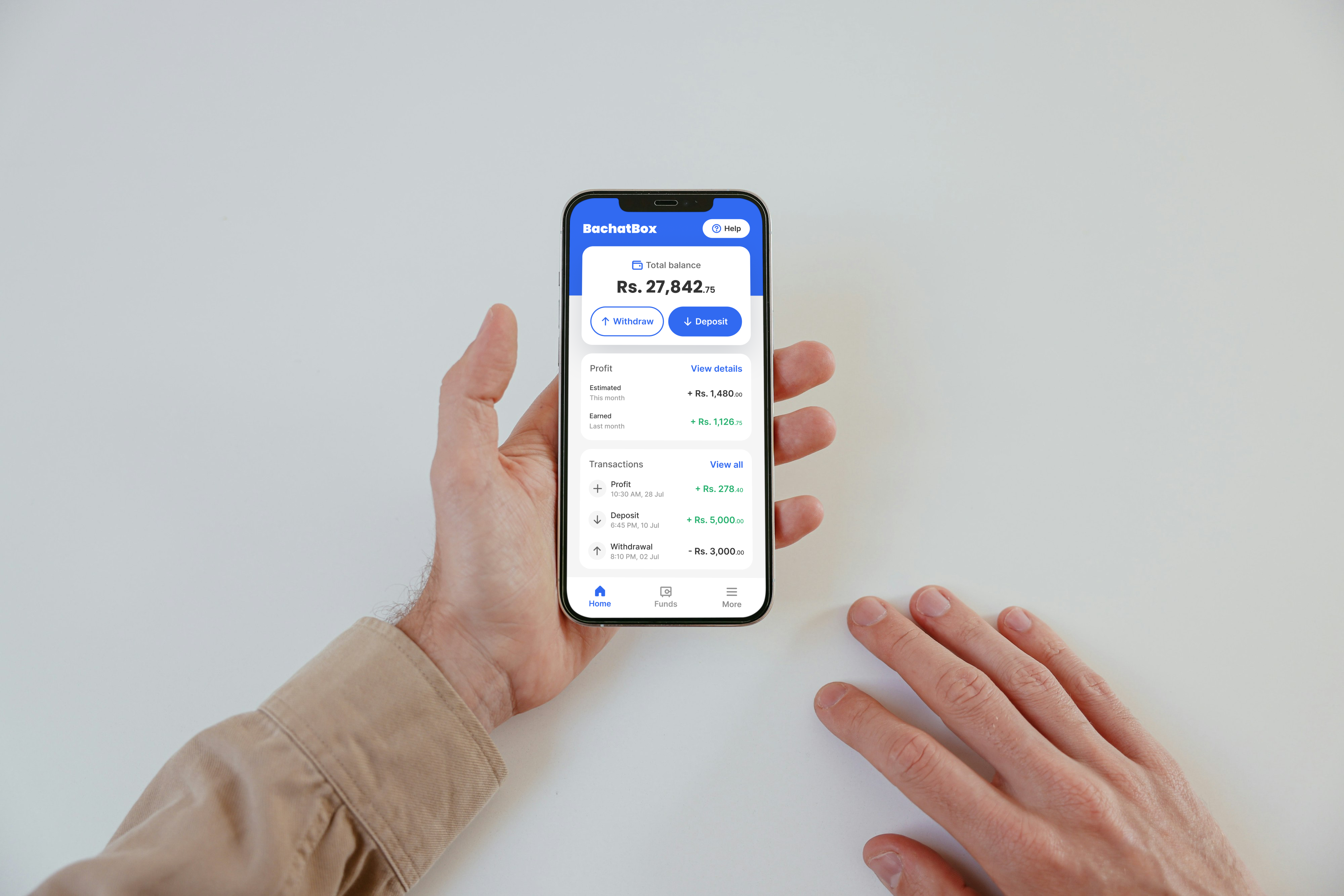

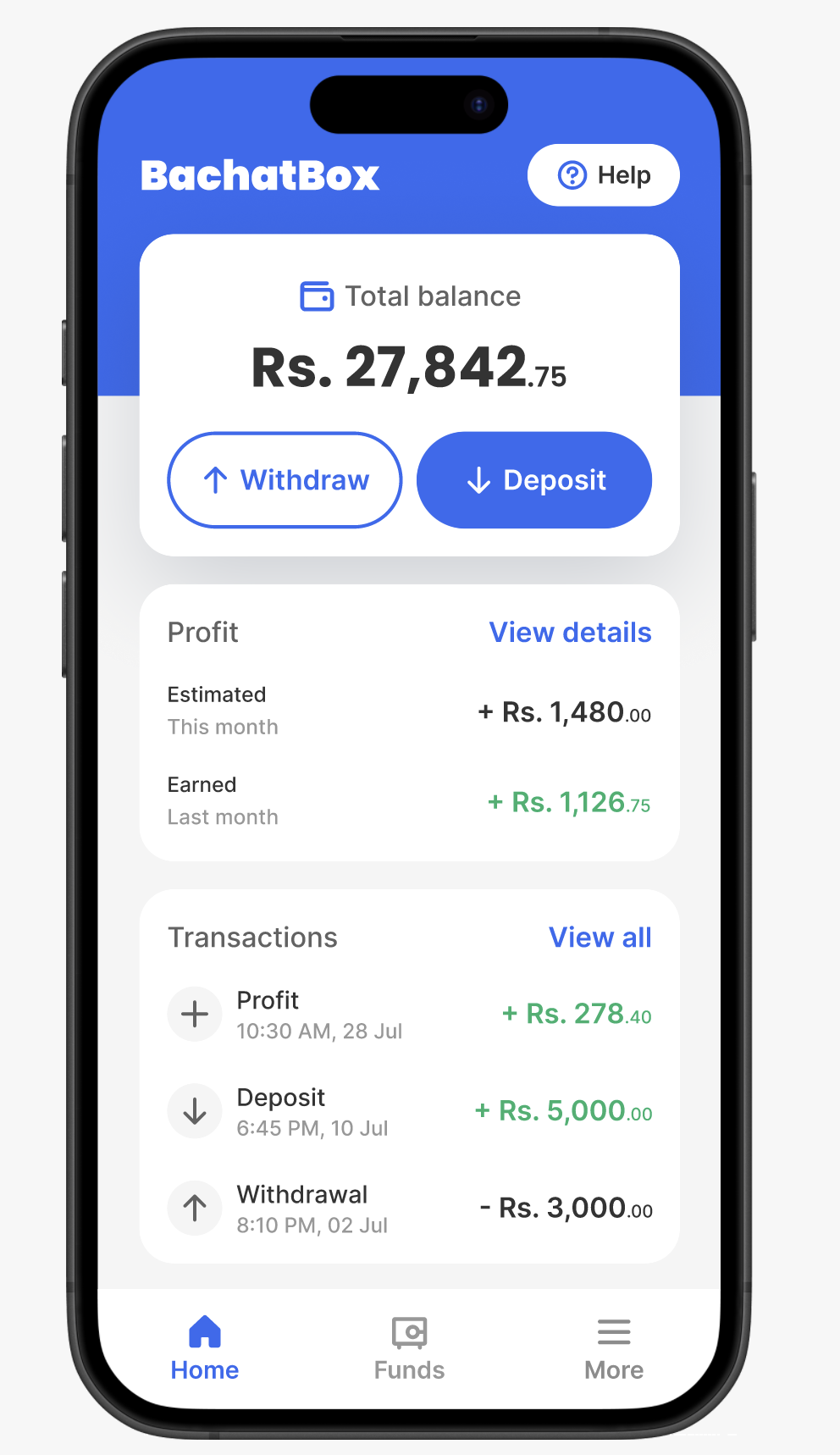

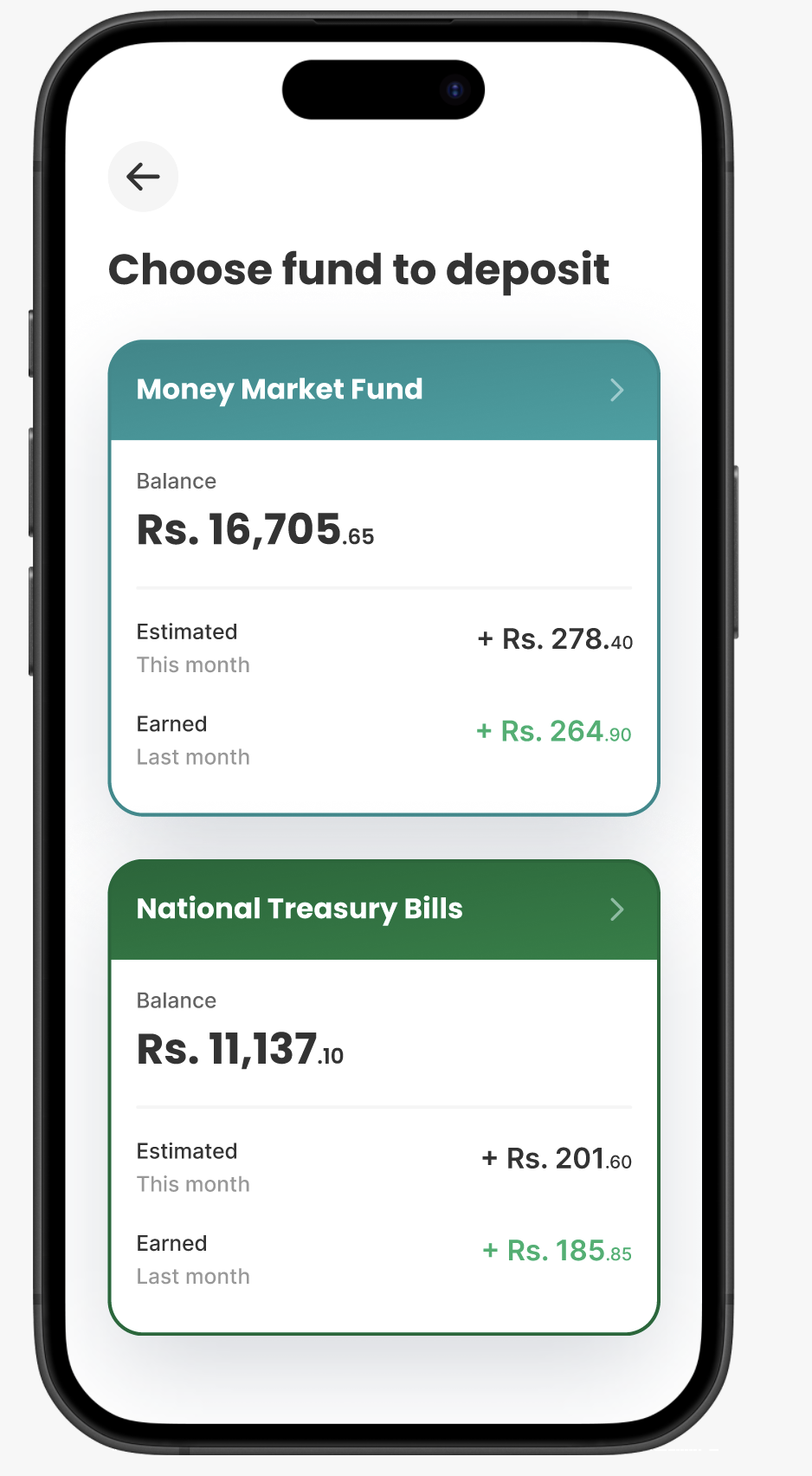

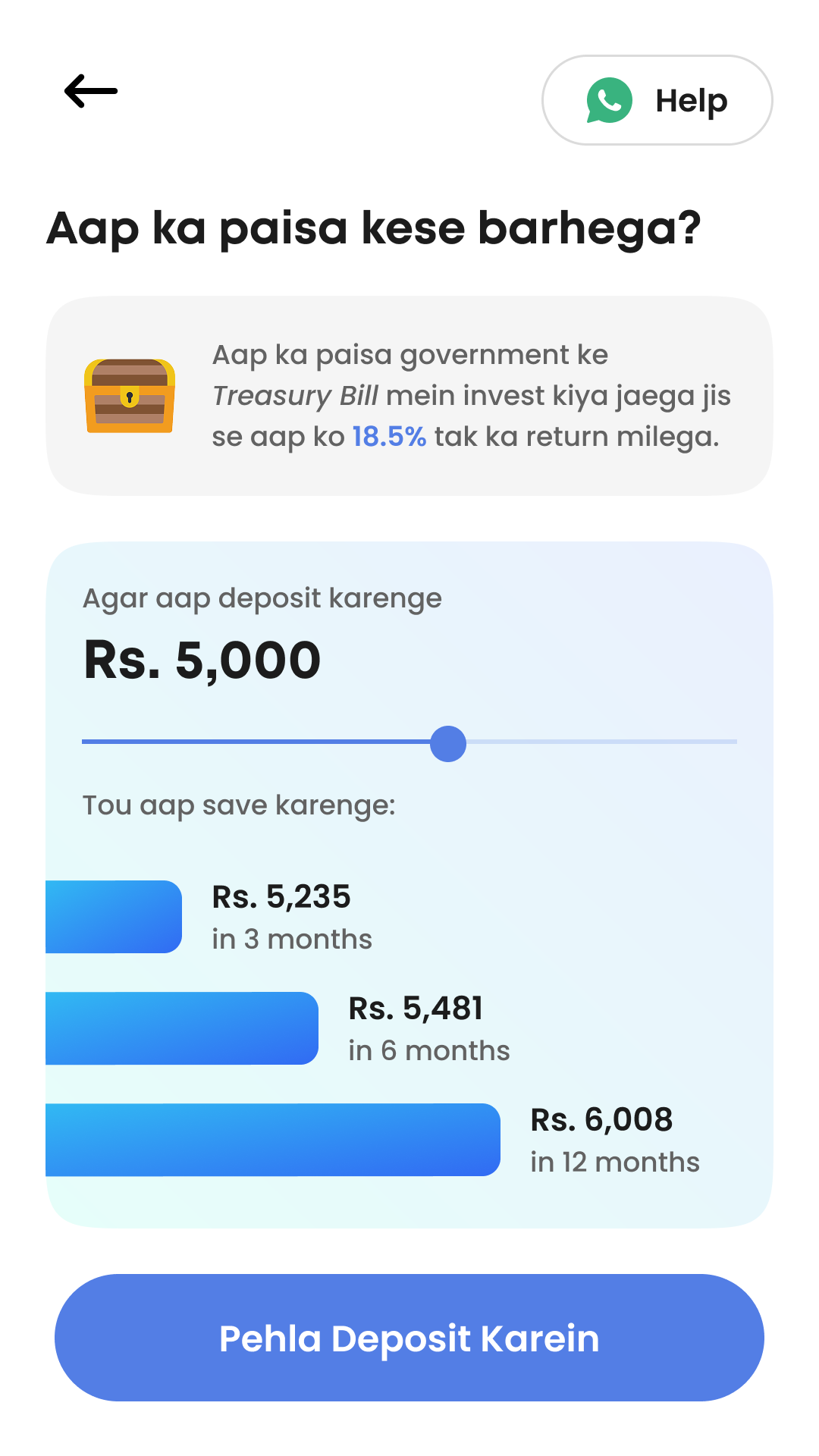

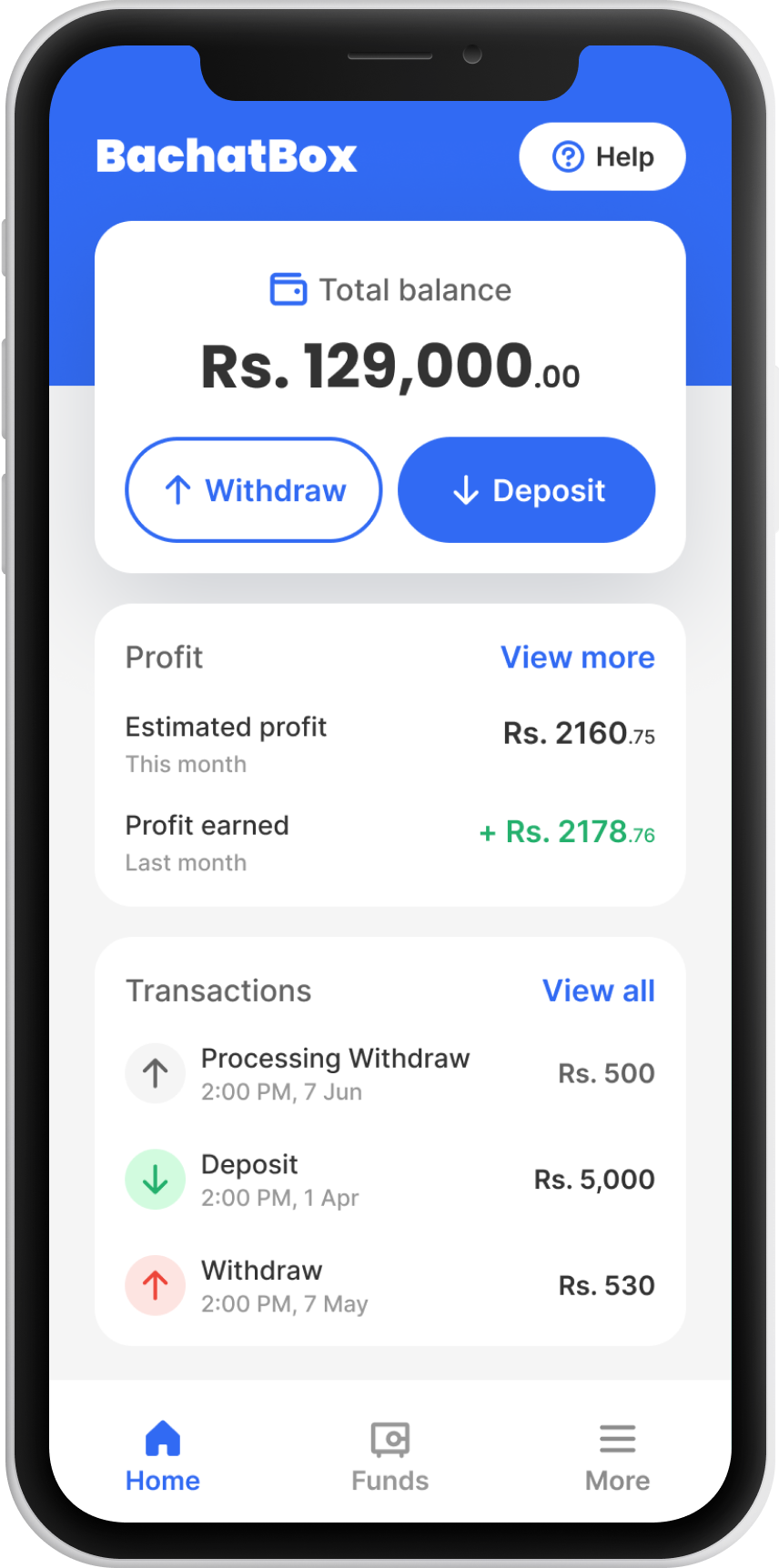

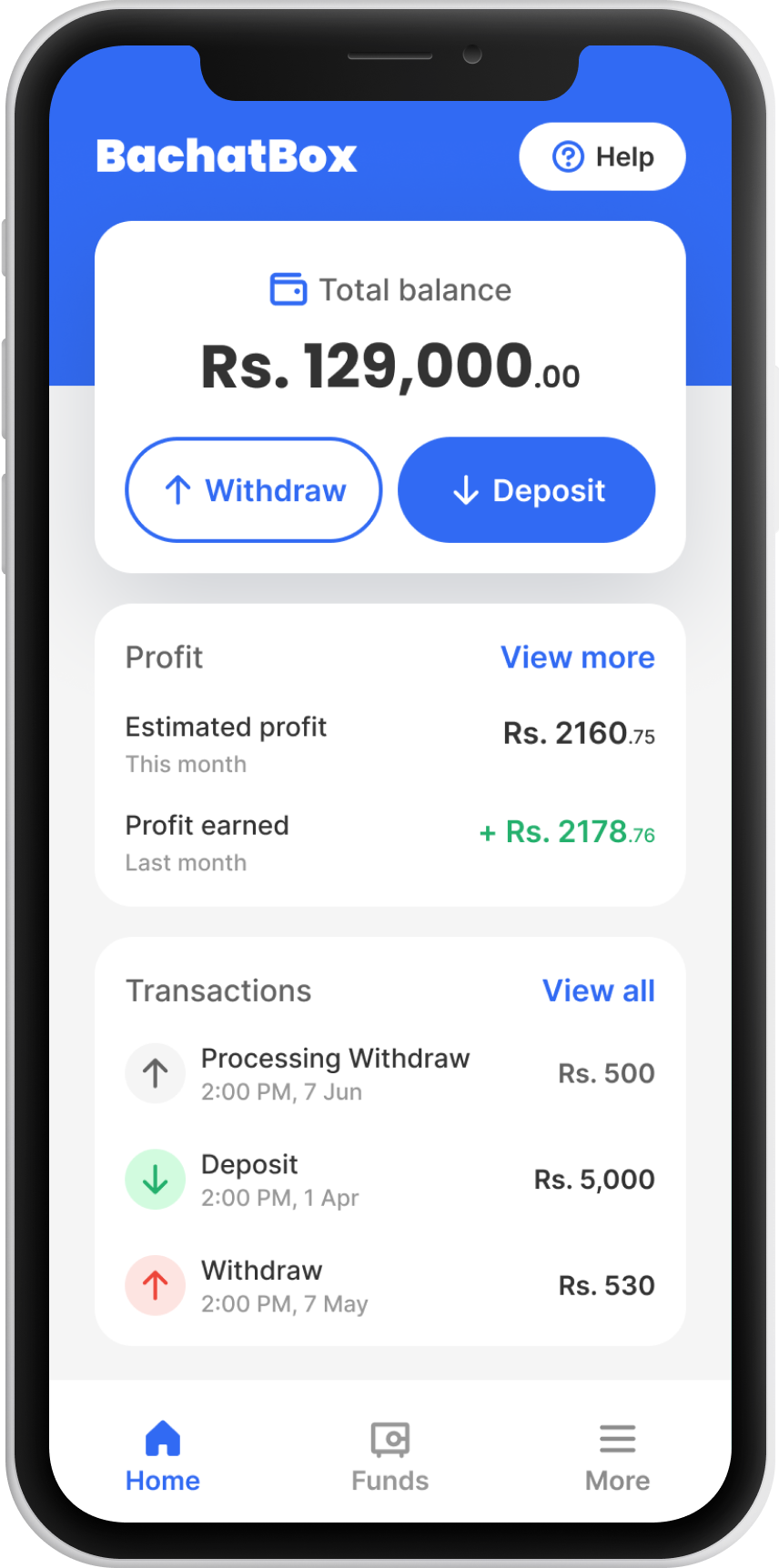

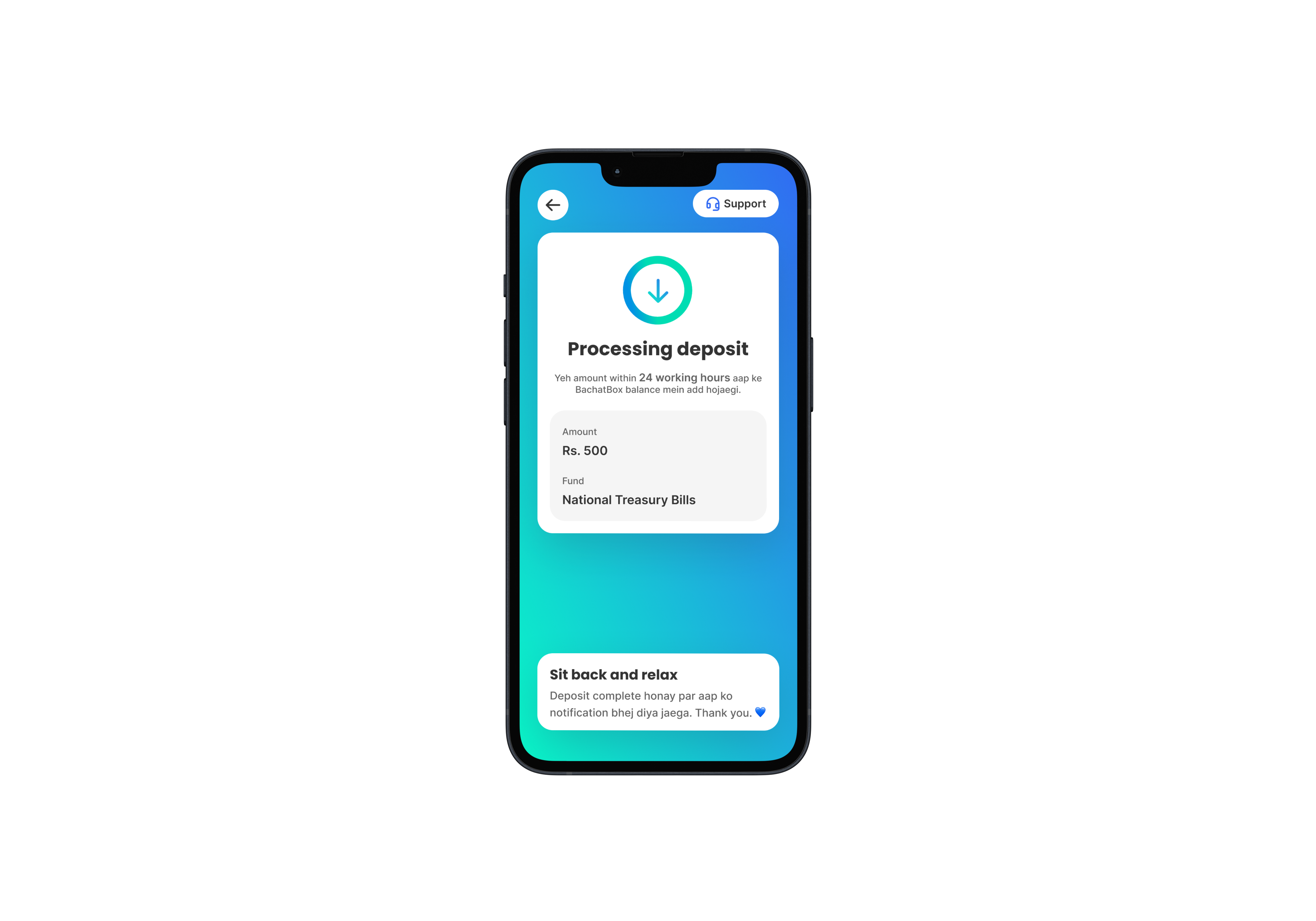

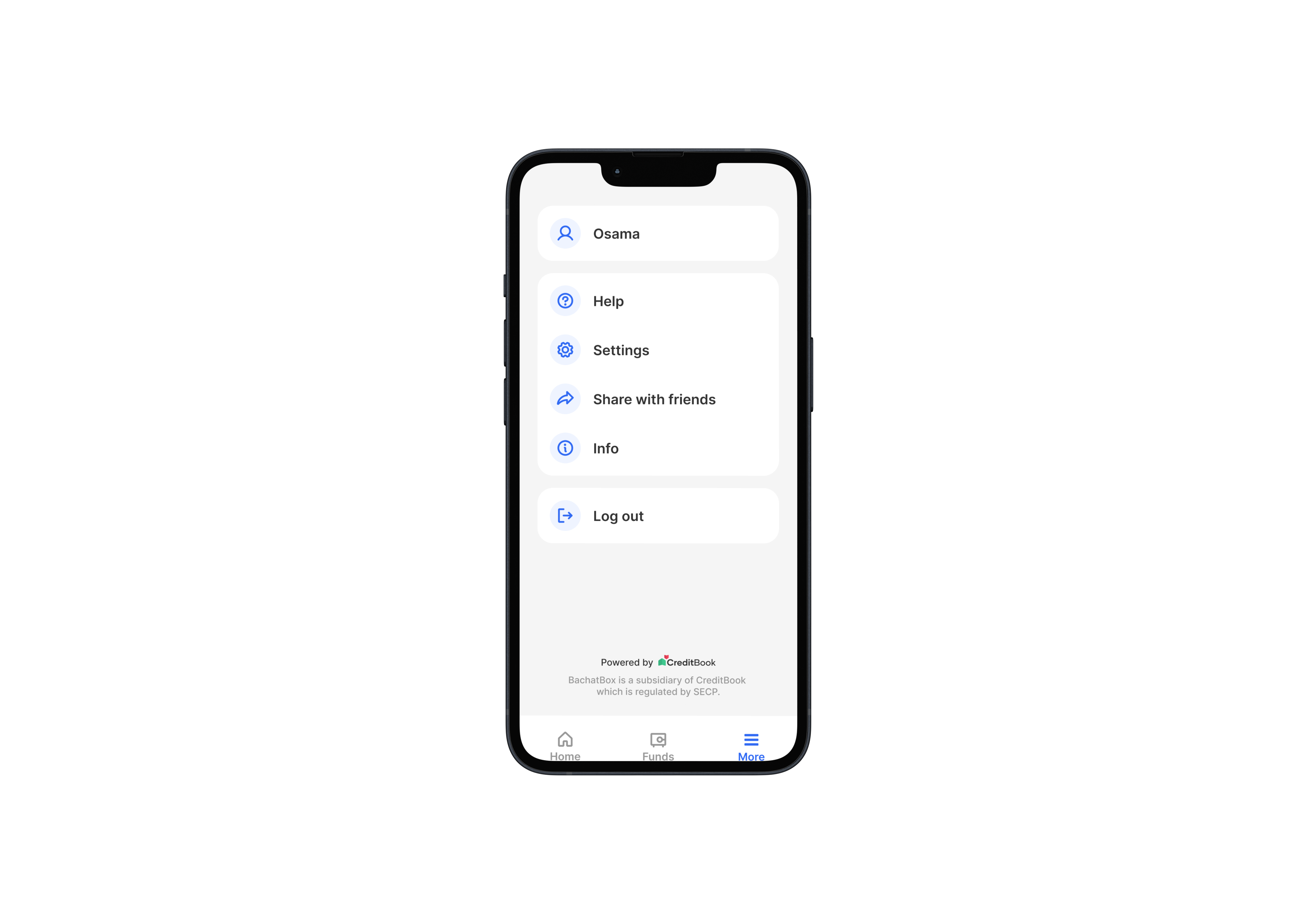

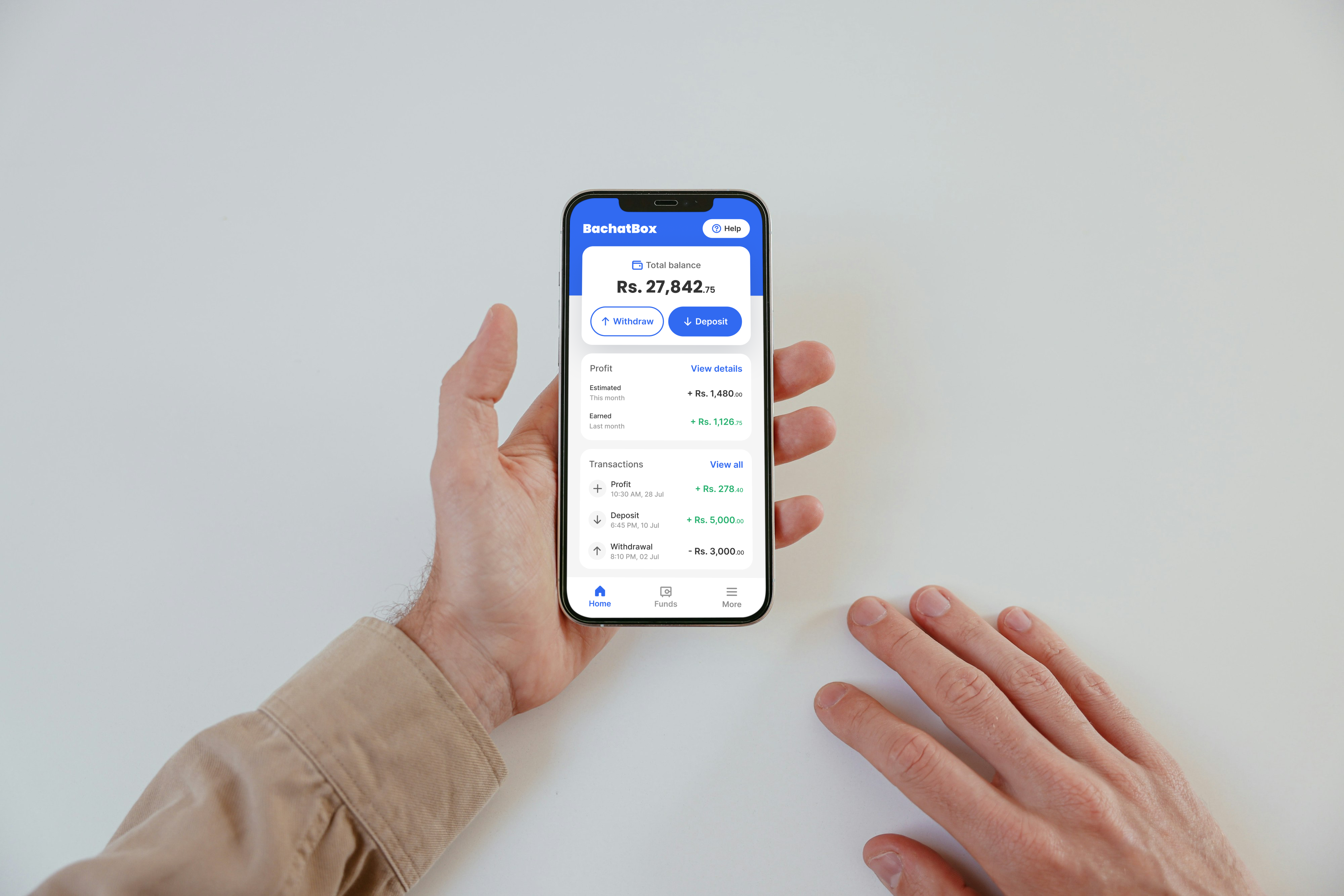

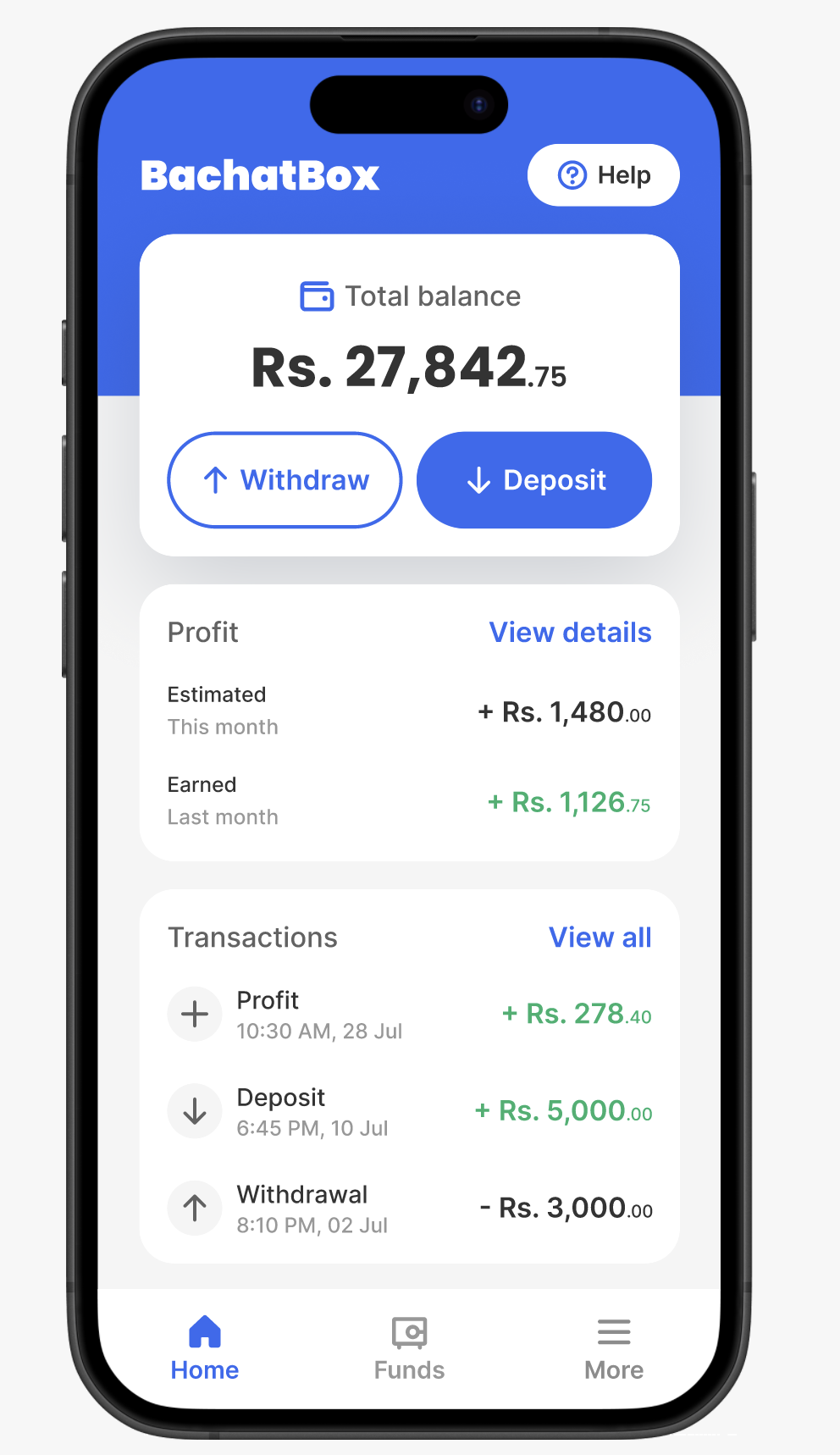

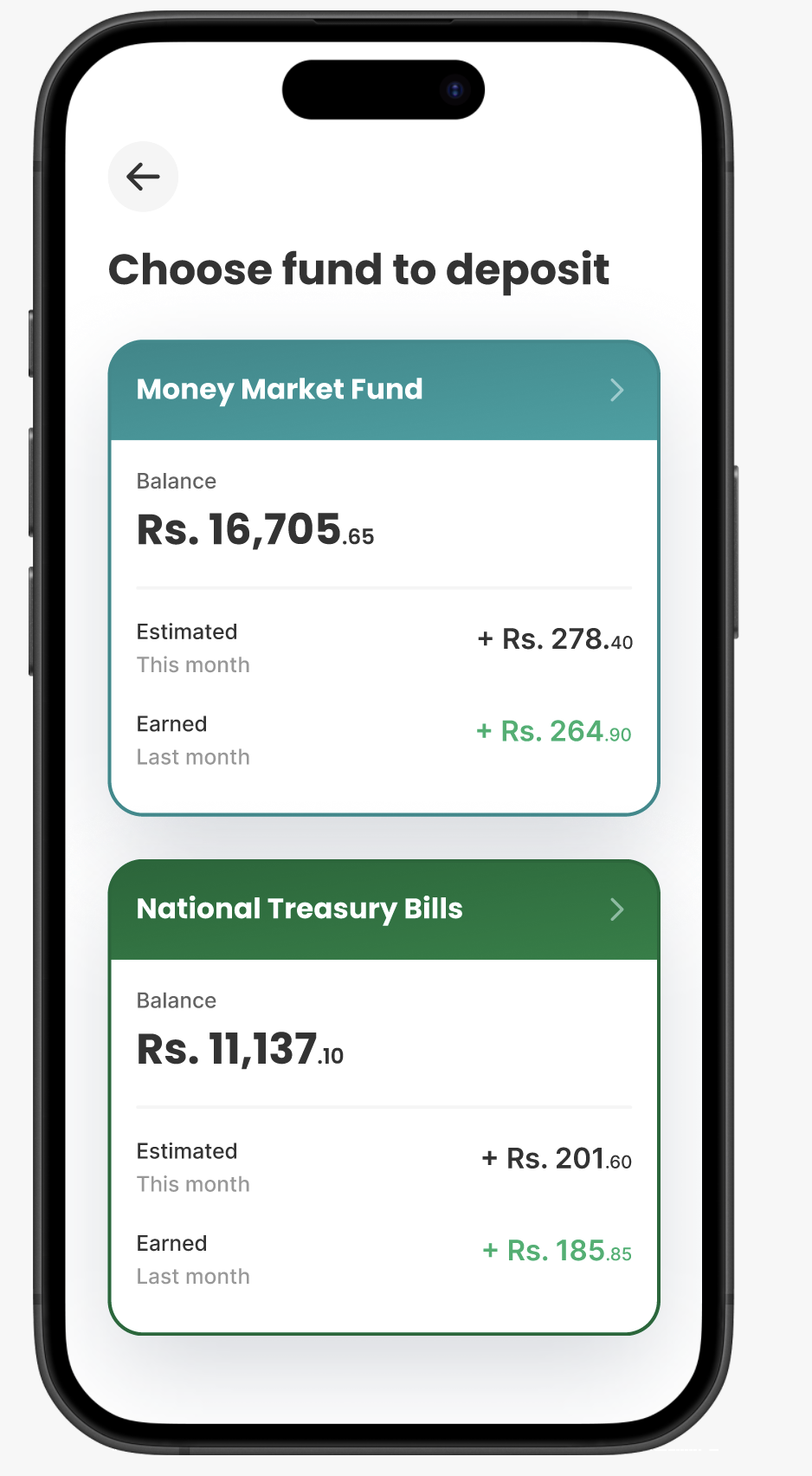

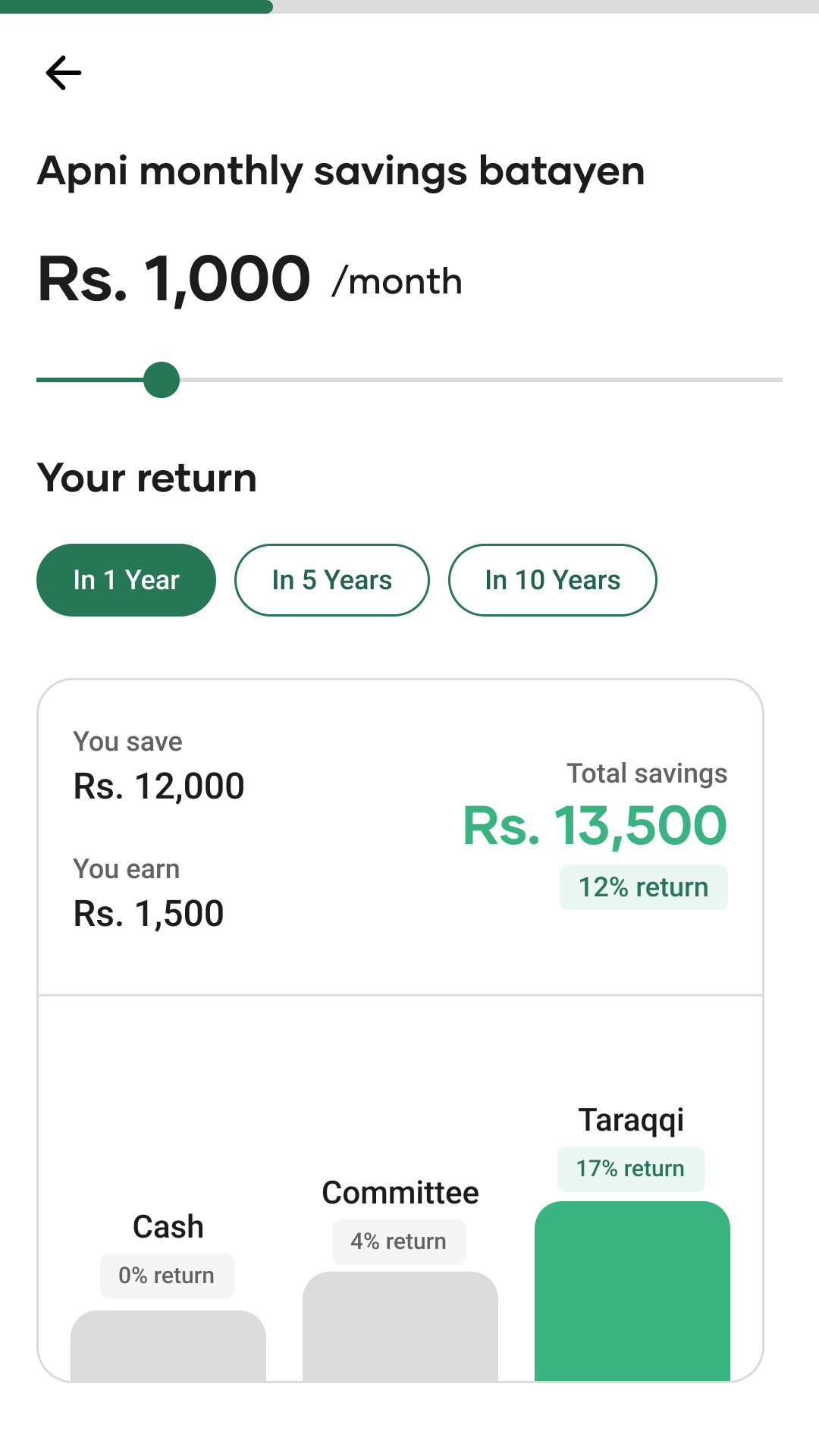

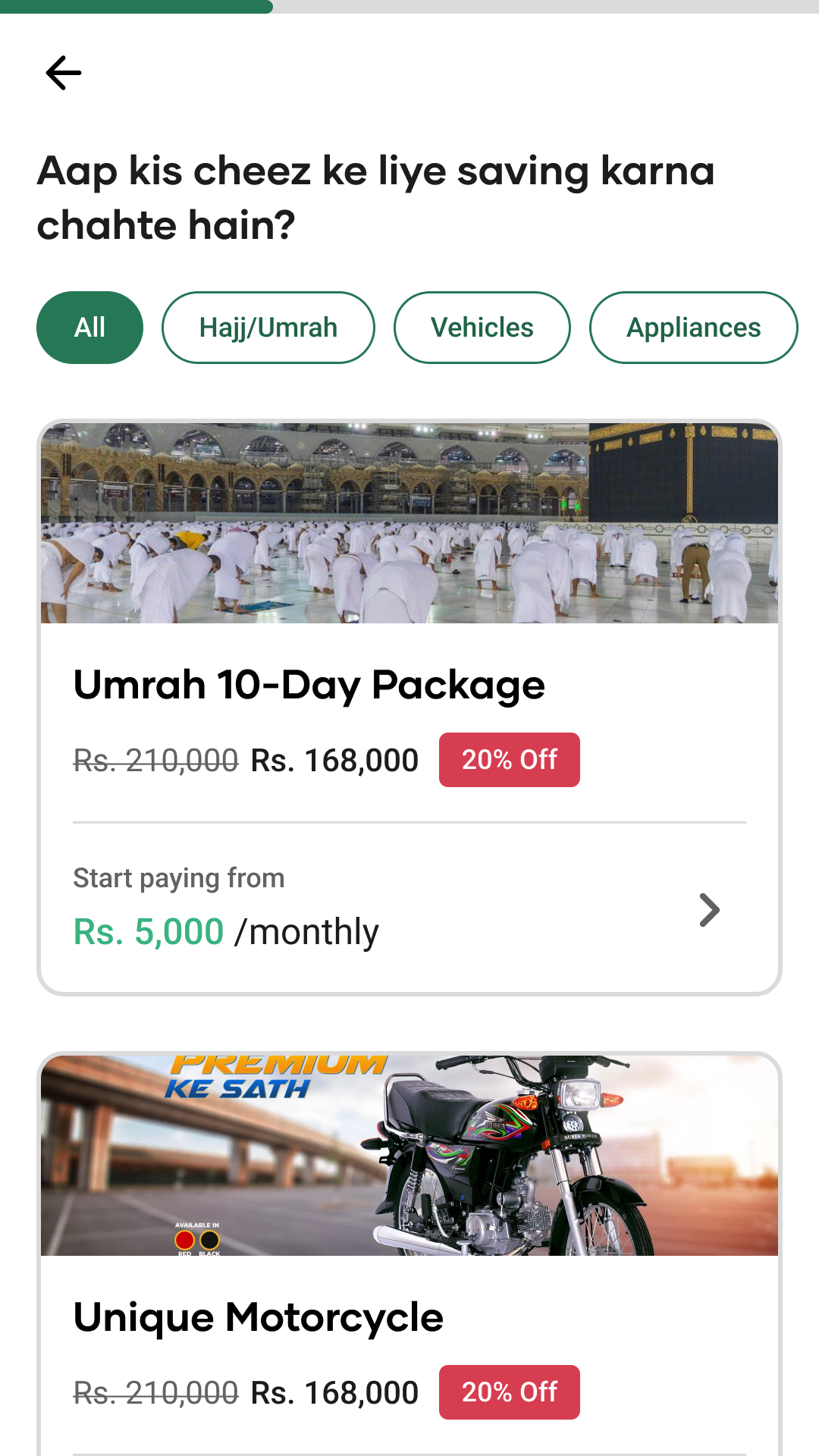

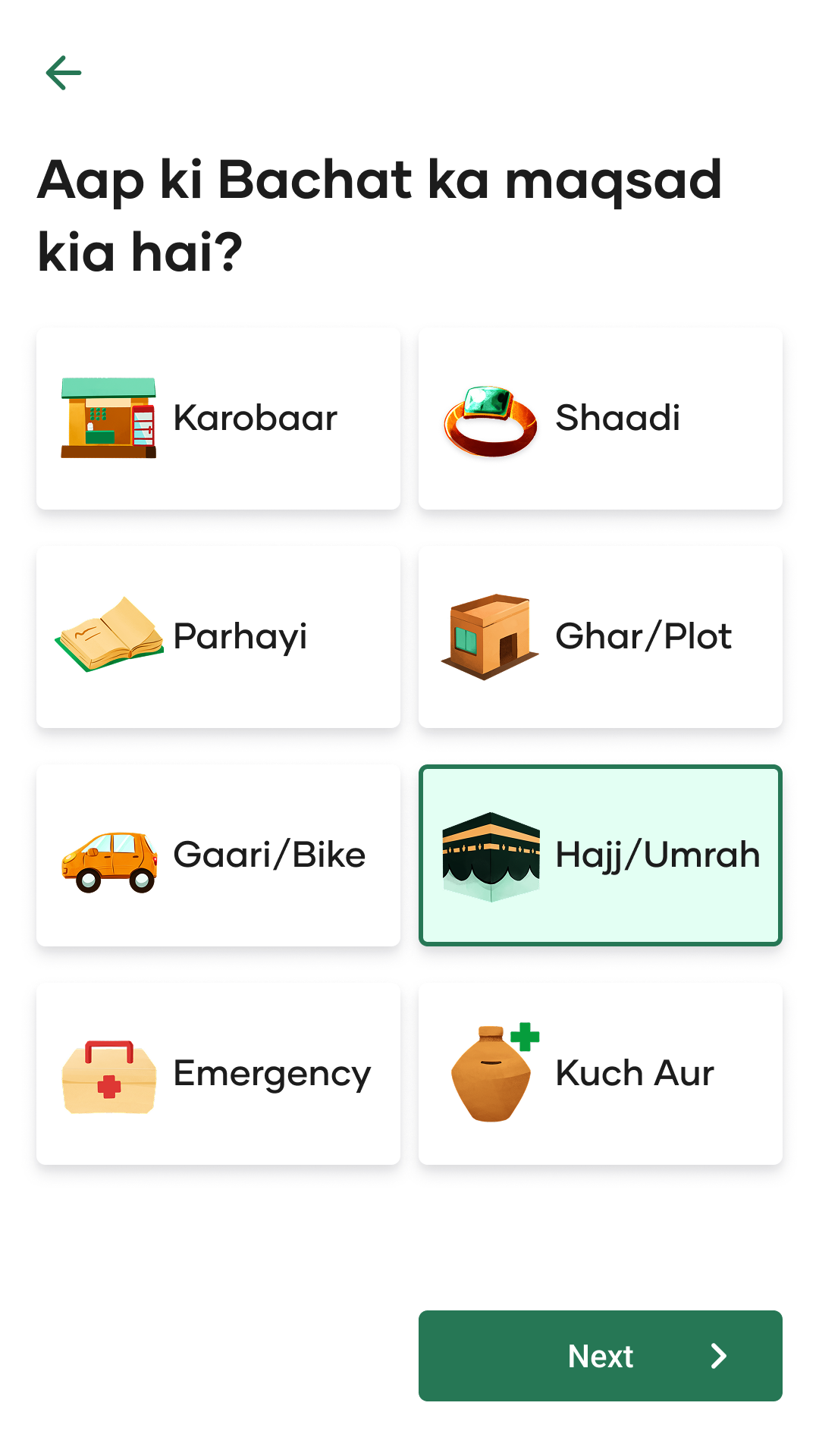

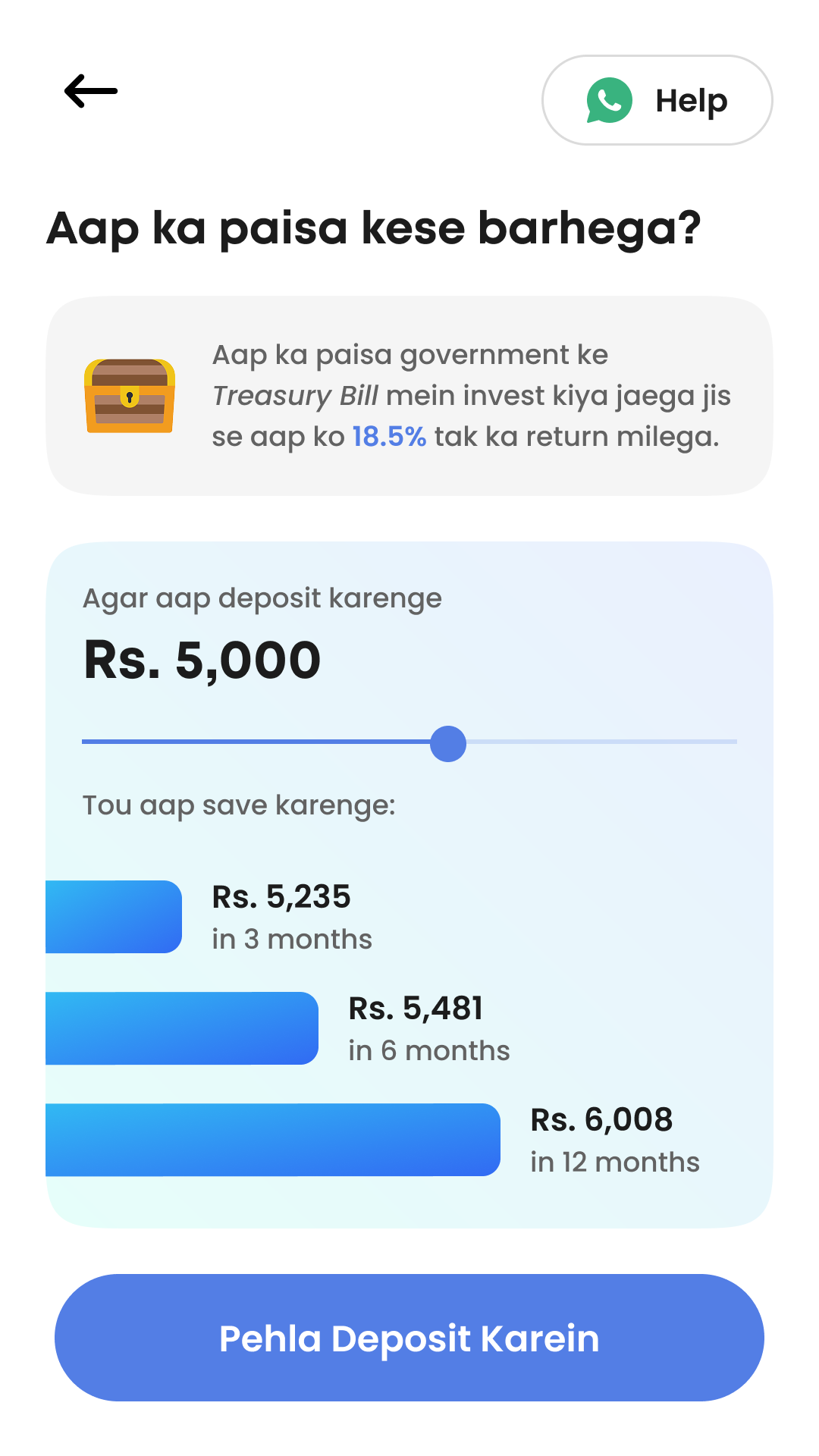

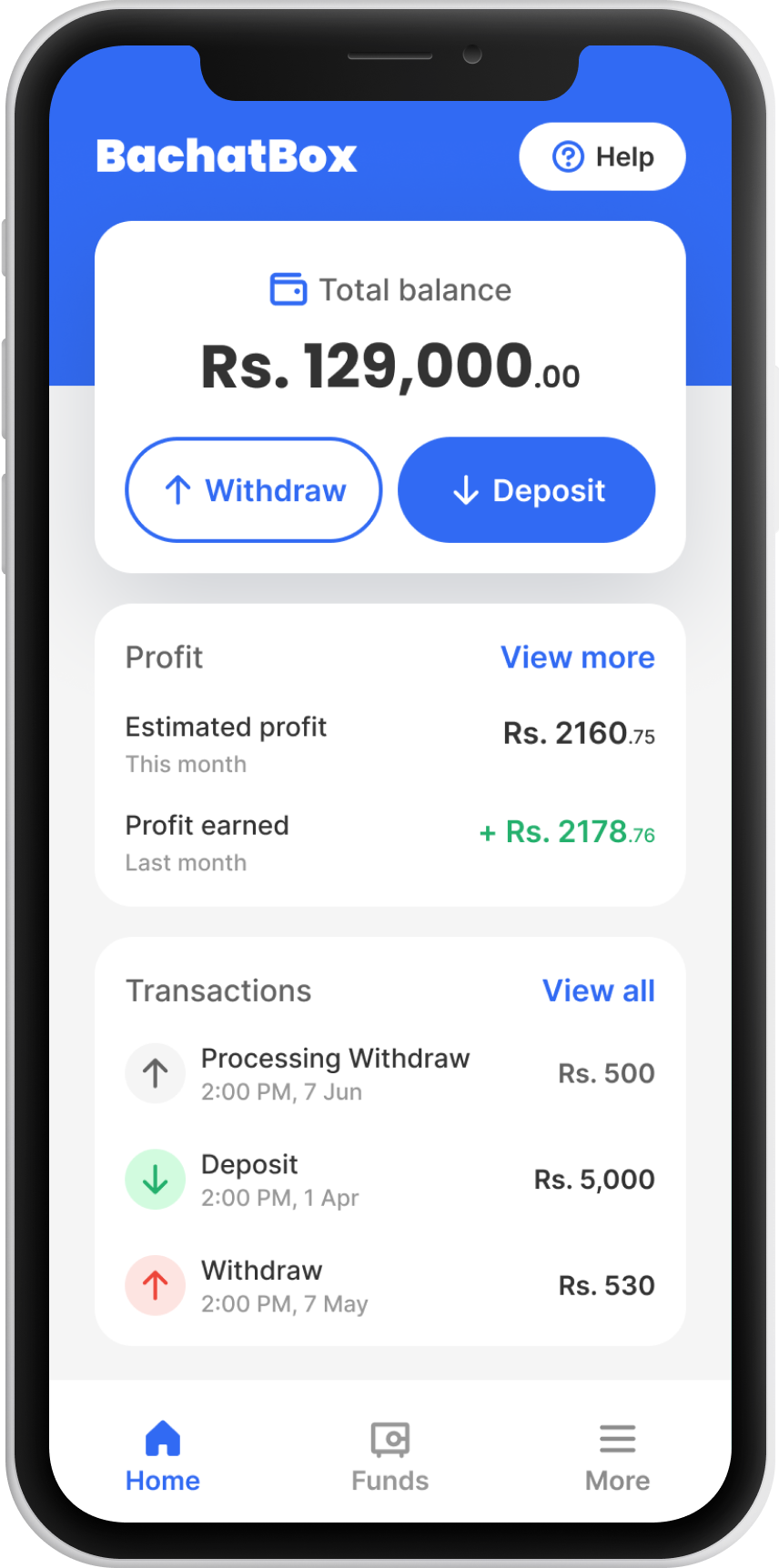

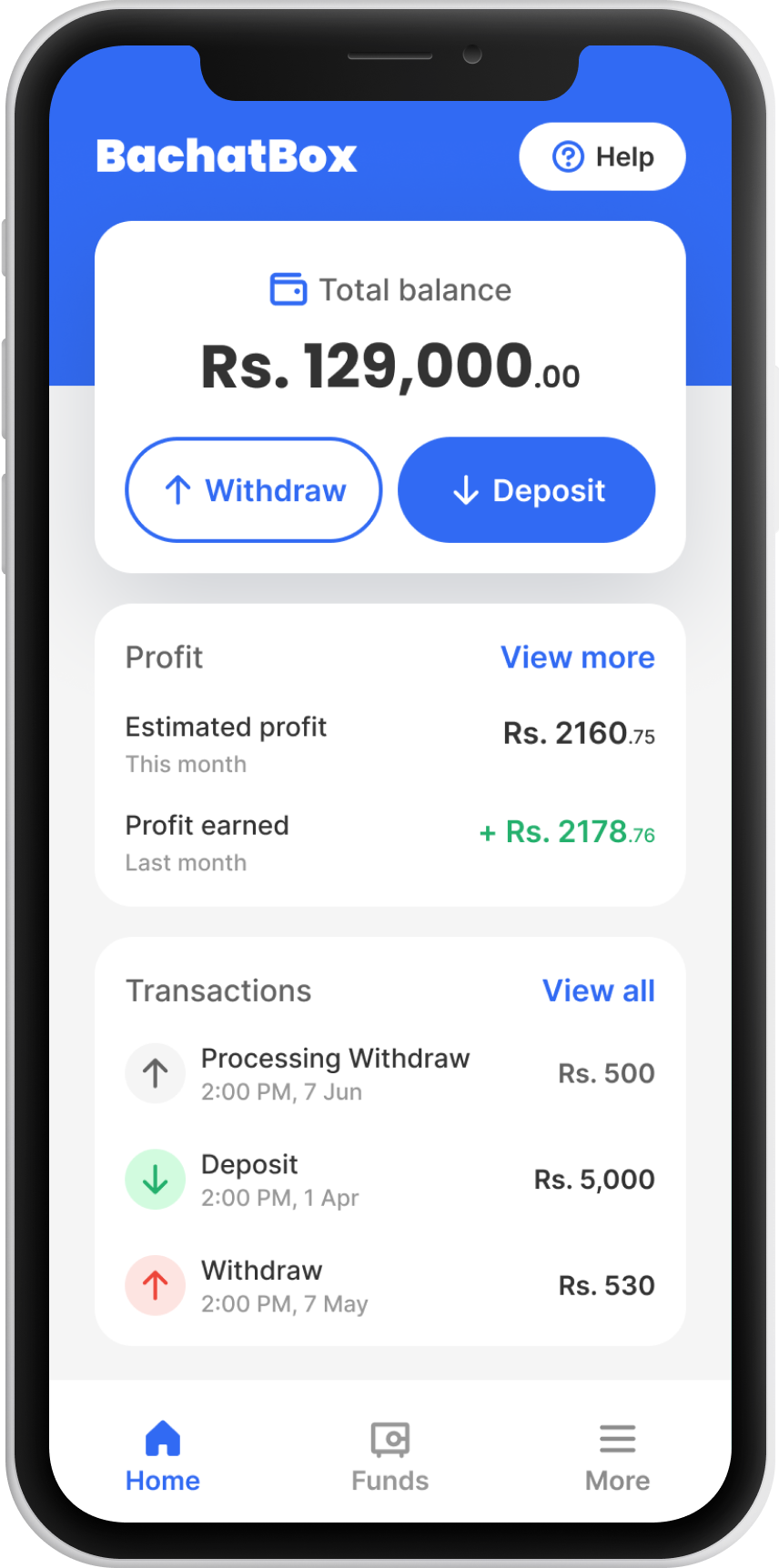

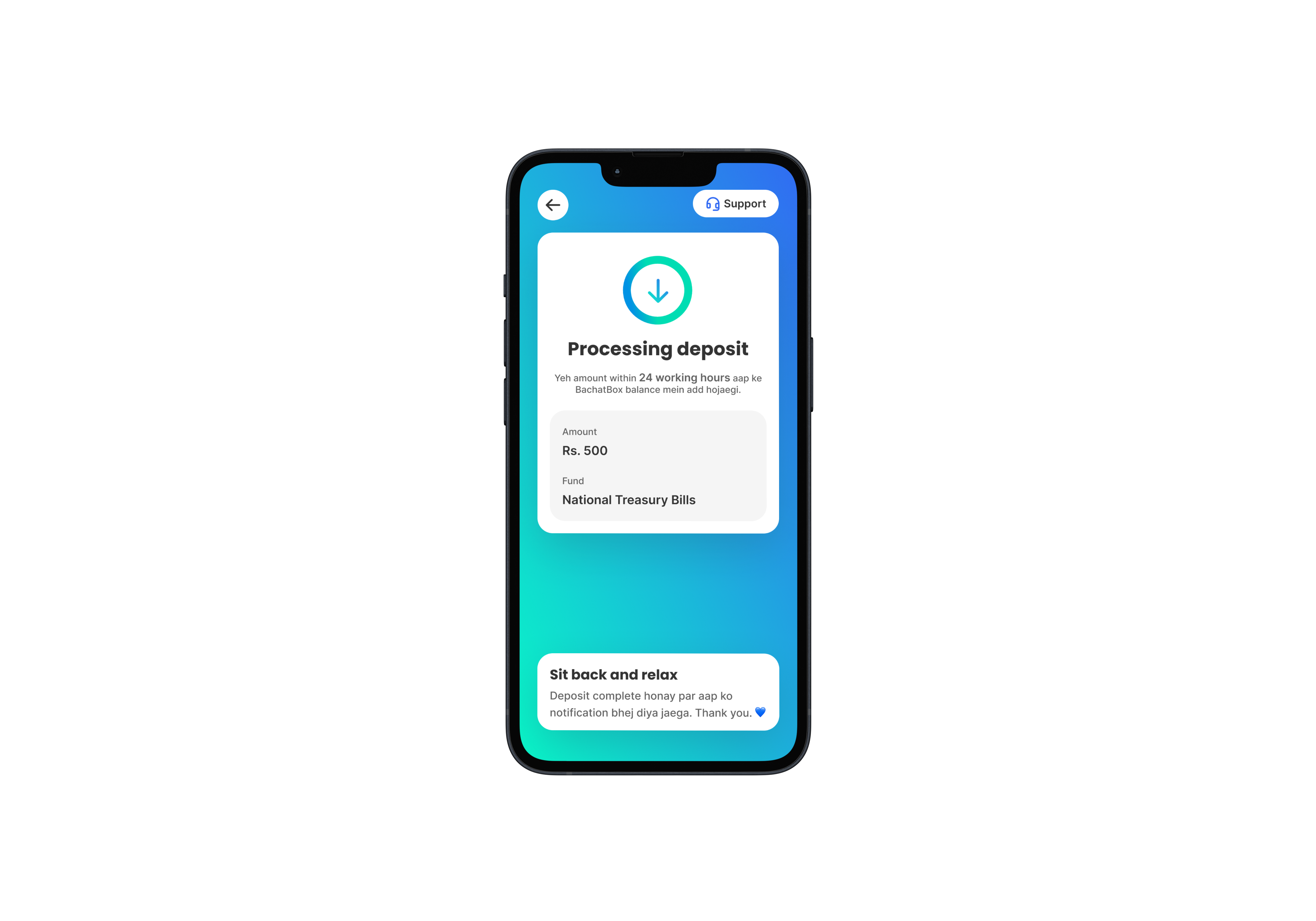

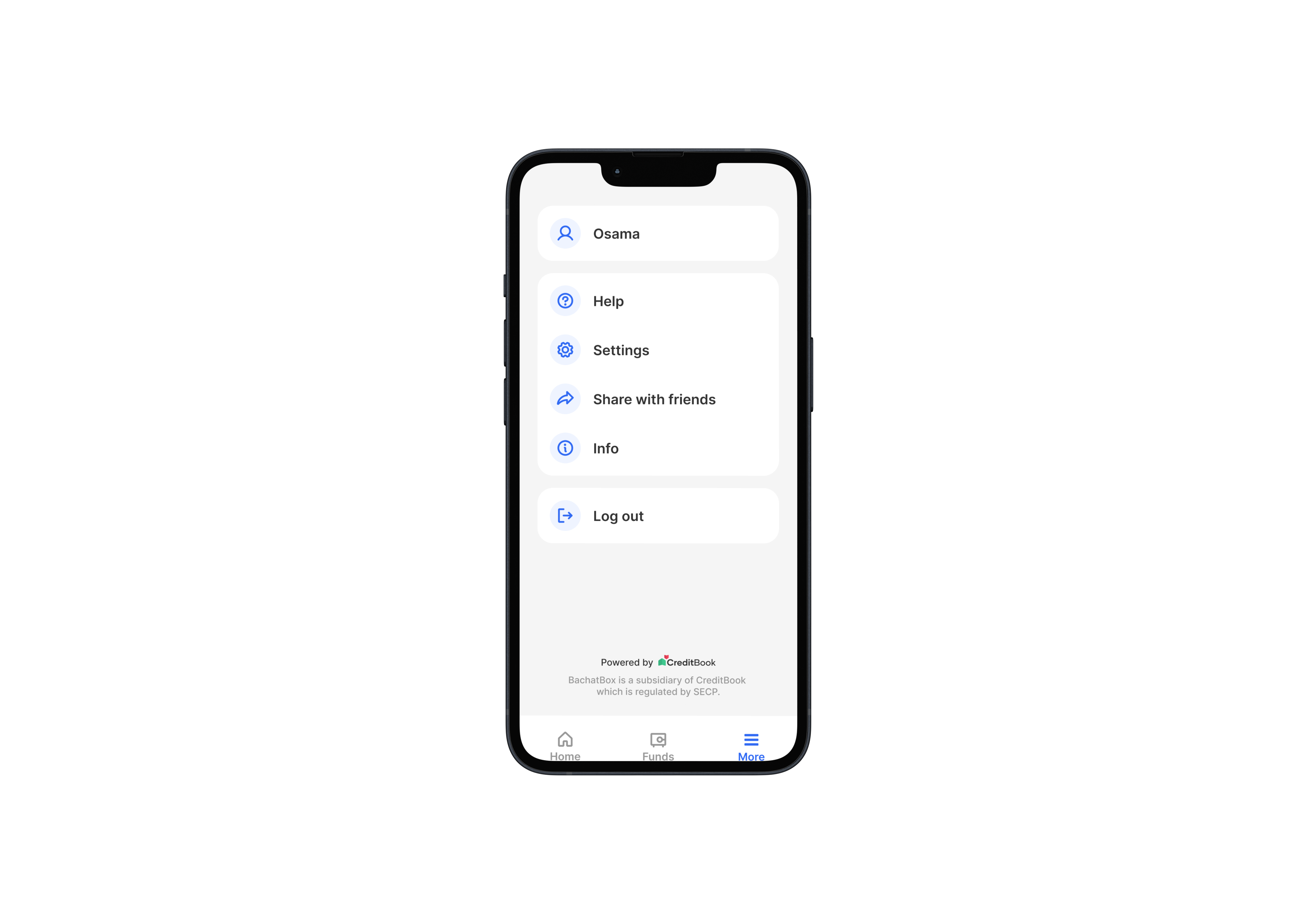

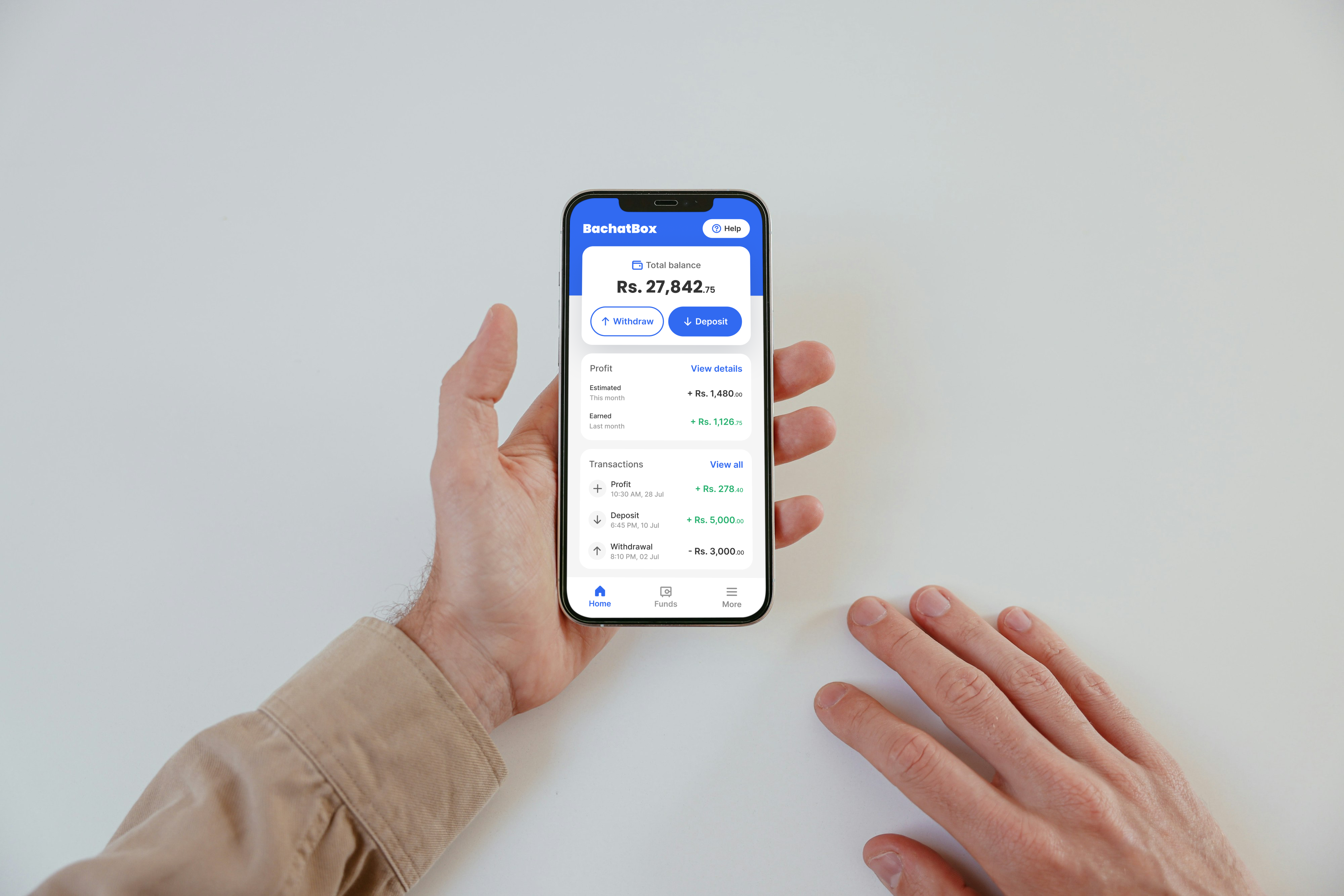

UI Design

With a clear scope in place, I took ownership of the UI design, shaping the visual language and overall experience.

Blue to convey trust and stability

High contrast ratio

for better readability

Rounded elements for a welcoming experience

3D illustrations to add realism

Conversational language for clarity

Large touch targets for better usability

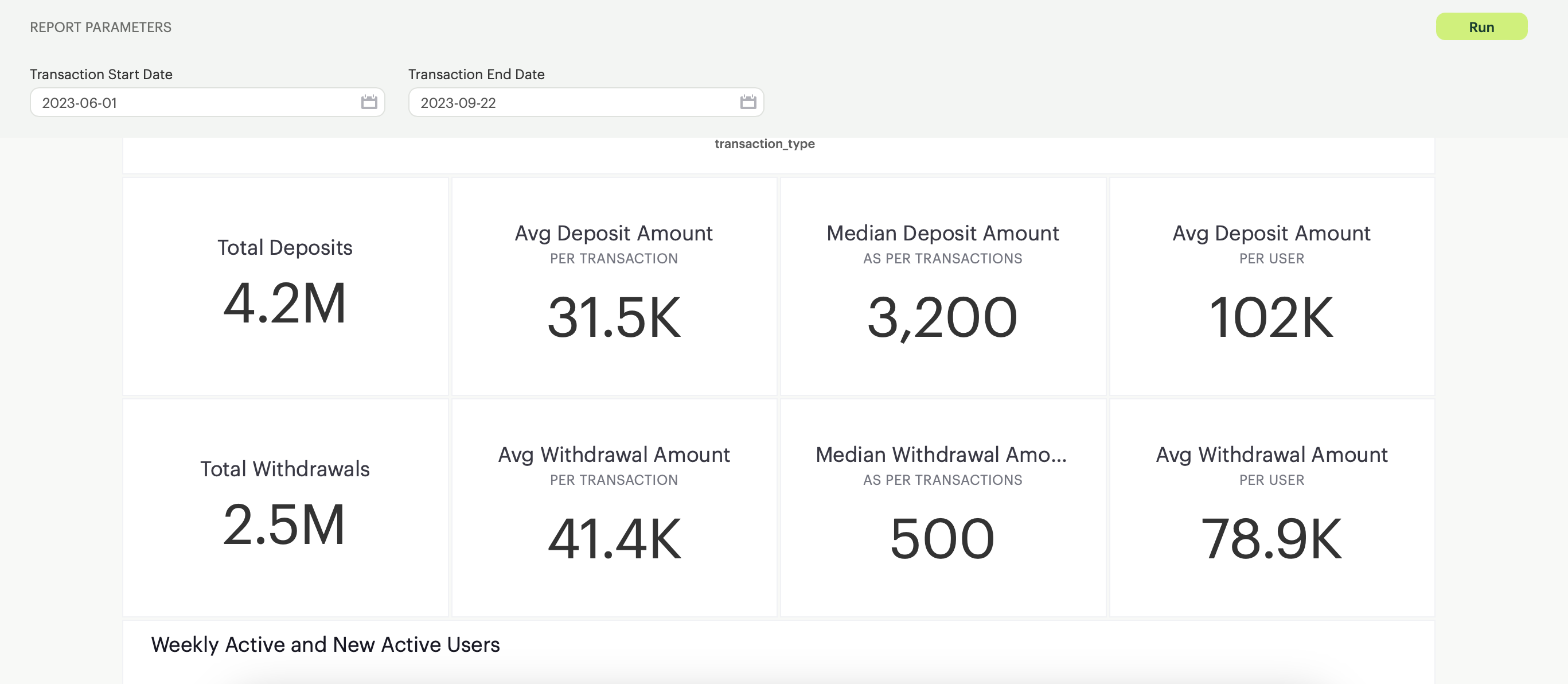

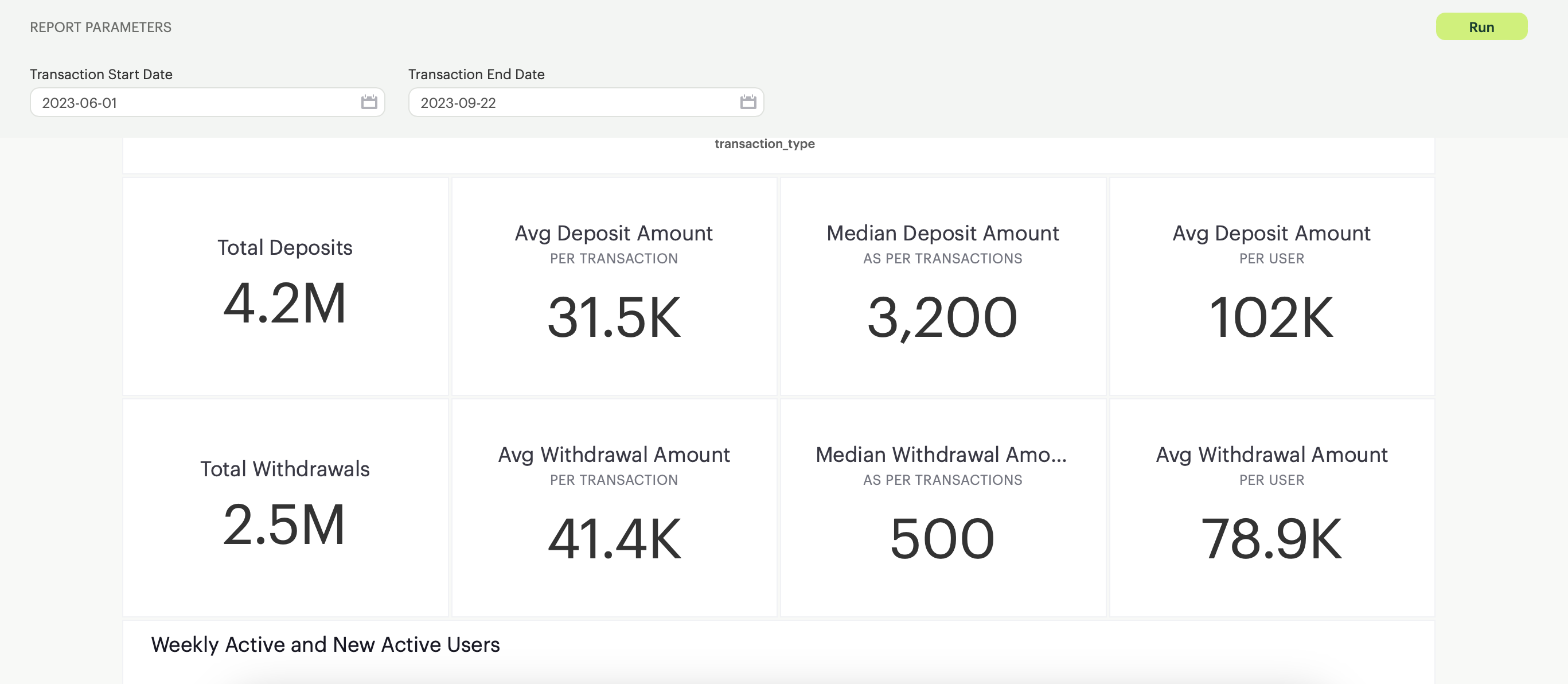

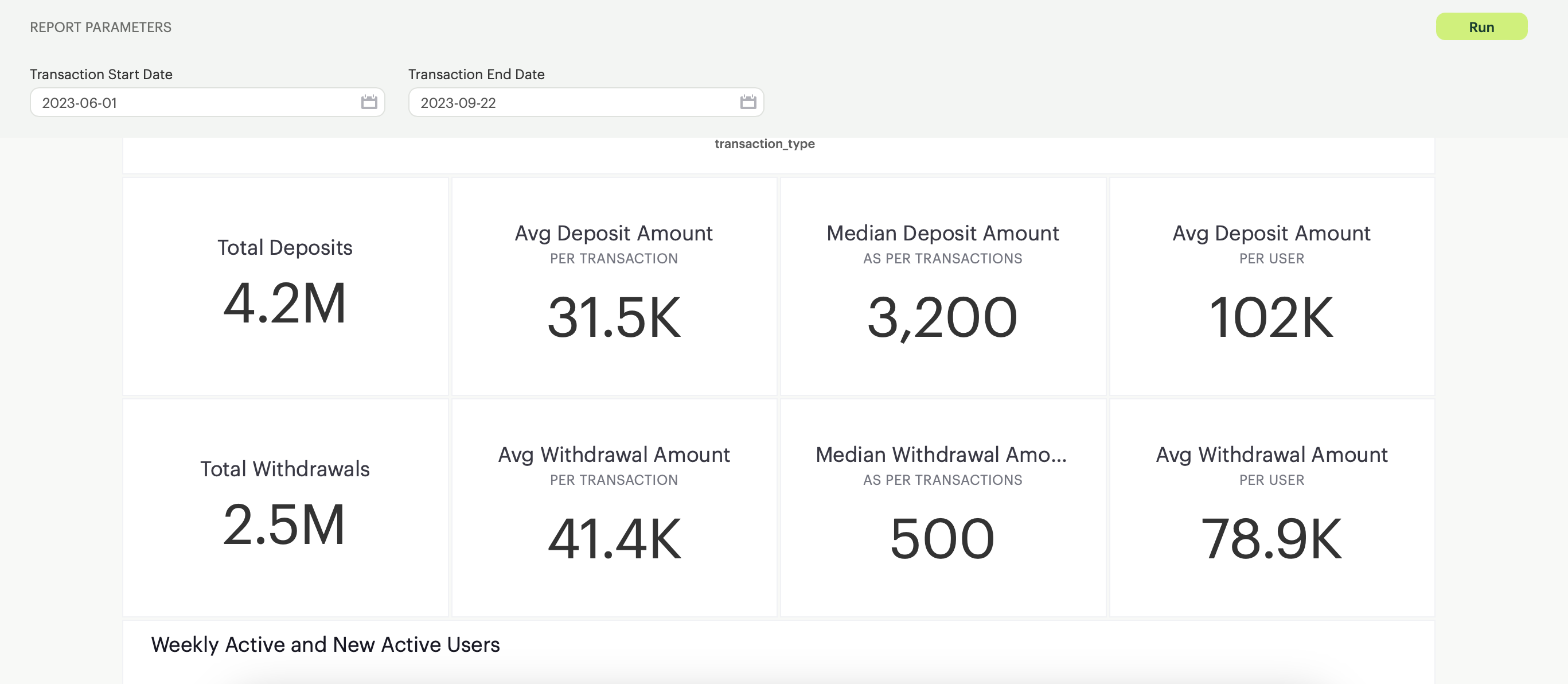

Pilot launch

• Rs. 4.2M deposited despite no automated money rails

• Frequent small deposits validated our low-barrier design approach

• Friction didn’t block adoption, trust and clarity made up for it

• With money rails + improved UX, potential for growth is high

Key takeaways

• What users do is often more revealing than what they say

• Even with constraints, meaningful progress is possible

• Data reflects behavior, it doesn’t judge it

© 2026 Osama Noor

“May the Force be with you.” — Obi-Wan Kenobi

Made in Karachi, by yours truly.

Last updated on Jan 20, 2026

Osama Noor

Home

Resume

Designing a savings solution for underserved users

BachatBox · 2023 · 3 min read

Background

In early 2023, CreditBook discovered that many users were using the main ledger app to track personal savings goals such as buying gold, getting married, or traveling.

This pattern hinted at a need for a more intentional savings solution.

Research

Our goal was to understand the motivations, pain points, and behaviors around saving, especially for users with low financial literacy or limited trust in formal systems.

To achieve this, we conducted secondary research, user interviews, and field studies.

Motivations

• Secure family future

• Shariah-compliant saving

Behaviours

• Informal saving methods

• Goal-based saving

Pain points

• Low trust in formal systems

• No simple digital alternatives

What we learned

Most savings platforms are too complex for everyday Pakistanis. Traditional banks add to the problem with accessibility issues and paperwork, making formal saving feel out of reach for many.

So we asked ourselves

How might we help users with low digital or financial literacy confidently grow their savings and meet their financial goals?

Experimentation

To validate our assumptions about user behavior and move closer to a solution, we ran four quick no-code experiments over a month.

Each experiment tested a specific hypothesis based on our early research.

Baseline savings intent

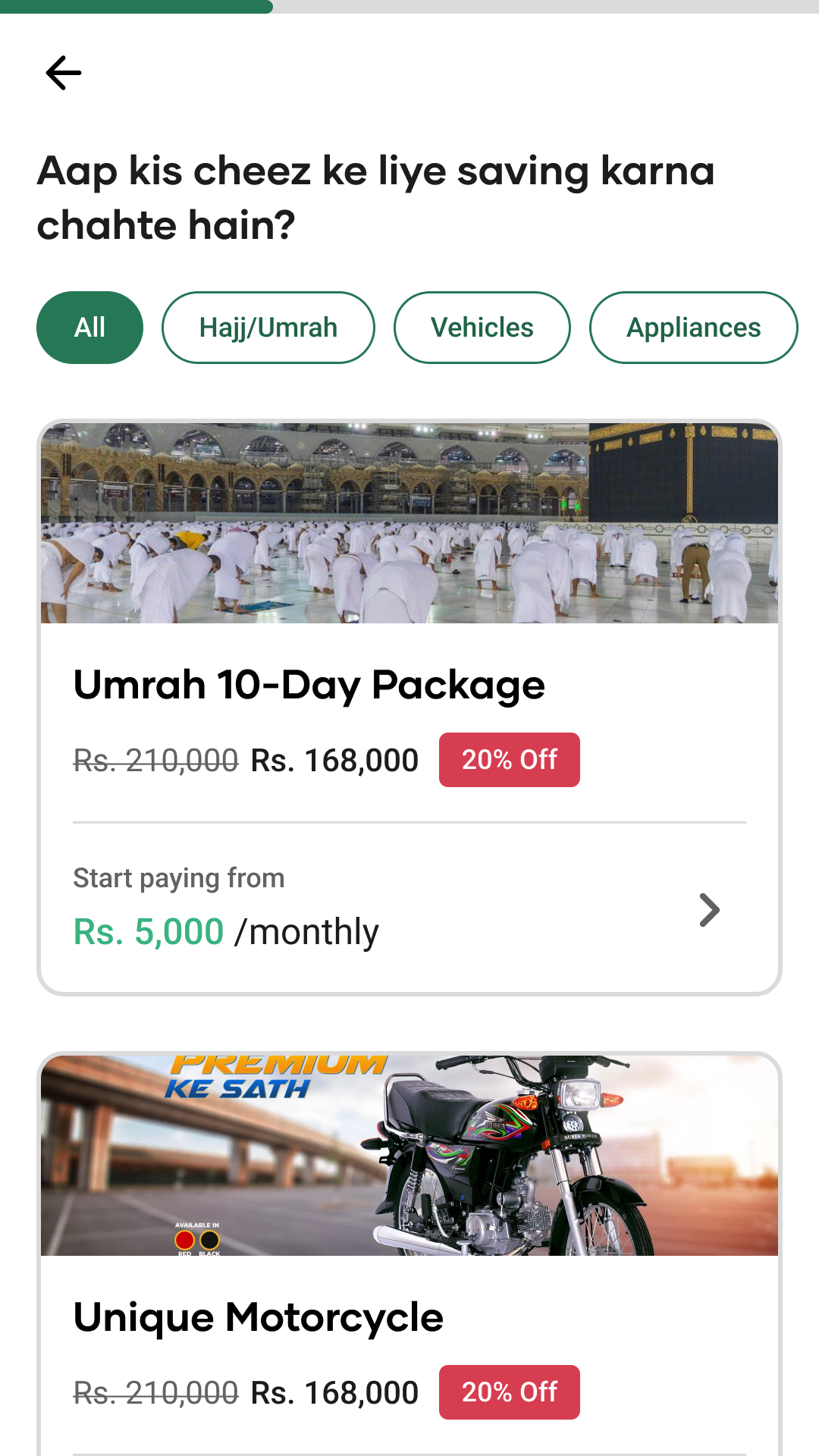

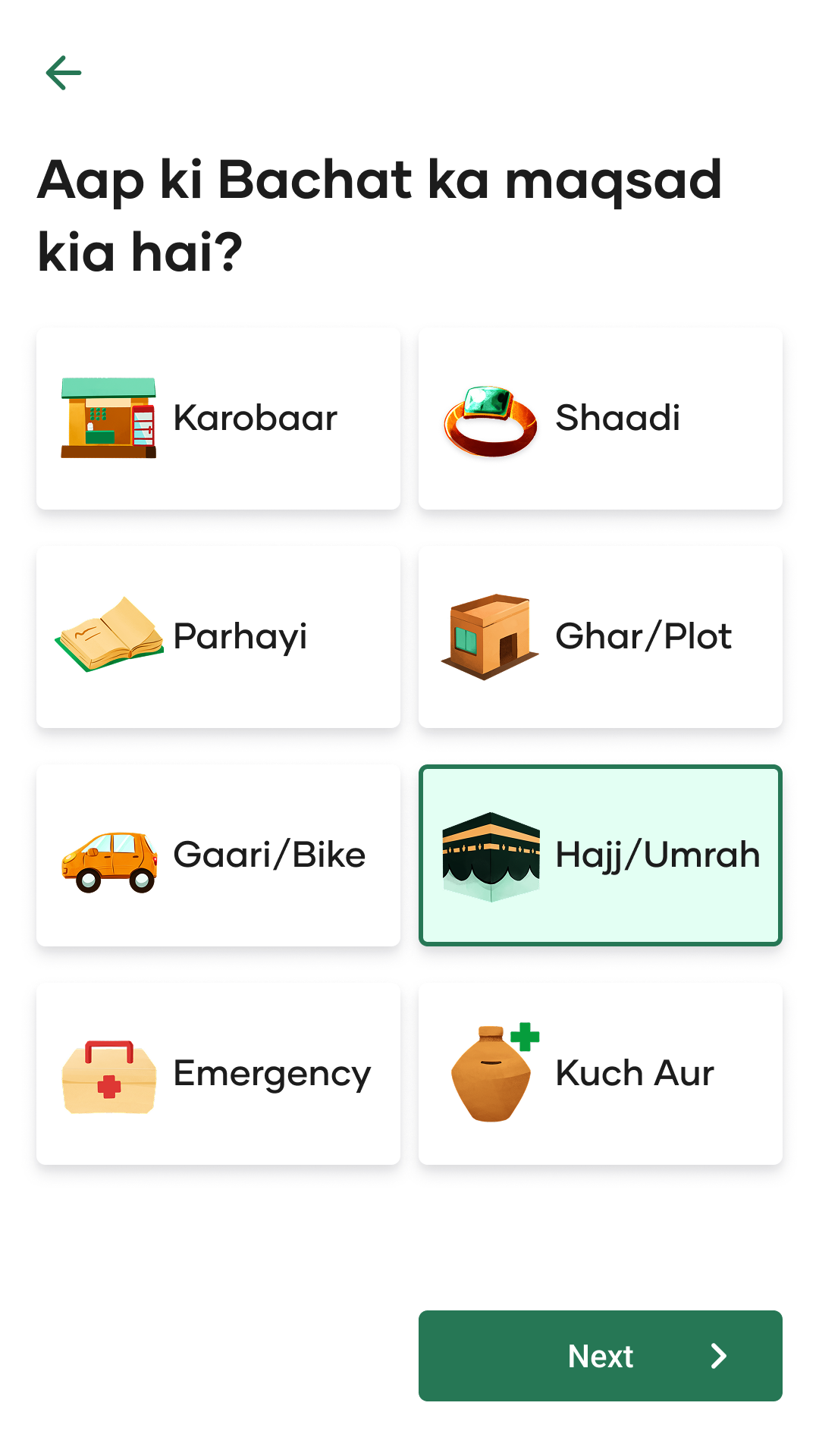

Goal-driven saving

Savings goal tracker

Trust in deposits

Design principles

Based on two months of research and experimentation, I defined the following principles to anchor our solution.

Simplicity and Accessibility

Design simple and accessible experiences for users with limited digital literacy.

Effortless Money Movement

Make it easy and intuitive for users to deposit, manage, and withdraw their savings.

Low Barrier to Entry

Allow users to start saving with minimal upfront investment and documentation.

Trust and Transparency

Build credibility through transparent, consistent, and trustworthy interactions.

Benchmarking

To inform our solution and understand how markets with similar challenges design for inclusion, I studied apps from Nigeria, Brazil, and India to identify patterns we could learn from.

Brainstorming and Ideation

I led whiteboarding sessions with the Fintech and Ops teams to map KYC and regulatory flows and shape the end-to-end journey.

We worked closely with the Research team on ideation, which informed the wireframes I created to review with key stakeholders.

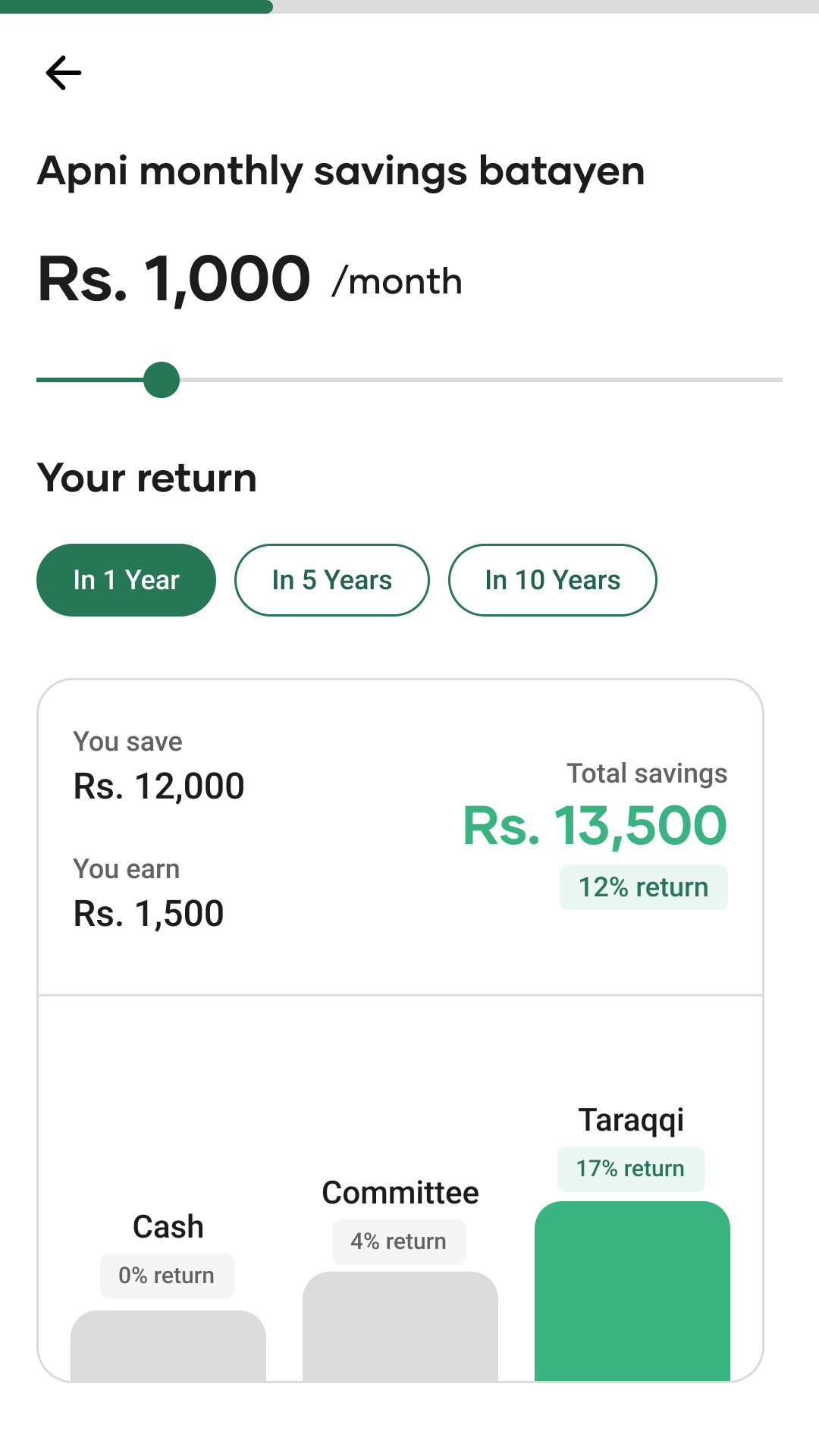

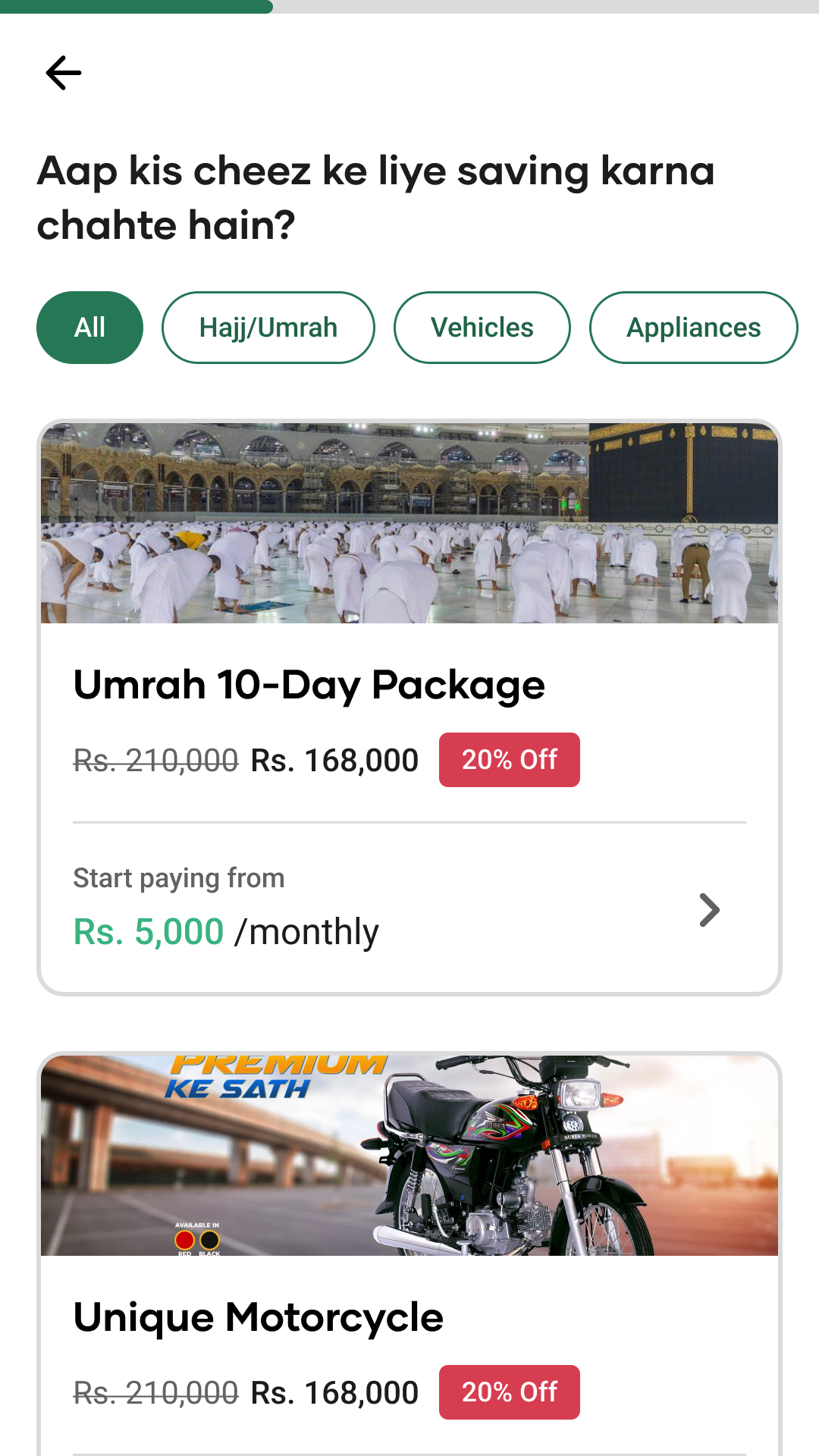

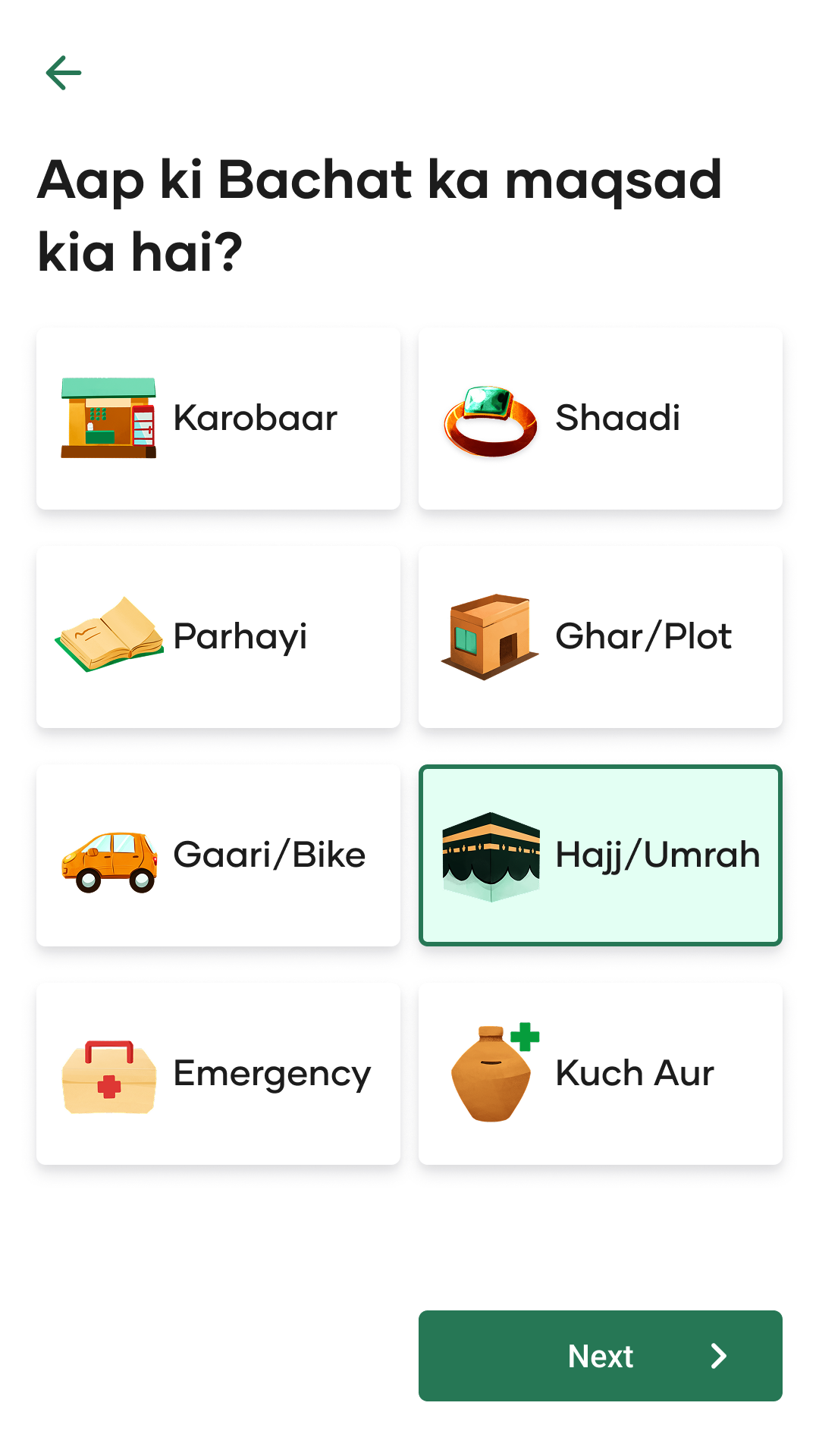

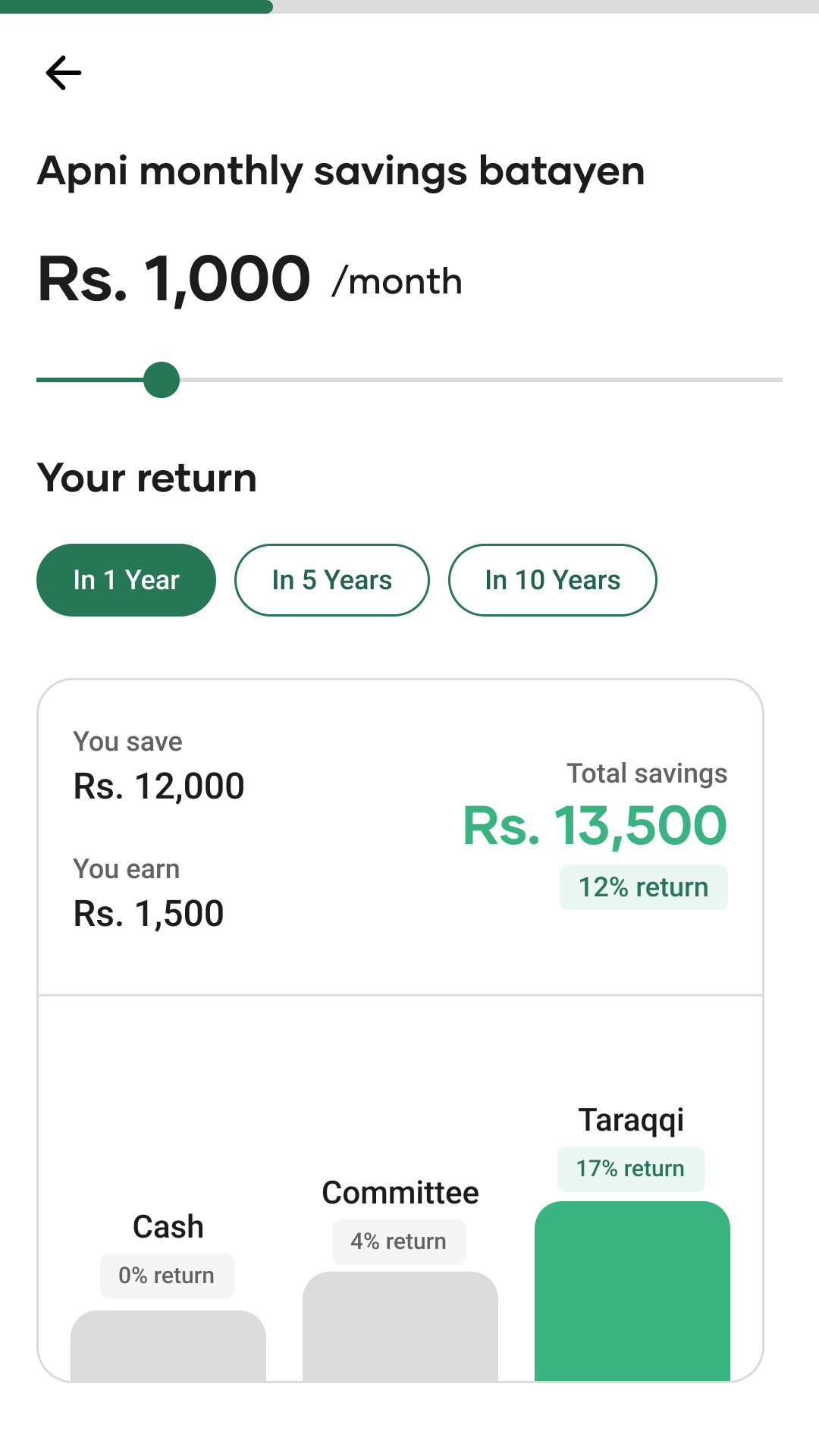

UI Design

With a clear scope in place, I took ownership of the UI design, shaping the visual language and overall experience.

Blue to convey trust and stability

High contrast ratio

for better readability

Rounded elements for a welcoming experience

3D illustrations to add realism

Conversational language for clarity

Large touch targets for better usability

Pilot launch

• Rs. 4.2M deposited despite no automated money rails

• Frequent small deposits validated our low-barrier design approach

• Friction didn’t block adoption, trust and clarity made up for it

• With money rails + improved UX, potential for growth is high

Key takeaways

• What users do is often more revealing than what they say

• Even with constraints, meaningful progress is possible

• Data reflects behavior, it doesn’t judge it

© 2026 Osama Noor

“May the Force be with you.” — Obi-Wan Kenobi

Made in Karachi, by yours truly.

Last updated on Jan 5, 2026

Osama Noor

Home

Resume

Designing a savings solution for underserved users

BachatBox · 2023 · 3 min read

Background

In early 2023, CreditBook discovered that many users were using the main ledger app to track personal savings goals such as buying gold, getting married, or traveling.

This pattern hinted at a need for a more intentional savings solution.

Research

Our goal was to understand the motivations, pain points, and behaviors around saving, especially for users with low financial literacy or limited trust in formal systems.

To achieve this, we conducted secondary research, user interviews, and field studies.

Motivations

• Secure family future

• Shariah-compliant saving

Behaviours

• Informal saving methods

• Goal-based saving

Pain points

• Low trust in formal systems

• No simple digital alternatives

What we learned

Most savings platforms are too complex for everyday Pakistanis. Traditional banks add to the problem with accessibility issues and paperwork, making formal saving feel out of reach for many.

So we asked ourselves

How might we help users with low digital or financial literacy confidently grow their savings and meet their financial goals?

Experimentation

To validate our assumptions about user behavior and move closer to a solution, we ran four quick no-code experiments over a month.

Each experiment tested a specific hypothesis based on our early research.

Baseline savings intent

Goal-driven saving

Savings goal tracker

Trust in deposits

Design principles

Based on two months of research and experimentation, I defined the following principles to anchor our solution.

Simplicity and Accessibility

Design simple and accessible experiences for users with limited digital literacy.

Effortless Money Movement

Make it easy and intuitive for users to deposit, manage, and withdraw their savings.

Trust and Transparency

Build credibility through transparent, consistent, and trustworthy interactions.

Low Barrier to Entry

Allow users to start saving with minimal upfront investment and documentation.

Benchmarking

To inform our solution and understand how markets with similar challenges design for inclusion, I studied apps from Nigeria, Brazil, and India to identify patterns we could learn from.

Brainstorming and Ideation

I led whiteboarding sessions with the Fintech and Ops teams to map KYC and regulatory flows and shape the end-to-end journey.

We worked closely with the Research team on ideation, which informed the wireframes I created to review with key stakeholders.

UI Design

With a clear scope in place, I took ownership of the UI design, shaping the visual language and overall experience.

Blue to convey trust and stability

High contrast ratio

for better readability

Rounded elements for a welcoming experience

3D illustrations to add realism

Conversational language for clarity

Large touch targets for better usability

Pilot launch

• Rs. 4.2M deposited despite no automated money rails

• Frequent small deposits validated our low-barrier design approach

• Friction didn’t block adoption, trust and clarity made up for it

• With money rails + improved UX, potential for growth is high

Key takeaways

• What users do is often more revealing than what they say

• Even with constraints, meaningful progress is possible

• Data reflects behavior, it doesn’t judge it

Back to Home

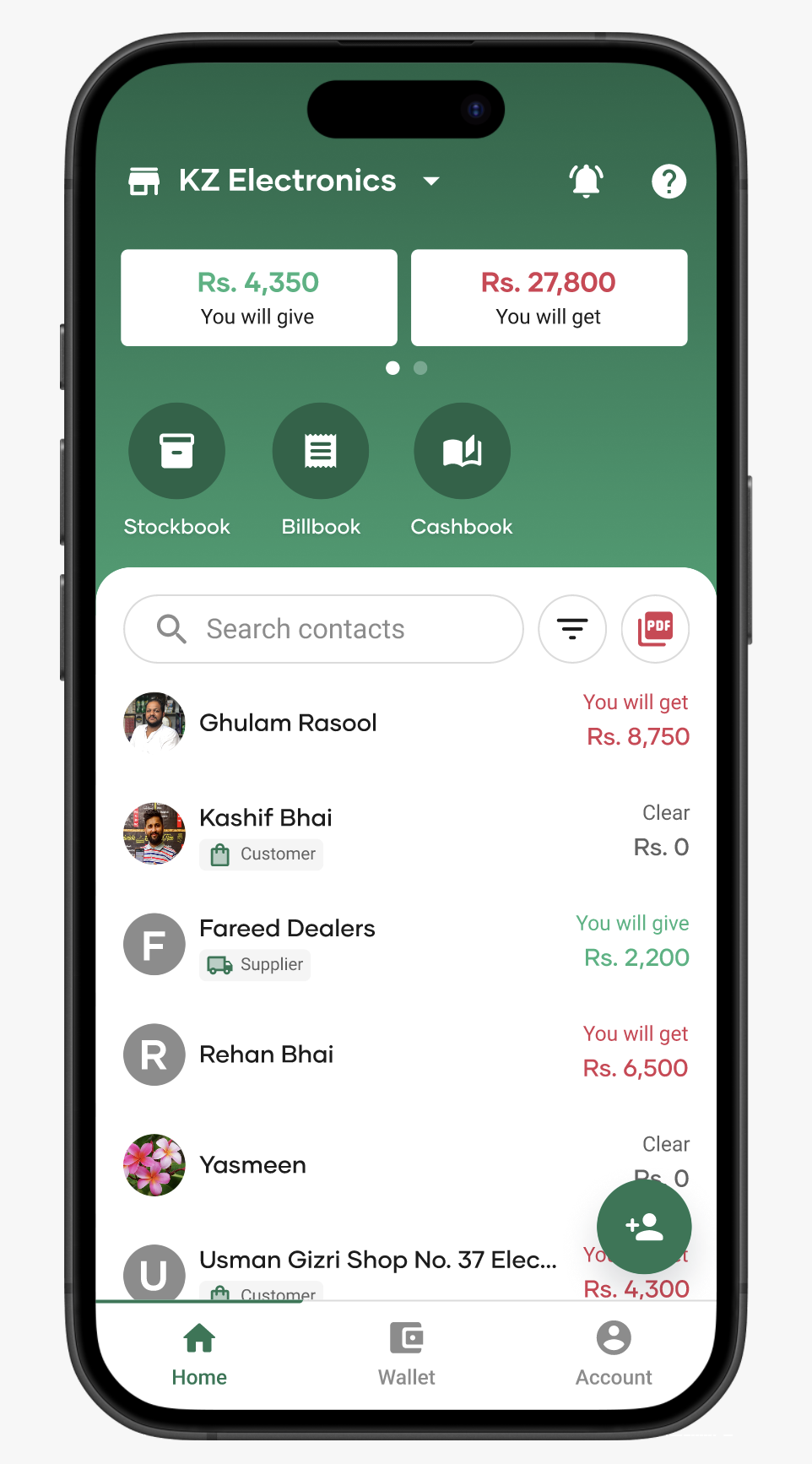

Improving usability in a ledger app for small businesses

CreditBook · 2022 · 2 min read

© 2026 Osama Noor

“May the Force be with you.” — Obi-Wan Kenobi

Made in Karachi, by yours truly.

Last updated on Jan 5, 2026